Money saving apps can help you budget, lower your bills, save more money, and build your wealth. Managing personal finances is a painstaking task, but that doesn’t mean you shouldn’t pay attention to budgeting.

Managing your money is the best thing you can do for yourself in today’s unpredictable economy. And, there are several money saving apps that can help you achieve your goal.

Whether you want to save money for a vacation or save up for a car, it’s crucial you stick to a saving or spending plan. If you need some help, check out our favorite money saving apps below.

Note: If you are looking for the best savings accounts, you can find that here.

Best Apps Everyone Should Use

Saving money doesn't have to be painful — In fact, I've listed the best money-saving apps and price-drop apps to help you save money automatically.

Whether it's preparing to buy a big-ticket item, building a nest egg for retirement or just saving dimes and dollars on every day recurring purchases, saving money is crucially important.

Saving money can be easy, especially with a powerful personal computer in your pocket disguised as a telephone. Next, check out the best money apps to help you save money — for today or tomorrow.

|

Pros:

|

Pros:

|

Pros:

|

- Free budgeting tools

- Retirement planner

- Free portfolio advice

- Robo plus human advisors

- Automatically invests spare change

- $20 new user bonus

- Cash back at select retailers

- Get control over your subscriptions

- Stay on top of your spending

- Put your savings on autopilot

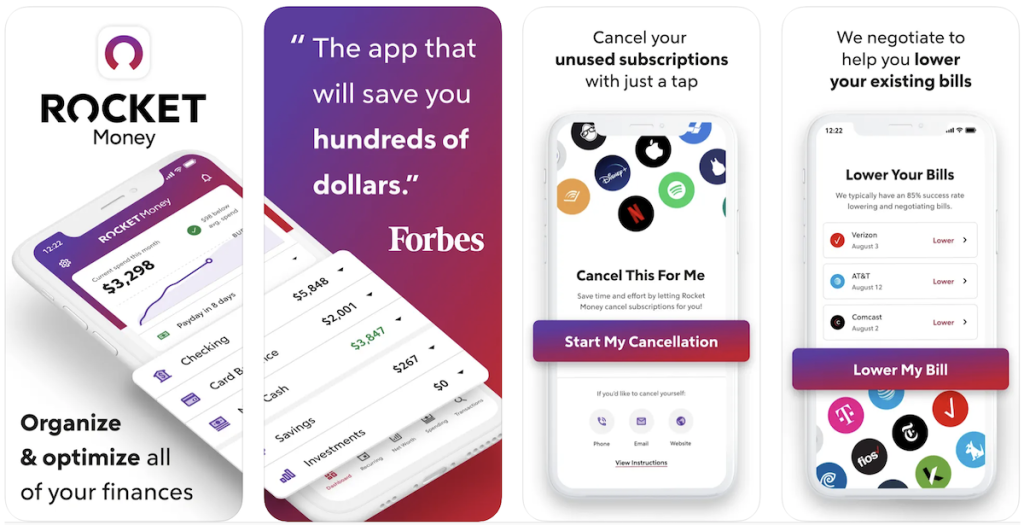

Rocket Money

Rocket Money is your automated financial assistant and budget tracker designed to put you back in control of your money. Rocket Money lets you easily track bills, cancel unwanted subscriptions, and proactively requests refunds on your behalf, putting real money back in your pocket.

With Rocket Money, you can save money, find the best credit card, lower your bills, and stay in control of your finances. It’s like your own personal finance watchdog. This free app delivers on its promise to save you money effortlessly. You can use it to lower your bills, cancel unwanted subscriptions and bill negotiations.

Learn More: Rocket Money Review

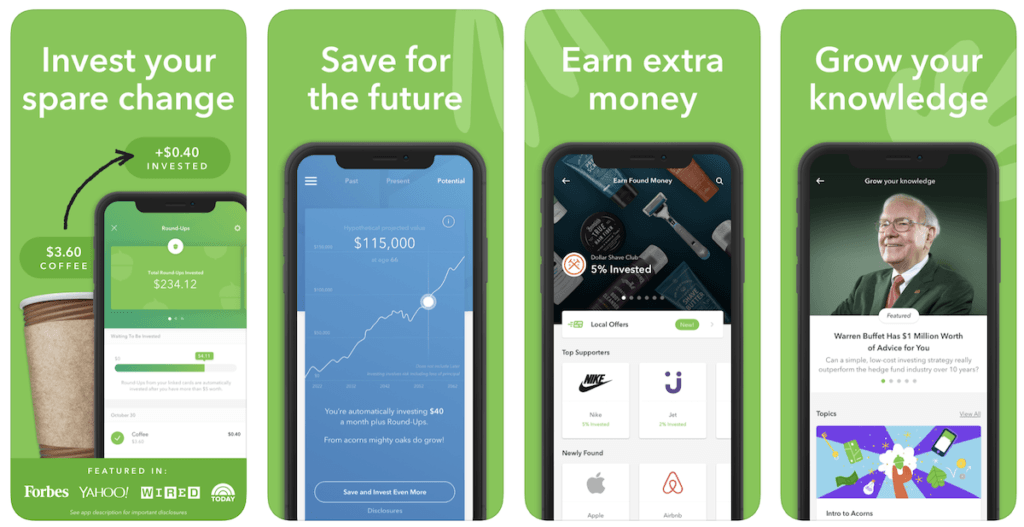

Acorns

Acorns offers a mobile and web app and invests your spare change automatically. Join over 7,000,000 people saving and investing every day. Sign up in no time to save and invest more money.

It functions by saving small amounts of money automatically, by rounding up your purchases on a linked account or card and by investing the difference in your Acorns account. The service recently launched “Acorns Later” — a full-featured retirement account that that's perfect for anybody without an employer-sponsored retirement plan. New users can claim a $10 welcome bonus as well.

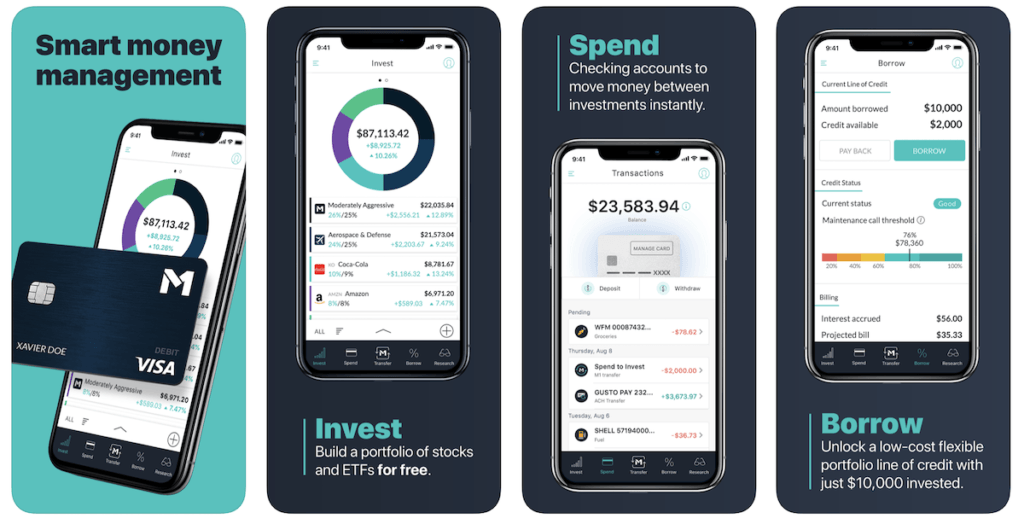

M1 Finance

M1 Finance lets you invest your savings into a portfolio of stocks and ETFs for free. It enables investors to create diversified portfolios, access a variety of financial tools and offered completely free to individual investors.

The M1 investment app was built with your financial well-being in mind. With M1, you can invest, borrow, and spend your money all in one place. You set your strategy and the app will automate it, so you can concentrate on the big picture while we take care of the day-to-day. If you are interested in investing for free — you can sign up for more information from M1 Finance by clicking here.

Learn More: M1 Finance Review

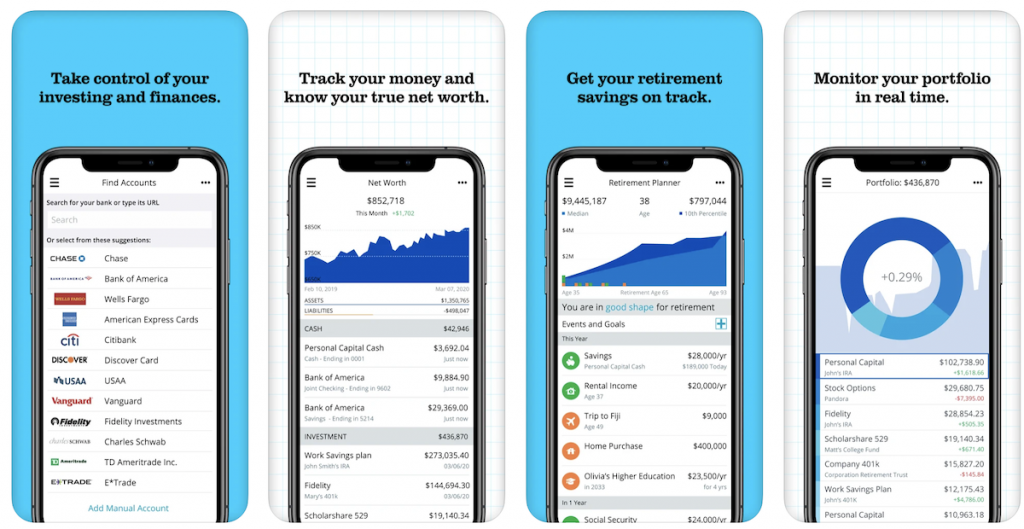

Empower

Empower is committed to altering the financial management landscape. The company is a useful blend of technology and financial savvy. The Empower app is an excellent example of how good things happen when technology meets finance.

Anyone can download the money management app to help take control of their personal finances – it’s 100% free. If you want to track your personal finances on a minute-by-minute basis, using an app is a great place to start. It allows you to manage your spending, monitor investments, and avoid getting into debt.

Learn More: Empower Review

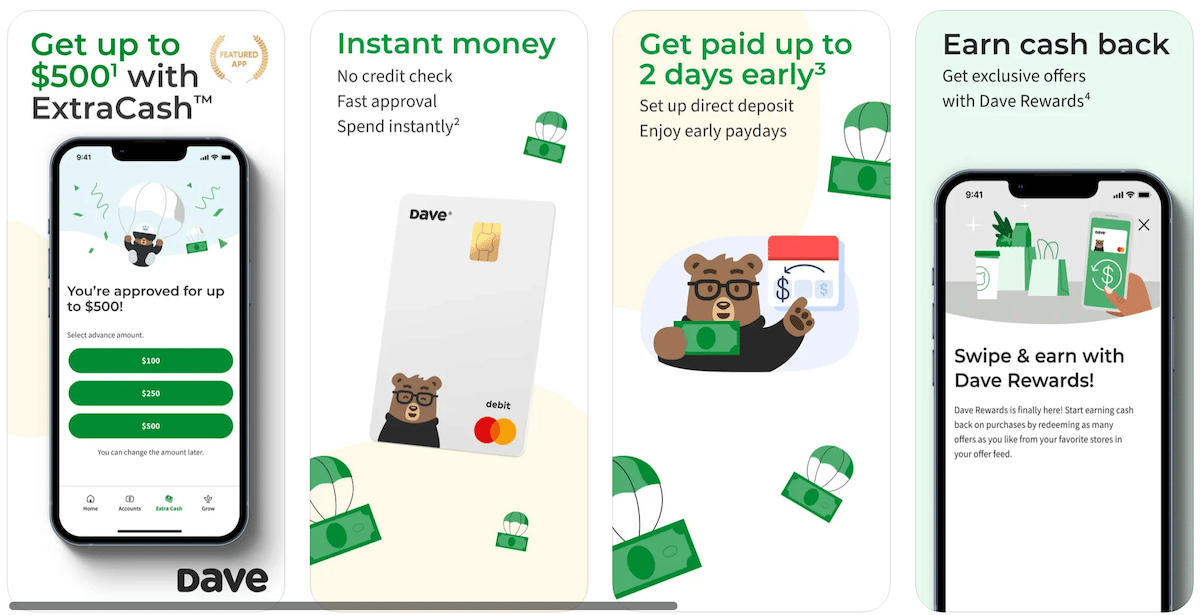

Dave

Dave is a mobile banking app that offers financial services and was founded in 2017 to help customers avoid overdraft fees. Over 5 million Dave members have taken 71 million advances to avoid $2.5B in overdraft fees.

