Bills have become unmanageable.

A notification from Klarna here, a text from Afterpay there, an email from Sezzle, a direct debit from Netflix… it gets confusing quickly!

Juggling multiple bills, subscriptions, and Buy Now Pay Later services requires your mental energy to remember what’s due, from where, and when!

Meet Cushion: Your go-to app for organizing, paying, and building credit with your existing bills and Buy Now Pay Later.

Meet Cushion, the app that simplifies your bills and helps you build credit with ease. This user-friendly app is designed to streamline your financial life by organizing and managing your existing bills and Buy Now Pay Later (BNPL) purchases. You can effortlessly stay on top of your payments, track due dates, and gain valuable insights to budget better.

Let's dive into this Cushion review.

What is Cushion?

Cushion is a first-of-its-kind app where you can automatically manage all of your bills, subscriptions, AND Buy Now Pay Later (Klarna, Afterpay, Zip, Affirm, Sezzle, and more) in one place – while also building credit along the way.

How Cushion Works

- Cushion organizes your bills, subscriptions and Buy Now Pay Later after you securely link your bank and email.

- You select a package and get issued a Cushion virtual card.

- You set the Cushion card as the primary payment method on billers you pay frequently – like Netflix, Comcast, or Klarna.

- Cushion automatically reports payments made with the Cushion card to the credit bureaus.

Key features of Cushion

- Track and manage all your bills, subscriptions and BNPL in one place

- Build credit when you pay Buy Now Pay Later, your bills, or both

- Get more insights into your spending and budget better

Is Cushion Free?

Cushion organizes all of your bills, subscriptions, and Buy Now Pay Later for free – which is incredibly helpful.

If you want to make payments and build your credit history, there are two paid options:

- BNPL Builder ($4.99/month) – Manage, pay, and build credit on your Buy Now Pay Later *

- Cushion PRO ($12.99/month) – Manage, pay, and build credit on all your bills, subscriptions, and Buy Now Pay Later *

Customers who sign up for the BNPL Builder or Cushion PRO subscription will be eligible for credit building. *The only way to build credit is to make payments with the Cushion card – which is generally accepted by any biller who accepts Mastercard.

At the end of each month, Cushion reports the amount spent on the Cushion card to the credit bureaus:

- For customers on the BNPL Builder subscription, one of the many perks is that Cushion reports the total amount paid to a verified Buy Now Pay Later provider (like Klarna, Afterpay, Affirm, Zip, Sezzle, etc.) using the Cushion card.

- For customers on the Cushion PRO subscription, one of the many perks is that Cushion reports the total amount paid with the Cushion card on all bills, subscriptions, and Buy Now Pay Later.

Cushion only reports successful payments, which means missed and late payments are not reported. The more you spend through the Cushion card, the greater the impact it can make on your credit score. Cushion gives you full visibility into what is being reported to the credit bureaus each month.

How to Download the Cushion App

Cushion is currently offered as a Progressive Web App (PWA). It looks and feels like a mobile app, but is available to access in browser only.