The Dave app's ExtraCash feature offers paycheck advances to help with emergencies or income gaps, available to part-time and temporary workers as well. Dave is only $1 per month.

When you sign up through here, Dave can spot you up to $500 from your next paycheck. You could get an ExtraCash advance as soon as you download Dave, connect a bank account, and transfer it to a Dave Spending account. Settle it later with no interest or late fees.

Learn More: Dave App Review

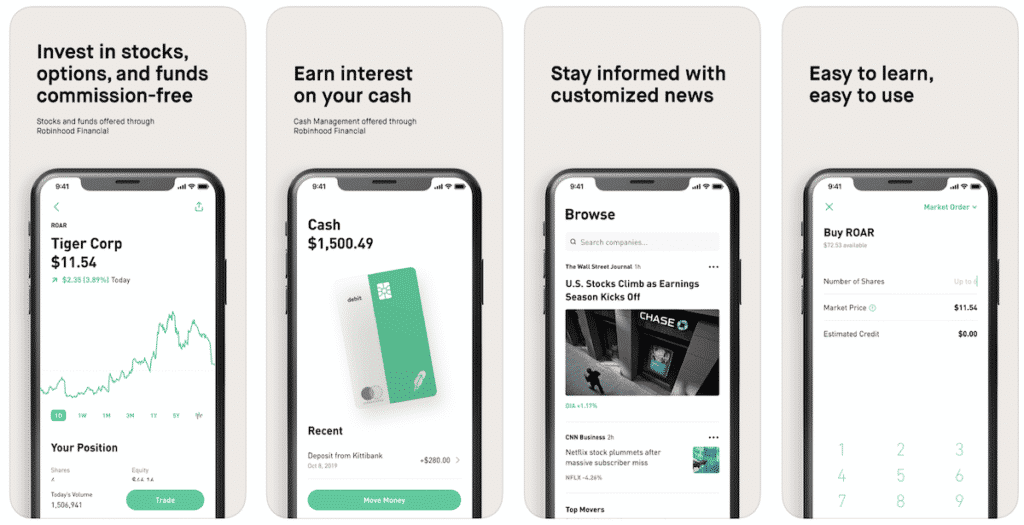

Robinhood

Robinhood makes investing simple. Trade stocks, options, ETFs, and crypto, all with zero commission fees. Other fees may apply. Join 22M+ investors and start building your portfolio with a free stock worth $5 and $200.

Learn More: Robinhood Review

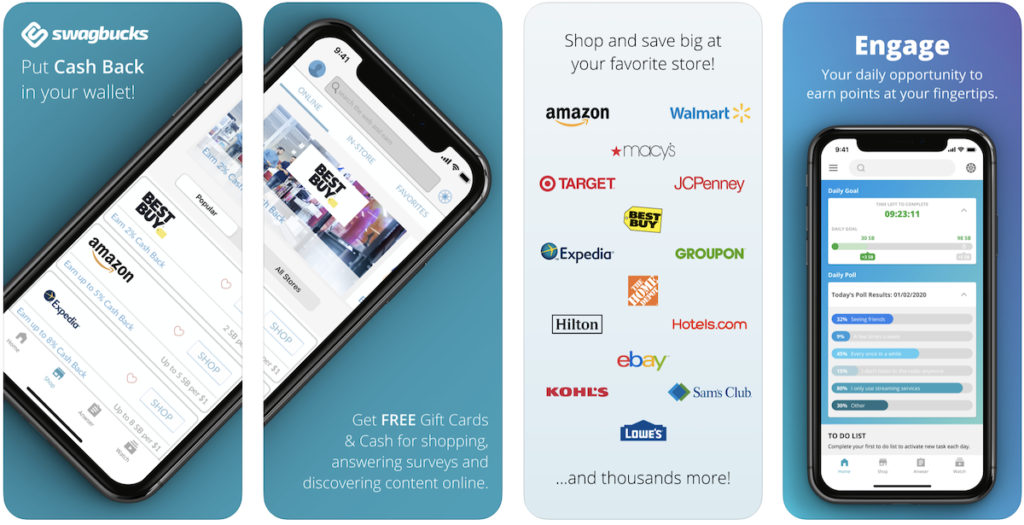

Swagbucks

If you're looking for a way to browse for cool deals, search for specific items, conduct paid surveys and generally earn a little bit back on all the shopping research you'd be doing anyway, Swagbucks is for you. After you link a PayPal account, most of your activity on the app — from doing product searches to providing marketing feedback — helps you earn points toward cash rewards. New users can get a $10 welcome bonus simply for joining the rewards app.

Learn More: Swagbucks Review

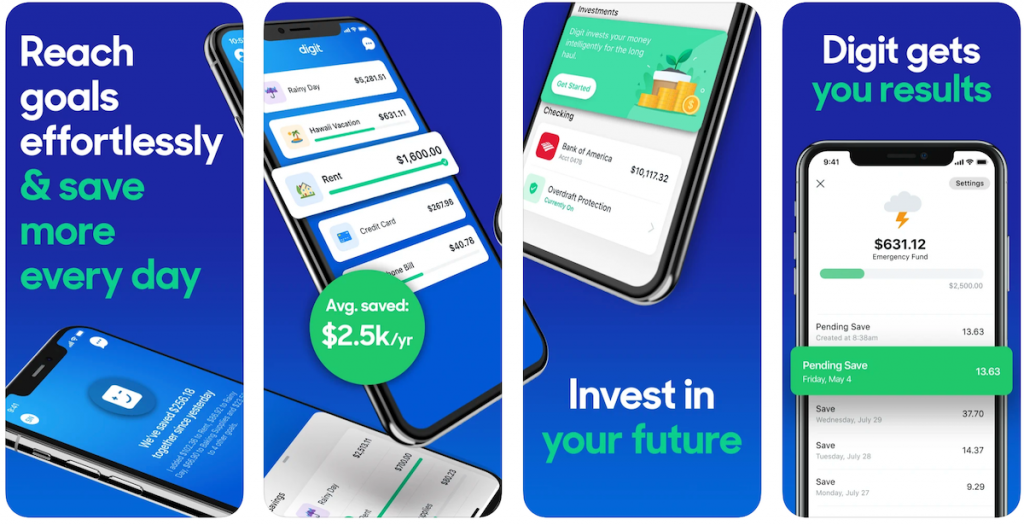

Digit

The Digit web and mobile app make it genuinely painless to save money “in the background.” It works by keeping an eye on a linked personal checking account and saving small amounts of money at a time based on your incoming profit or wages.

Learn More: Digit Review

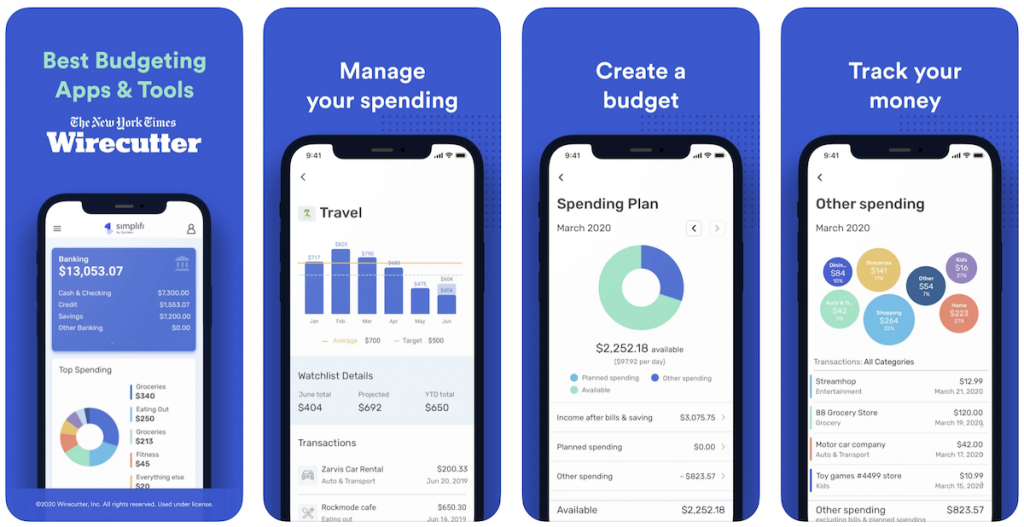

Simplifi by Quicken

Simplifi by Quicken helps you effortlessly manage all of your finances in one place and make your hard-earned money work harder for you. Simplifi makes it easy to customize and track your budget, manage spending, and reach your financial goals with one personalized, use-anywhere app.

It is similar to Empower, allowing you to automatically connect with and view all your financial accounts in one place so you know exactly where you stand. You can also effortlessly identify changes in spending, income, net worth, and more so you know you’re on the right track. You can enjoy your first 30-days free, and after it is $2.99 per month or $35.99 billed annually unless cancelled before the trial is over.

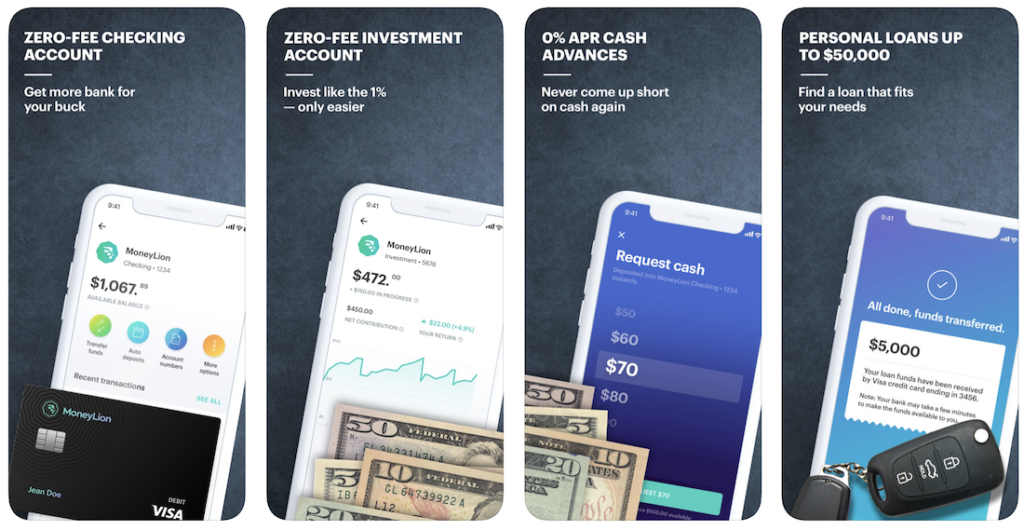

MoneyLion

The free MoneyLion app styles itself as a jack of all trades. It's a platform for managing your current finances, investing and keeping track of your credit score — all while you save money and plan for the future. A free account gets you saving and borrowing tips, while a MoneyLion Plus account opens up the app's suite of investment tools.

Learn More: MoneyLion Review

Best Cash Back Apps

There are lots of cash back shopping apps and rebate apps that offer top-rated cash-back offers, exclusive deals, and other perks. Here are our top picks.

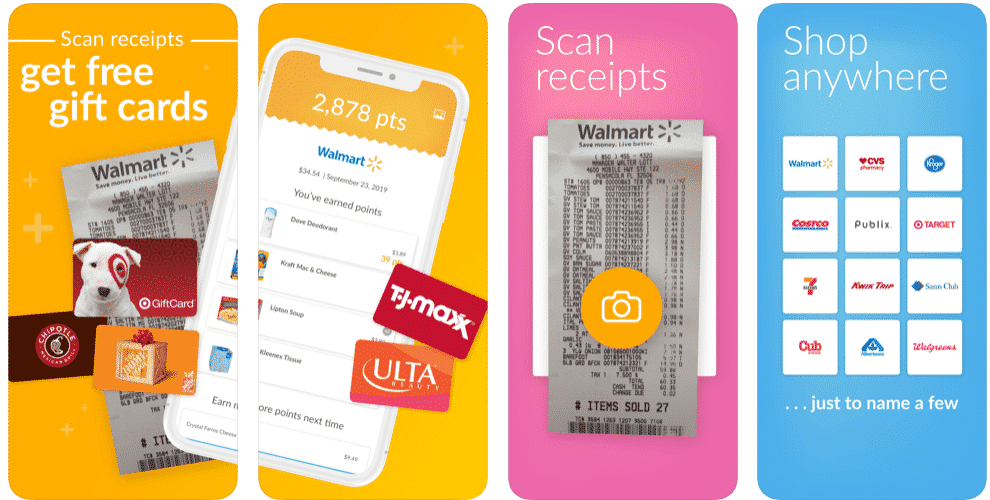

Fetch Rewards

Apps like Fetch Rewards offer mobile rewards and literally pays you for shopping (from any store). This is an easy and of the best money making apps to earn gift cards the easy way, and can add up to a large wad of free gift cards with time. And there is a low threshold to cash out, unlike other cash back apps.

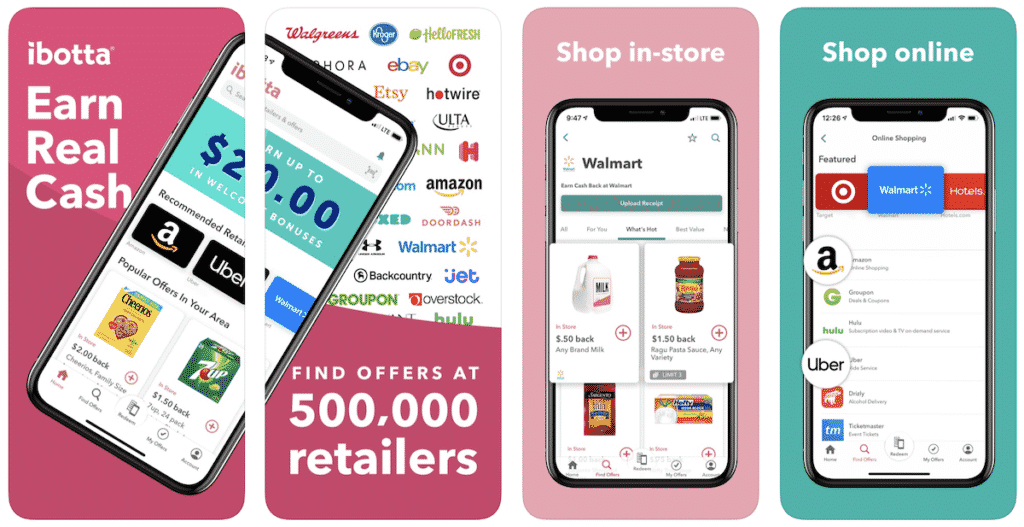

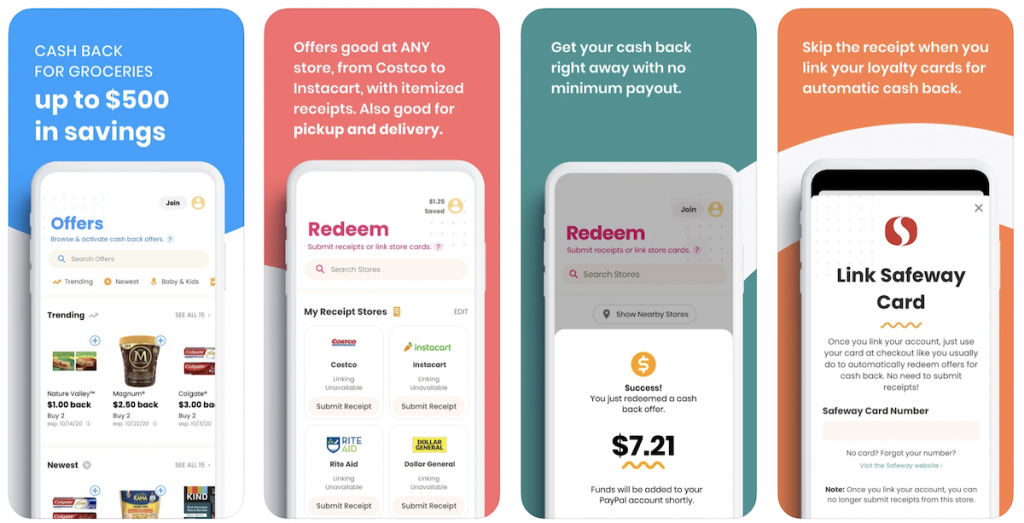

Ibotta

Apps like Ibotta allow you to earn real cash back shopping online and in-store with Ibotta. The average Ibotta user earns $150 a year on groceries, online purchases, delivery, and more. Register for the free Ibotta browser extension and app today to start saving.

You can probably file this one under “sounds too good to be true, but isn't.” Ibotta is an app that works with 250 major retailers, including big-box stores, to help you get some money back, retroactively, on purchases you already make regularly. Some users report savings of up to $25 in their first month without changing their shopping habits and using Ibotta cheats.

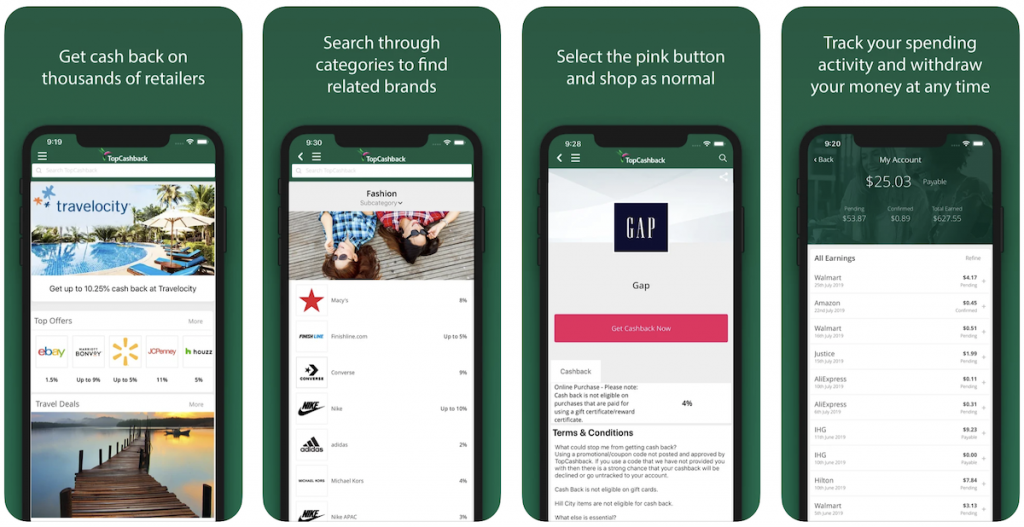

TopCashBack

TopCashback.com is one of the United States' most generous cashback sites. In addition to passing at least 100% of the commission rate that stores pay back to their members, they also provide discount coupons that can be used in conjunction with cash back.

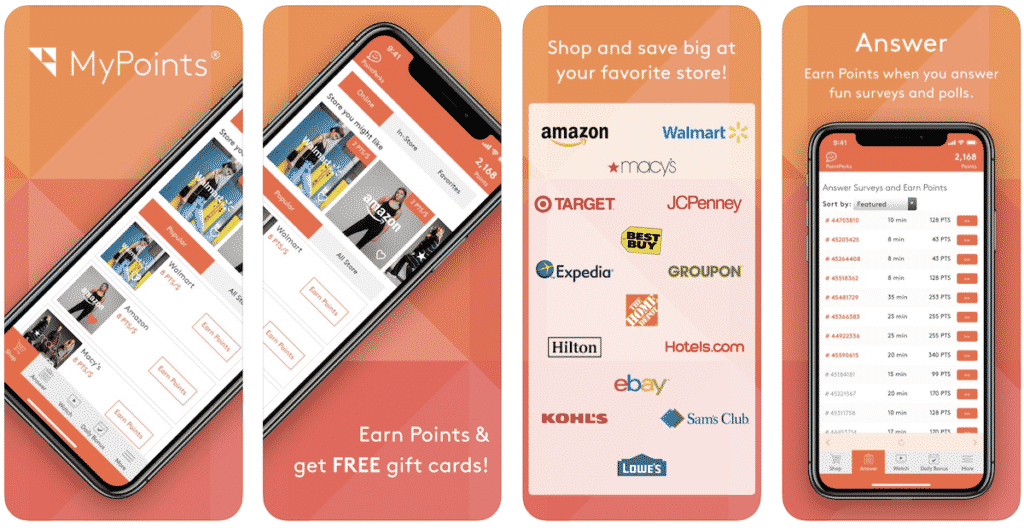

MyPoints

MyPoints is another app that gets you paid just for answering simple questions about your purchasing habits. Your first survey should take about three minutes and will earn you 10 points in the process. After that, you can earn additional points and other rewards by playing games, watching videos and clipping coupons.

Upside

Upside promotes shopping locally so it can put you back in touch with your community and help you uncover hidden gems. But you still want to get the best deals, which is why Upside is so helpful. The app maintains a local focus and points you toward discounts in your local area on the products you’d be buying anyway, like groceries and gas.

Pro Tip: Upside promo code (SMGJQ) gives you a 20¢/gallon savings bonus!