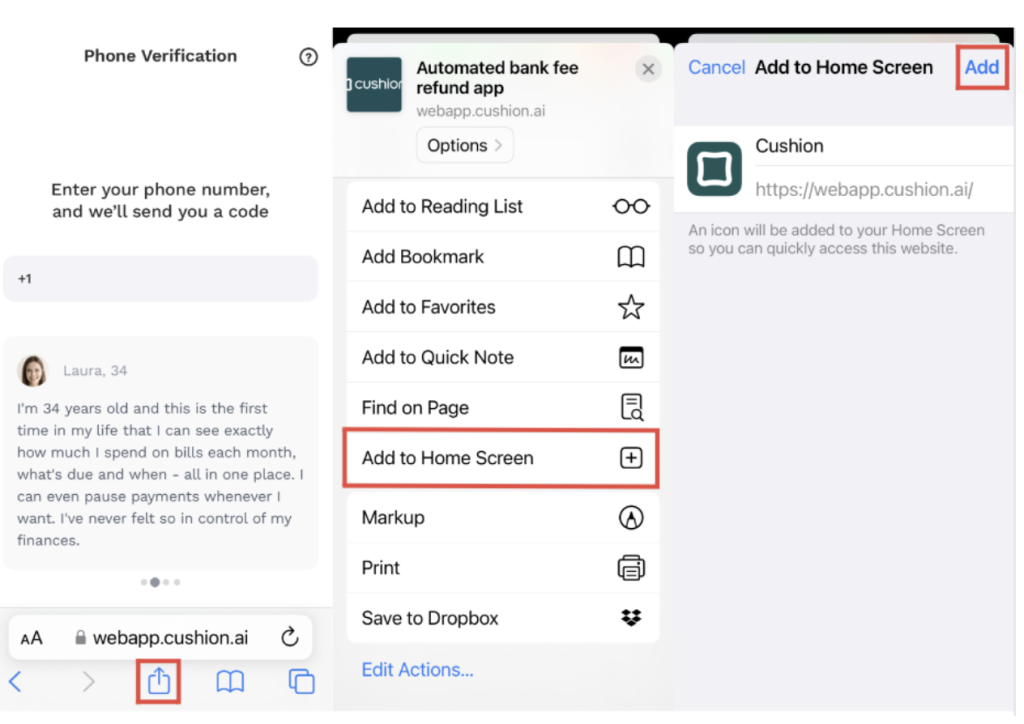

You can easily add a shortcut on your iPhone’s home screen using the following instructions:

- Head to https://webapp.cushion.ai on your iPhone

- Click the Add to Home Screen button

- Lastly, click the Add button, and you’re all set!

To download the Cushion app for Android, follow the following steps:

- Press the “three dot” icon in the upper right to open the menu.

- Select “Add to Home Screen”.

- Press the “Add” button in the upper right, and you’re all set!

Is Cushion Safe to Use?

Yes! Cushion uses high-security standards to protect your data. In addition to the 256-bit SSL encryption, Cushion has invested in security partnerships and experts to build a secure infrastructure that keeps your sensitive information safe at all times.

Cushion uses bank-level security to make sure that your sensitive personal and financial information is fully encrypted and securely stored. The most sensitive information never touches Cushion’s servers and is only handled by their security partners.

Competitors and Alternatives?

Actually, this is not the only mobile application whose goal is to provide people with an effortless way to simplify bills and build credit.

In the context of managing bills, Simplifi by Quicken presents an efficient method for keeping track of expenses. Its bill tracking system is user-friendly and intuitive. However, it doesn't provide a convenient solution for overseeing upcoming Buy Now, Pay Later (BNPL) payments.

For those interested in enhancing their credit score using their current bills, Grow Credit provides a viable solution. This service includes a no-cost Mastercard that can be utilized to pay for significant subscription services. Grow Credit then settles the card balance each month and reports your timely payments to the credit reporting agencies.

Conclusion

Cushion has taken a messy problem–bill pay in the modern era–and solved it by giving consumers unprecedented visibility into their bills and the control to turn payments into an advantage by building credit.

With its easy-to-use app and secure service, it has proven itself to be a valuable tool that helps people easily simplify their bills, subscriptions, and Buy Now Pay Later.

Meet Cushion, the app that simplifies your bills and helps you build credit with ease. This user-friendly app is designed to streamline your financial life by organizing and managing your existing bills and Buy Now Pay Later (BNPL) purchases. You can effortlessly stay on top of your payments, track due dates, and gain valuable insights to budget better.

Many factors are involved in your credit score, making the experience and result unique for each individual. Cushion does not guarantee and cannot predict that your credit score will improve by a specific amount, percentage, or at all within a specific period of time or by using Cushion. Credit building is one of several premium features included in Cushion’s paid subscription.