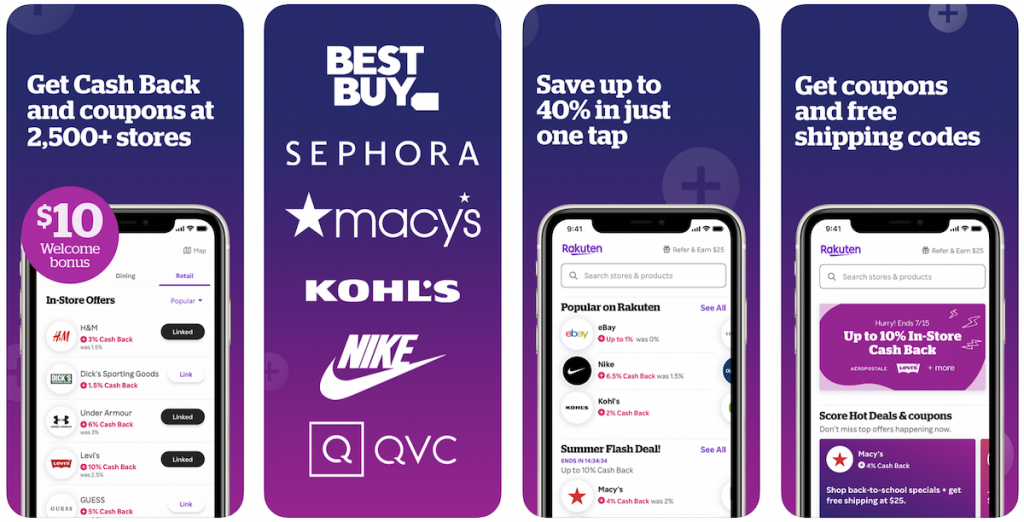

Rakuten

Rakuten functions a little like an outlet store for 2,500 Internet retailers. By making Rakuten your “shopping portal,” either through the web app or a browser extension, you have access to thousands of great deals — up to 40 percent off — on almost anything you can imagine, straight from your retailers of choice. You can also get cash back on your purchases.

Learn More: Rakuten Review

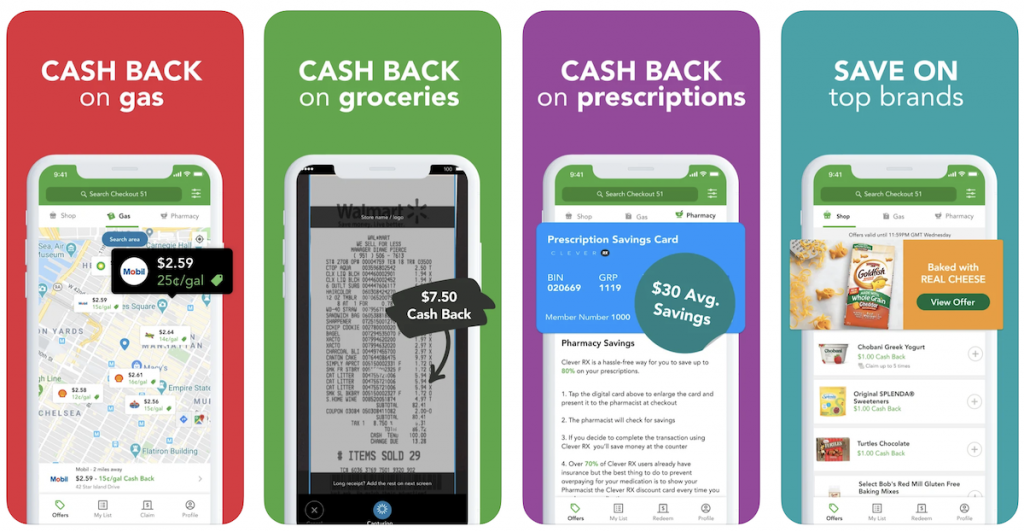

Checkout 51

Apps like Checkout 51 are excellent tools for anybody who frequently shops for household groceries and other items. Using the app is easy — you create a free account and then upload receipts of purchases you've made for qualifying items. Checkout 51 keeps a continually updated list of manufacturer deals and sends you cash back any time you buy something for which there's a posted deal. Earn $5 cash back once you redeem your first offer through this link.

Learn More: Checkout 51 Review

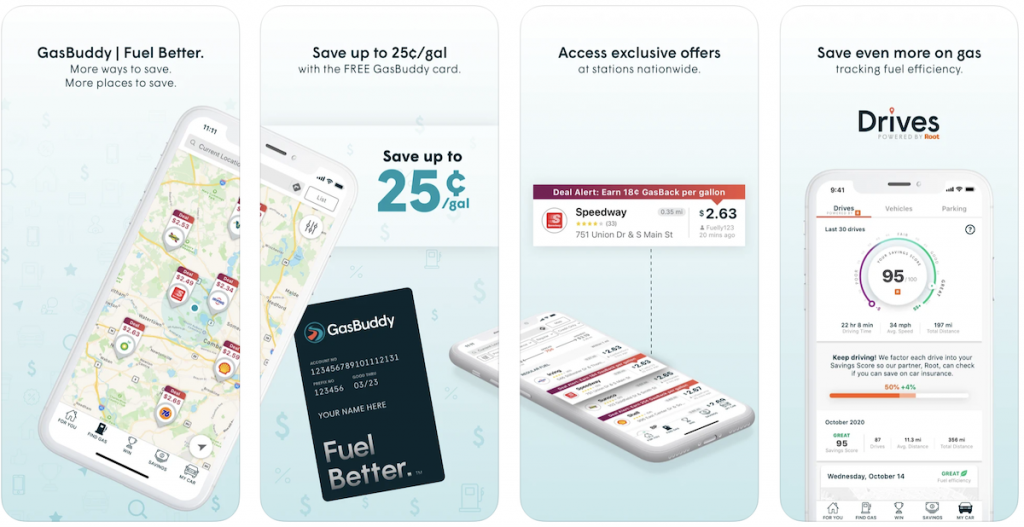

GasBuddy

If somebody out there enjoys buying — and overpaying for — gasoline, we've never met them. That's what GasBuddy is for, it is one of the best gas apps that pays you. It offers several tools for frugal drivers. First, it'll show you the lowest gas prices near you. You can also use it to calculate MPG. Or, for long road trips, you can find the best gas prices in advance and add them as stops on your itinerary.

Honey

Honey is a browser extension for Safari, Firefox, and Chrome, rather than a standalone mobile or web app — but it's a potential money-saver just the same. After you install it, Honey keeps an eye on the checkout process at major Internet retailers and automatically finds current coupon codes to apply to your order.

Coupons.com

Clipping coupons and using apps like Ibotta and Rakuten are excellent ways to save an often-incredible amount of money on name brands. But without Coupons.com, you get stuck searching for, clipping or printing those coupons and the old-fashioned way. Coupons.com removes all the hassle from grocery shopping and gives you access to savings from 70,000 retail locations.

Seated

Nothing is frugal about dining out in restaurants — but if you do it right, even infrequent visits could help you earn back a little something. Seated is an app that makes securing table reservations on a mobile device painless. However, you also earn points for each reservation and can cash out for affiliated restaurant gift cards or Amazon gift codes.

Best Price Drop Apps

These price drop apps promise to automatically get you refunds when it finds lower prices through monitoring your inbox. You can get automatic price drops with these apps:

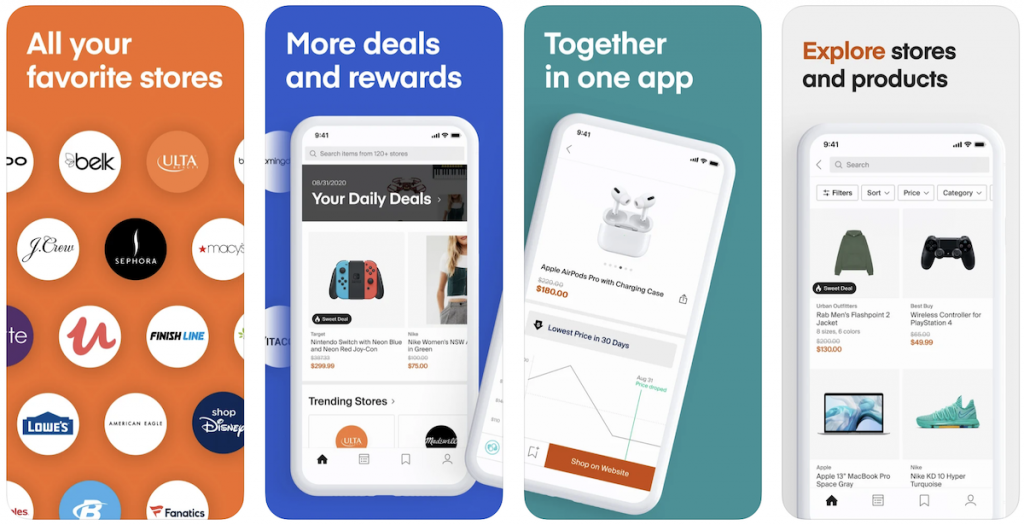

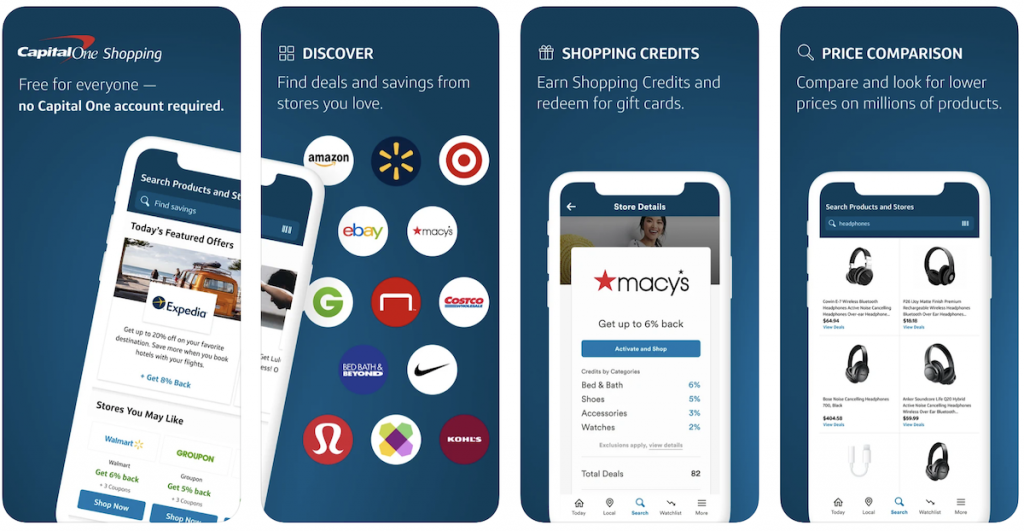

Capital One Shopping

Capital One Shopping is a shopping browser extension and app that helps you get better prices, automatically applies coupon codes at checkout, and lets you know when prices drop on products you’ve viewed or purchased. For example, if you are shopping on Amazon, Capital One Shopping searches thousands of merchants to compare prices on millions of products. You just shop normally and if you have the Chrome extension installed, you're bound to save money.

You can also earn credit for your purchases on popular sites like Walmart and eBay. Use your credit to buy gift cards. Lastly, this extension keeps track of products you've viewed or purchased and lets you know when prices drop so you never miss a great deal.

Cushion

Cushion is your go-to app for simplifying bills, building credit, and managing your finances. With Cushion, you can effortlessly organize and pay your bills while also gaining insights to budget better.

The app securely connects to your accounts, automatically finds and organizes all your bills and Buy Now Pay Later (BNPL) purchases in one convenient place. Whether you're a teen looking to make money as a social media manager or anyone seeking to streamline their financial life, Cushion offers a user-friendly solution to stay on top of your bills and improve your credit.

Start simplifying your financial journey with Cushion today.

Learn More: Cushion Review

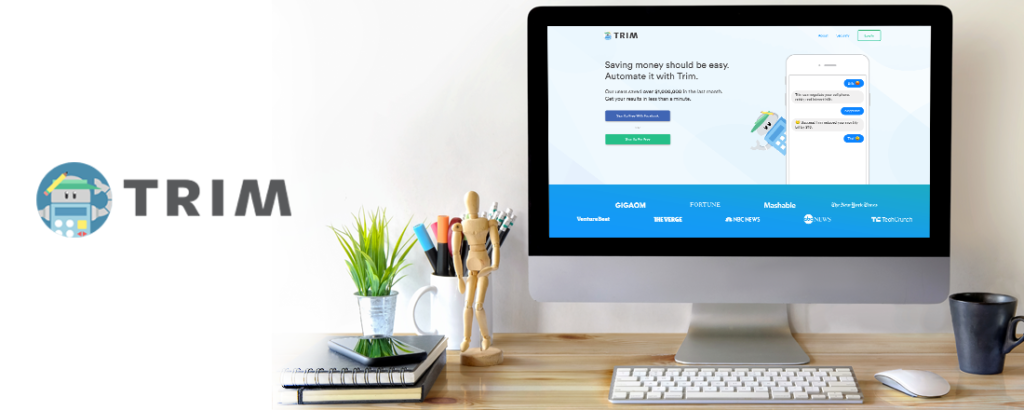

Trim

Trim makes the bold claim that its machine-learning-facilitated app platform saves its users $1 million per month. How? By looking over your finances and canceling unused subscriptions, finding more affordable utility and service providers and generally looking for waste and redundancy. Give it a try. They also have a host of other features that make them worth checking out.

Learn More: Trim Review

Best Budgeting Apps

These are the best budgeting tools to eliminate debt and save money. Get one of these apps and start to better manage your money.

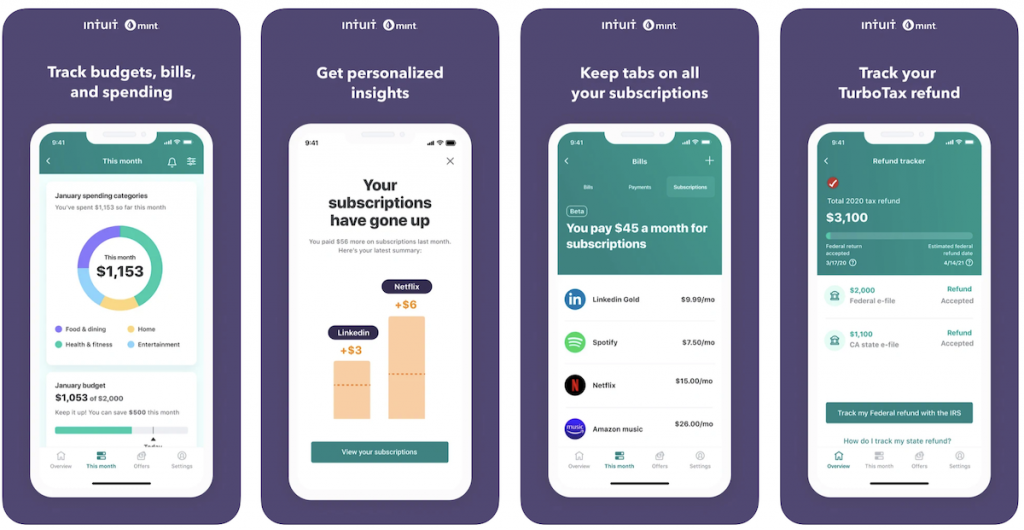

Mint

Mint styles itself as your personal finance consigliere. By linking your major financial institutions and ATM cards, Mint delivers a top-down view of your entire financial life. You can build and fine-tune a budget, create an emergency fund and look over your credit score — all for free.

Learn More: Is Mint Safe: Should You Trust It With Your Financial Accounts?

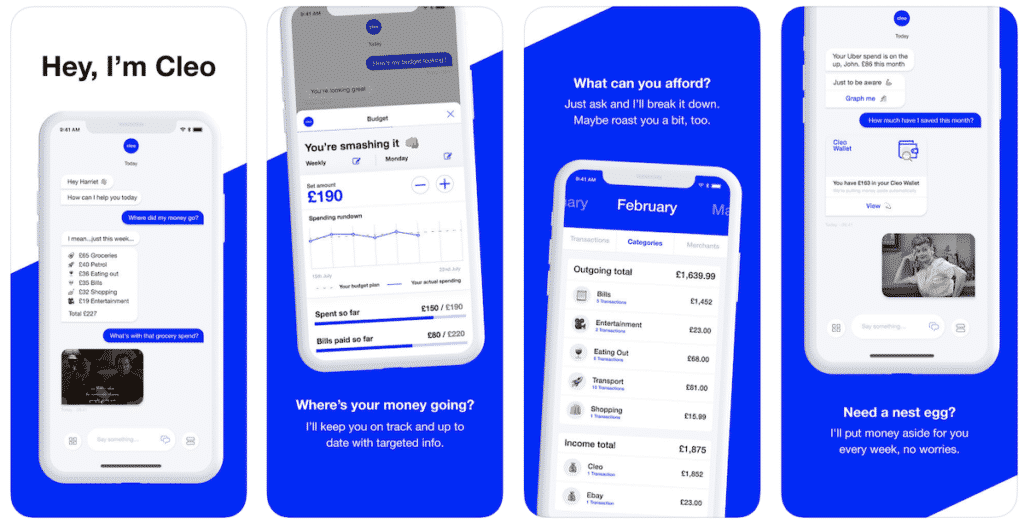

Cleo

Cleo is an intelligent money assistant that looks after your money allowing you to better budget, save and track your spending. Cleo is not your bank, and she doesn’t want to be. She doesn’t want your money or to sell your data to the highest bidder. She wants to change the way you interact with your money.

Cleo combines data from your cards, savings accounts and even your PayPal into one platform. Ask Cleo “How much have I spent on Ubers this month?”, or “Keep an eye on your eating out spend” and she’ll be there to help.

She’ll sass you when you’re overspending and hype you when you’ve smashed your budget for the 5th day this week.

Learn More: Cleo Review

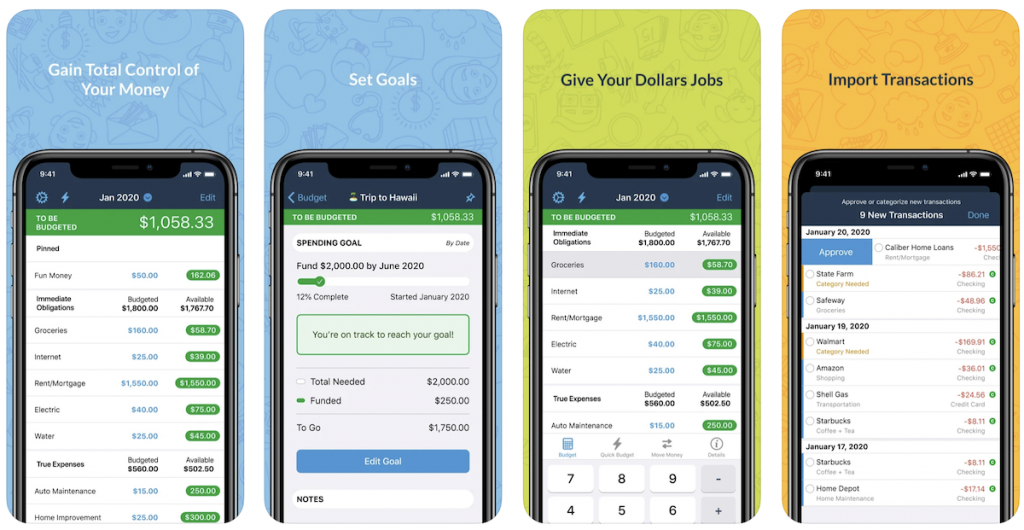

You Need a Budget

You Need a Budget has got an on-the-nose name, but maybe straightforwardness is exactly what you want in a financial app. You Need a Budget has long been a favorite because it makes it easy to account for all your spending, prioritize your expenses, understand basic and advanced budgeting techniques and save easily for unforeseen emergencies — or just a rainy day.

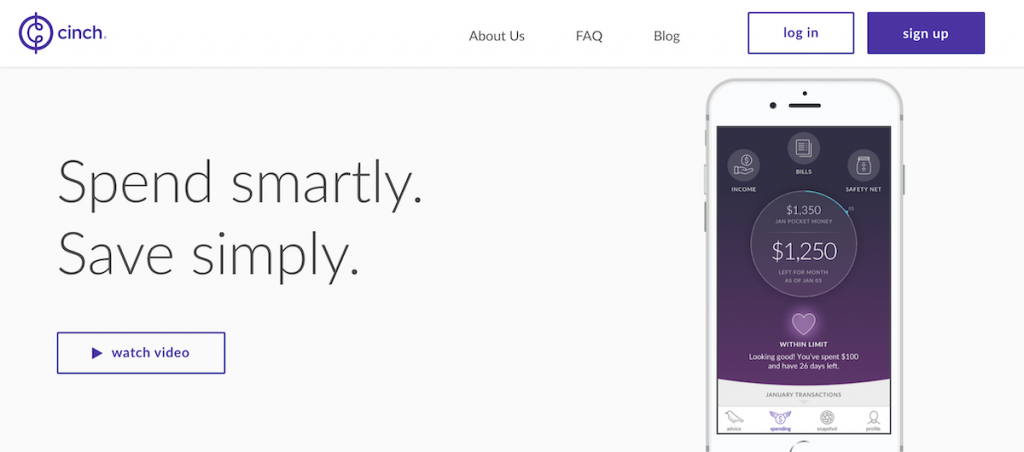

Cinch Financial

Cinch Financial first and foremost brands itself as a “minimalist” assistant for your entire financial life. Using algorithms that operate in the background, the app analyzes your financial life and creates a forecast of several practical, actionable steps you can take right now to improve your standing. The goal is to help you save money and get into better spending habits.

Learn More: Cinch Review

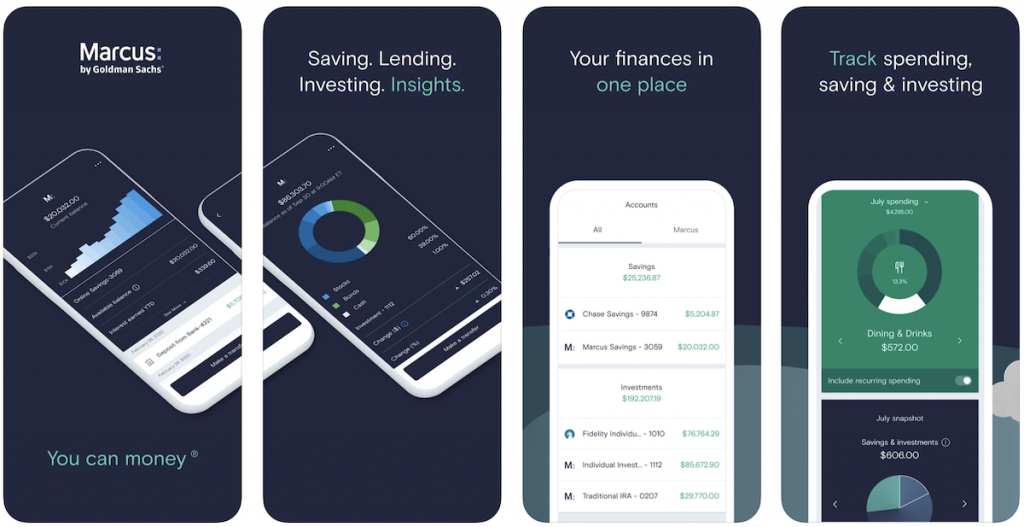

Marcus

Marcus by Goldman Sachs offers personal finance tools to help you save, borrow, and invest. Marcus lets you grow your money with a high-yield online savings account, high-yield CDs and no-penalty CDs. Plus pay down high-interest debt with a no-fee personal loan or automate your investing with Marcus Invest.

And you can connect thousands of financial institutions to Marcus Insights — free tools and trackers that help you organize and optimize your finances. Whether you choose to use all of its personal finance products or just one, this money-saving app can help you make the most of your money.

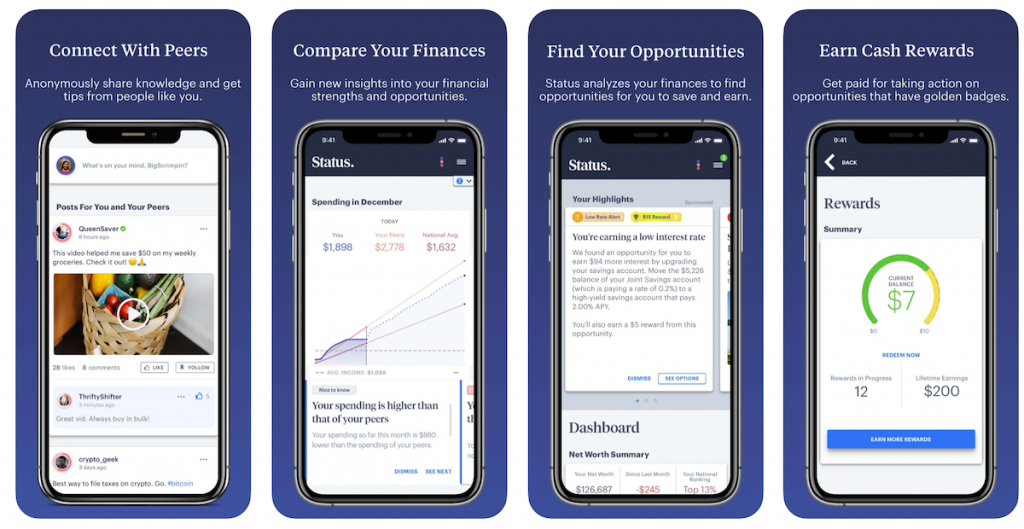

Status Money

Status Money brings all your financial accounts into one place and lets you discreetly compare your finances to those of your peers to get a better sense of how you’re doing when it comes to spending, credit scores, debt balances, your income and more. However, Status Money is perhaps best suited for those are who already aware of their net worth and balances so that they can catch any mistakes.

Learn More: Status Money Review

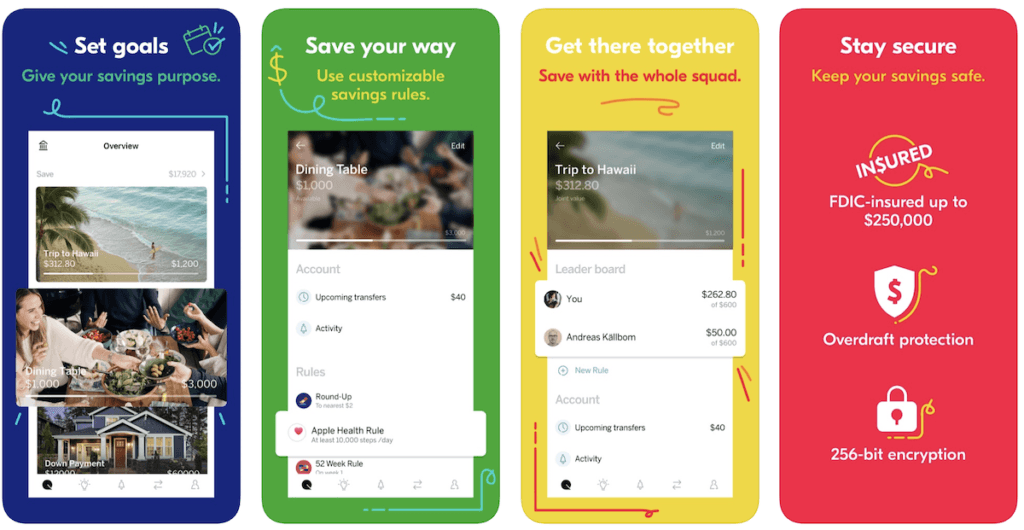

Qapital

Qapital is another mobile-focused savings app that makes automatic or manual deposits based on your income. But it goes a step further than some of the others by offering a social and family component, where you can save money as part of a group, as well as robust goal-setting features for when you have specific savings milestones in mind.

Learn More: Qapital Review

Best Apps That Will Save You Money

Check out these money-saving apps that will not only help you save money but offer a plethora of other financial resources and tools.

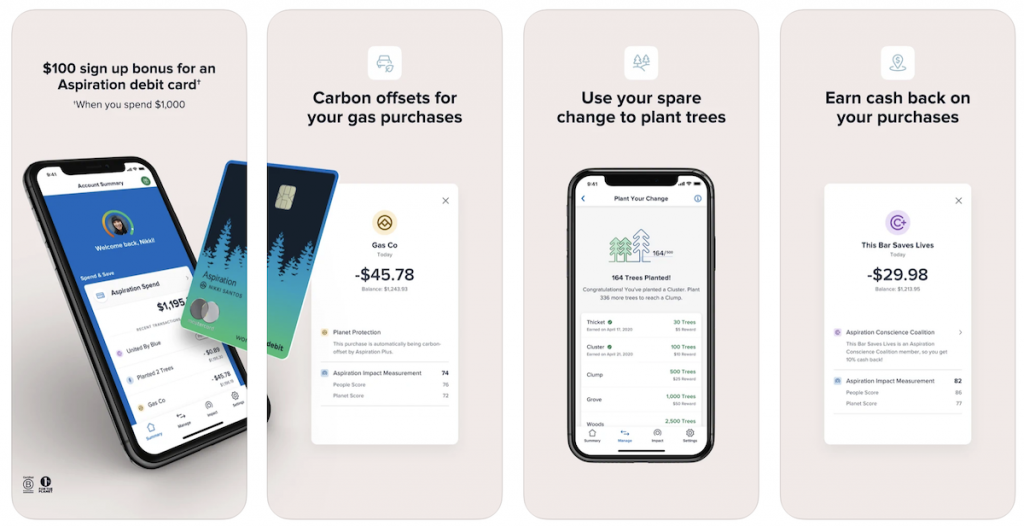

Aspiration

With so many savings apps available, it can be difficult to decide which app is best for you. Thankfully, the Aspiration Savings app is a versatile account that provides a positive impact on our planet and reduces your carbon footprint. And unlike a traditional savings account, the Aspiration account maintains separate checking and savings balances.

This bank account is legit and only takes two minutes to sign up for an account.

Learn More: Aspiration Review

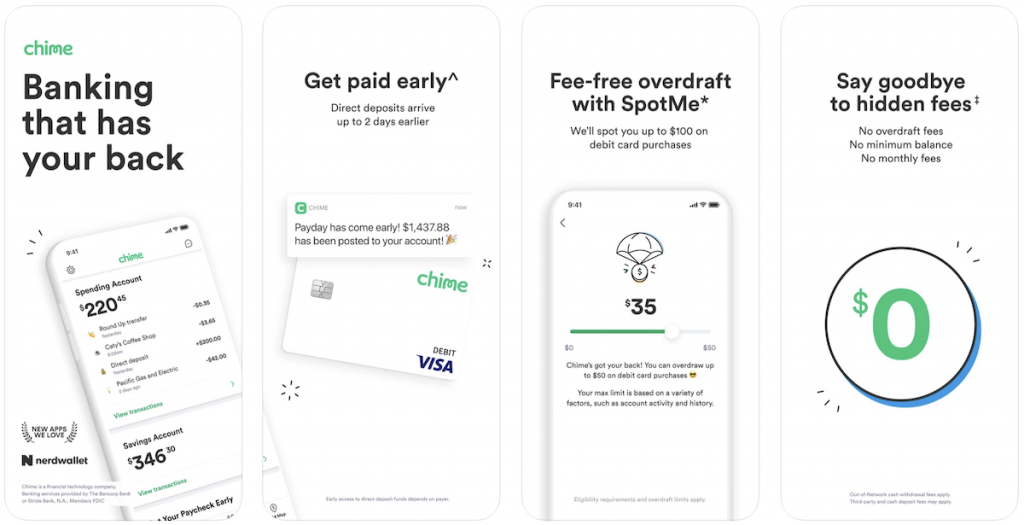

Chime

Chime brands itself as an award-winning mobile financial technology app and debit card. You can set your checking account to commit 10 percent of incoming paychecks to savings automatically. Additionally, some purchases you pay for using your Chime account are eligible for cash-back rewards.

Chime is a financial technology company, not a bank. Banking services provided by, and debit card issued by, The Bancorp Bank or Stride Bank, N.A.; Members FDIC.

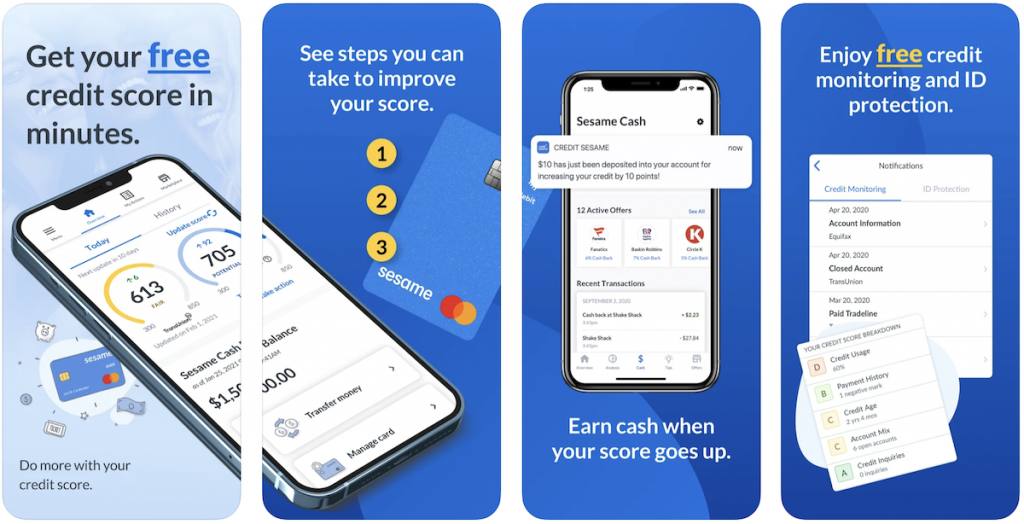

Credit Sesame

Get your free credit score, monitor your credit, get personalized tips for improving your score, and enjoy zero-fee mobile banking with Credit Sesame. If your credit, or lack thereof, has been on your mind, you might find Credit Sesame as a jack of all trades for credit monitoring and even free identity theft protection. The result is an app that delivers helpful and timely advice, as well as alerts to help you keep your money safe.

Learn More: Credit Sesame Review

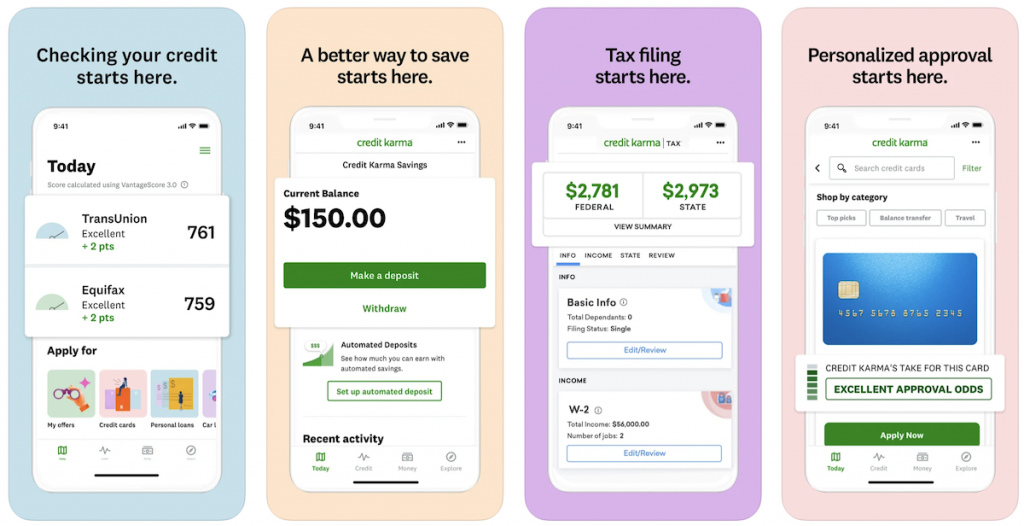

Credit Karma

Credit Karma lets you make the most of your credit score. From spotting identity theft to getting personalized loan and credit card recommendations. Sometimes, saving money for the future or a major purchase requires a little personal finance triage first. If that's the case, the Credit Karma is a good starting point for anybody who wants to find out where they stand credit-wise and get some practical tips for improving it, saving money on ordinary expenses while you do so.

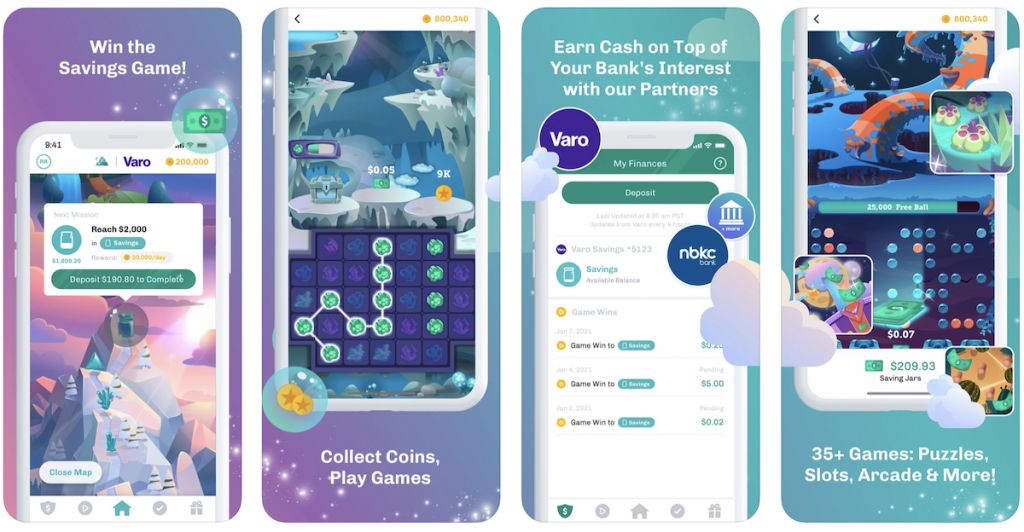

Long Game Savings

Making the most of your income over a lifetime requires you to play the “long game” — hence the name of this app. Long Game Savings is a fully featured savings account that rewards you with cash and cryptocurrency rewards. Saving money in your account earns you playing time with fun interactive games and the chance to earn additional cash prizes. You can withdraw your money anytime, just like a regular savings account.

Learn More: Long Game Review

Best Money Saving Shopping Apps

These apps can help you spend less on things you buy everyday.

CamelCamelCamel

CamelCamelCamel is a web app and browser extension has a funny name, but potentially significant results. It works exclusively with Amazon.com and provides historical overviews for the price of almost every item. If you want to uncover the best times to buy online from Amazon, CamelCamelCamel is an indispensable tool.

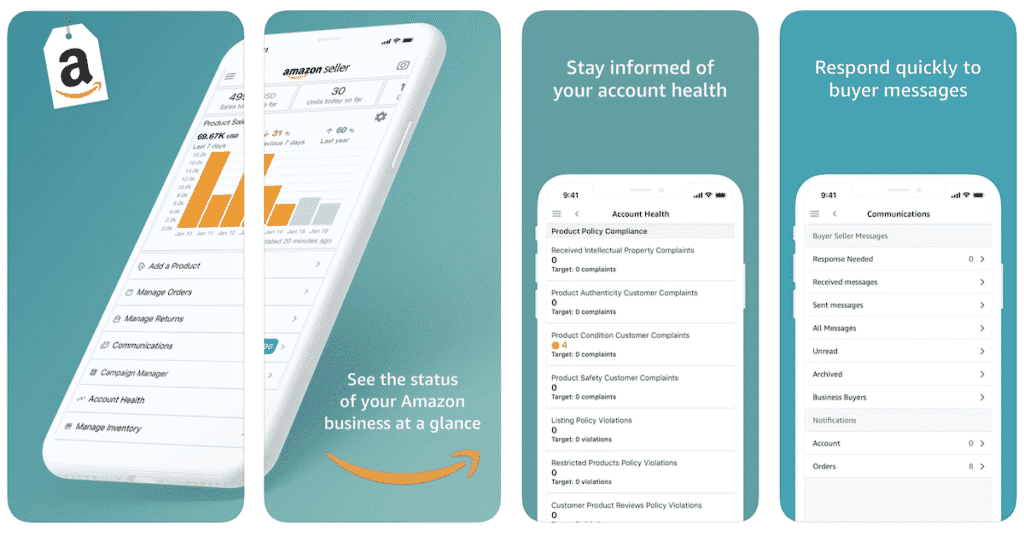

Amazon

Concerns about Amazon's working conditions have finally reached the mainstream, but there's little doubt Amazon can be a cost-savings godsend when you know how to work the system. A good start is using the Amazon.com mobile app to scan barcodes when you're out shopping. If Amazon — or a third-party affiliate — has a lower price on the item, it'll let you know.

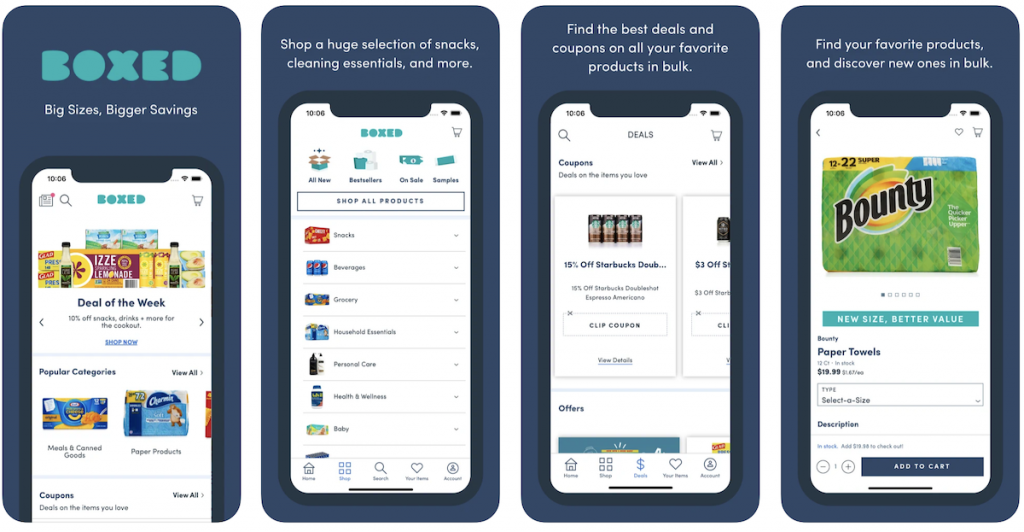

Boxed

Boxed is an app and online service that combines most of the benefits of a warehouse store membership — BJ's, Costco, Sam's Club, etc. — with the convenience of home shopping. Signing up is free, and there is no membership fee — just free shipping in the contiguous U.S. and wholesale prices for bulk amounts of groceries and household products.

Best Debt Payoff Apps

Need a debt payoff planner or looking for the best ways to pay off debt? There’s an app for that! Here are the best debt payoff apps so you can pay off debt quickly.

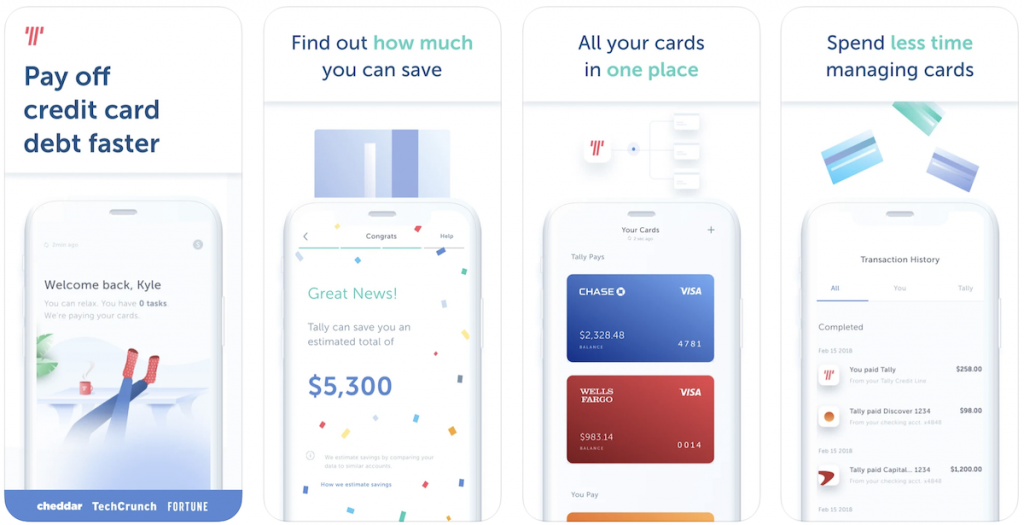

Tally

Credit card debt is the bane of many consumers' existence. Tally is an app designed to help those with credit card debt track and pay it all off in a timely, responsible manner so you can get your finances back on track. Without harming your credit score, Tally analyzes your finances and opens a line of credit for you to automatically pay off your debt for you at a rate you can manage.

Learn More: Tally Review

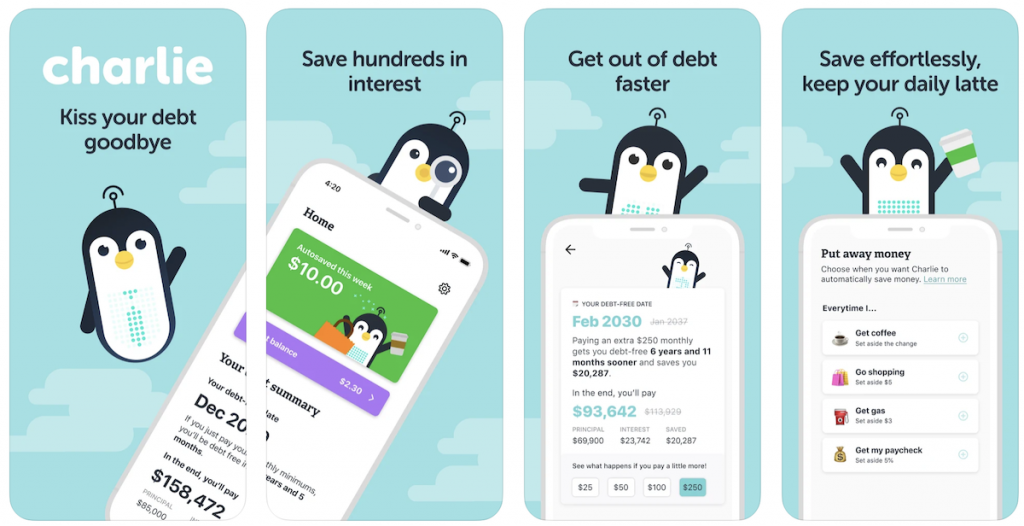

Charlie

Charlie is a smart, adorable, friendly penguin who will get you out of debt faster. With Charlie on your side, you will be debt-free sooner, all while keeping your daily latte. No budgets. No judgment. Surprisingly fun.

Charlie is completely free to try for a month. After your trial period, a monthly subscription costs just $4.99 and can be canceled anytime. With Charlie on your side, you will save thousands in interest.

Best Investing Apps

Investment apps allow you to interact with the market on the go. Here are our top recommendations.

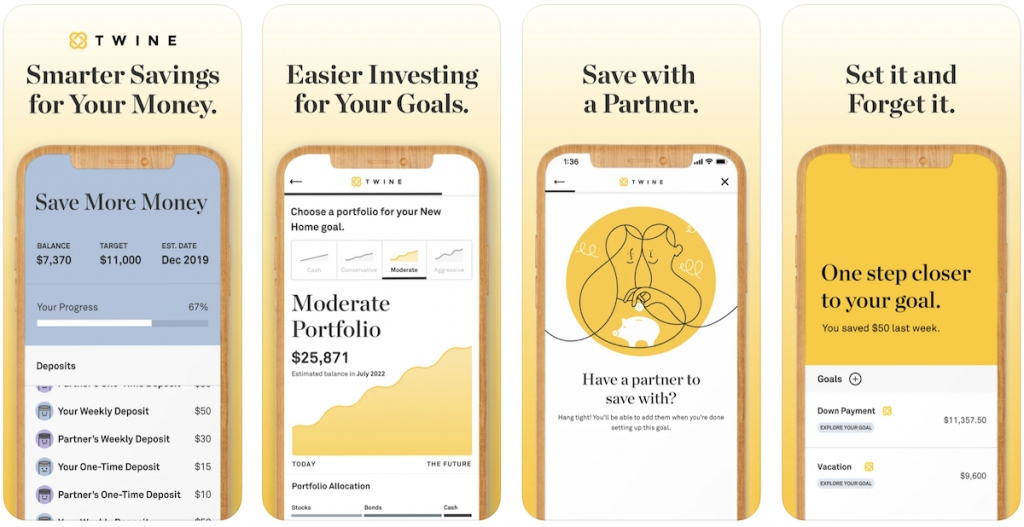

Twine

Twine is a product of John Hancock, America's oldest mutual fund company. The Twine app helps Americans save for a better tomorrow, whether by using their fee-free savings accounts, that earn some of the best interest rates out there or by funding future goals, Twine is a great new way for American's to start saving for their future.

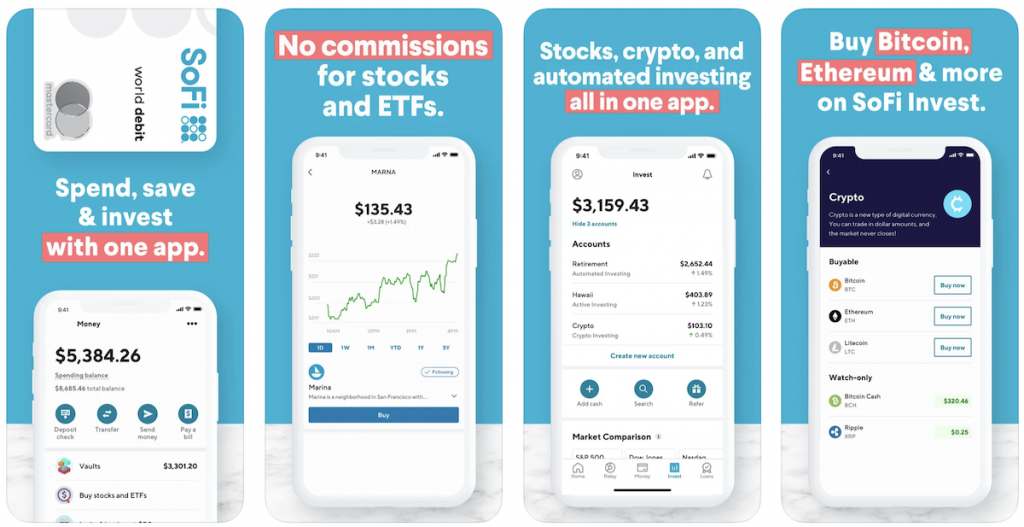

SoFi Bank

SoFi offers personal finance tools to help you spend, save, and invest all with one app. SoFi lets you grow your money with a high-yield online checking account and earn 6x the national average. Plus pay down high-interest debt with a no-fee personal loan, refinance student loans, or automate your investing with SoFi Invest.

And you can connect thousands of financial institutions to SoFi Relay — free tools and trackers that help you organize and optimize your finances. Whether you choose to use all of SoFi's personal finance products or just one, this ultimate personal finance app can help you make the most of your money.

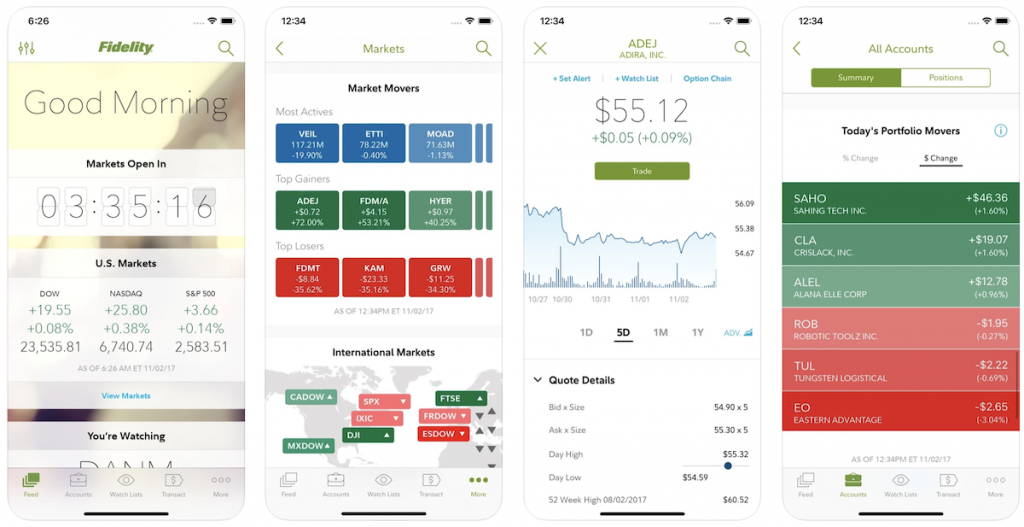

Fidelity

Whether you have an employer-backed retirement account or a personal Roth IRA, there's a good chance you manage it through Fidelity. Using the mobile and web app, it's easy to watch your accounts grow or make additional one-time investments in your future as often as you can afford to do so.

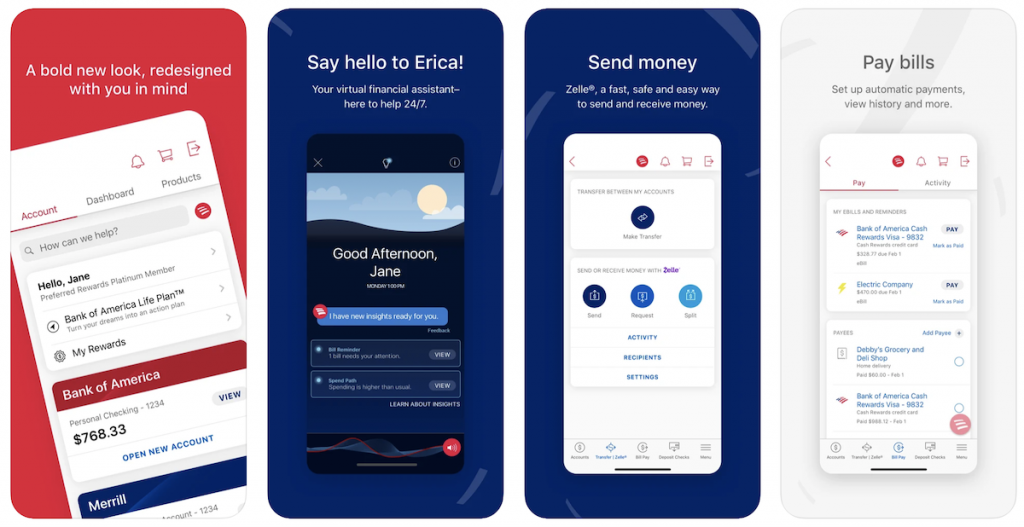

Bank of America

Bank of America, as the name suggests, “B of A” is one of the biggest financial institutions in the country and one the best private banks for high net worth individuals. They cater to all demographics and they've recently upped their game for savings and checking account holders by adding a “Keep the Change” feature to their account apps. This program rounds up your purchases to a whole-dollar amount and saves these small amounts as deposits to your savings account.

What Are Money Saving Apps?

Money-saving apps utilize the power of technology to help you effortlessly save money. Most of them are available through iPhone and Android devices and can help you budget without lifting a finger.

But you probably already know that. So which ones are the best?

To help you pick the right one, we listed all the major money-saving apps on the market that can save you the most.

Best Online Savings Accounts

Did you know you can make passive income with savings accounts? Yes, I wouldn't think of a savings account as a good source of passive income but your cash should be getting something in return instead of just sitting in a checking account.

Online banks can offer over 20X more in interest — and consumers are missing out. The best high yield savings accounts offer a higher interest rate and there is absolutely no risk to your money (you'll actually earn 1% or more on your cash).

|

APY: 5.00%

|

APY: 4.65%

|

APY: 4.60%

|

APY: 4.50%

|

APY: 4.40%

|

|

Minimum to Earn APY: $5,000

|

Minimum to Earn APY: $100

|

Minimum to Earn APY: $1

|

Minimum to Earn APY: $100

|

Minimum to Earn APY: $0

|

|

Bonus: N/A

|

Bonus: N/A

|

Bonus: $300

|

Bonus: N/A

|

Bonus: N/A

|

In Conclusion

To close, let's reflect on the fact that there's often no better way to get a handle on your finances than to make them more accessible. To that end, find out if your regional credit union or bank has a mobile app.

If they do, it means you can go everywhere with the means, in your pocket, to move money between accounts, check your balance or identify questionable transactions right when they happen. If saving money is the goal, keeping your eyes on your money in the first place is step one.

Many of the money-saving apps offer help to let you build up savings over time. In fact, the saving apps help change your mindset about money and provide valuable ongoing lessons about financial wellness that can keep you out of debt and on the road to saving more money for today and tomorrow.

Next, get yourself a great savings account and put that money to work! Millennials who want to open savings accounts can benefit from shopping around to receive the best interest rates, as well as pay the lowest fees for account maintenance.

What Next?

If you find it difficult to save money, using money saving apps to help you automatically save can get you on the right track. By saving money regularly you get in the right habit and start building wealth.

Get started today!

If you are looking for a new savings account, check out below for our most updated list of the best savings accounts available to you.