Over the years, Empower, formerly Personal Capital, has established itself as one of the most popular finance management services available. There are two versions: the Free Financial Dashboard and Wealth Management service.

The free edition is mostly a budgeting program, although it does provide a number of investing tools. The wealth management version is a full investment management service that works somewhat like a robo-advisor.

Getting started with Empower is easy and completely free. Although it seems targeted for people of higher net worth or savvy investors, anyone can sign up and get a look at their finances and investments.

The biggest benefit is the personalized insights that guide you through your day-to-day financial decisions. With this information, you will be able to see where you can improve your finances and what accounts are costing you money or not bringing in enough.

About Empower

There are a ton of personal financial management tools available online, but the Empower app is one of the better ones.

Empower is committed to altering the financial management landscape. The company is a useful blend of technology and financial savvy. Empower is an excellent example of how good things happen when technology meets finance.

Anyone can download the money management app to help take control of their personal finances – it’s 100% free. If you want to track your personal finances on a minute-by-minute basis, using an app is a great place to start. It allows you to manage your spending, monitor investments, and avoid getting into debt.

The app has won tons of awards and scored lots of praise online. CNN voted it as one of the five best apps to manage investments and iTunes App Store staff voted it as one of their “Top Picks”. Let’s look at whether the Empower website and app can make your life easier.

- Plan smarter, retire sooner—Empower helps you optimize your investments for free.

- Maximize your retirement with tools like Monte Carlo simulations and portfolio tracking.

- Take control of your future—get personalized insights to grow your savings.

How Empower Works

Empower is a smart way to track and manage your financial life. They combine award-winning financial tools that provide unprecedented transparency into your finances with personal attention from registered financial planners.

And as fiduciaries, their advisors are legally bound to act in your best interest so they will never put the companies personal financial gain above yours.

The result is a complete transformation in the way you understand, manage and grow your net worth.

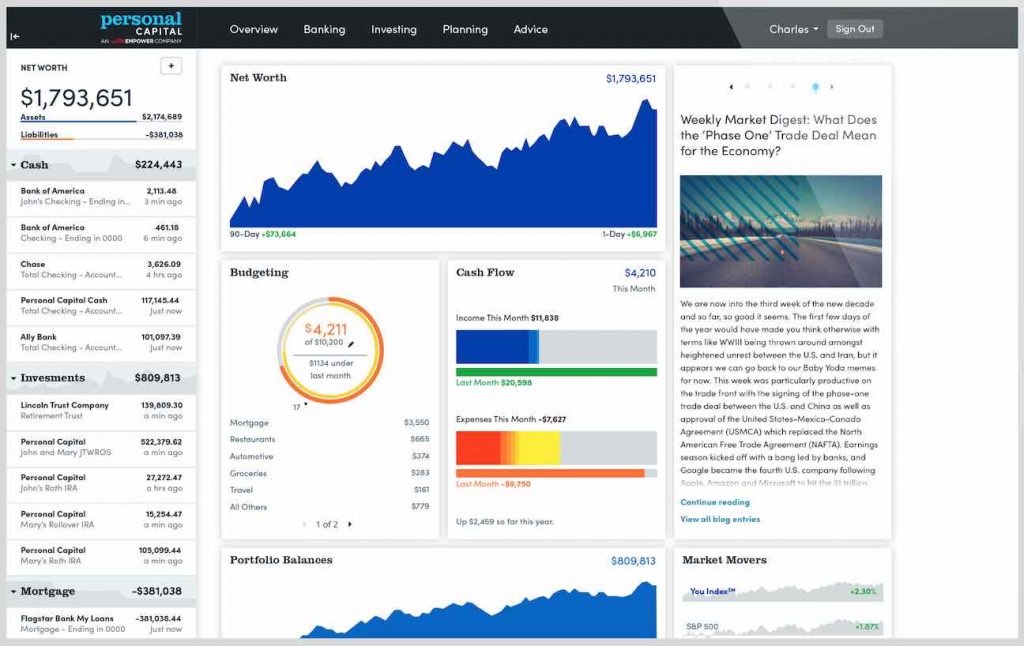

With Empower, you can see all of your accounts in one place. Manage your bank accounts, 401k, IRA accounts, investments, and even debt on their dashboard.

Empower's Free Financial Dashboard

Empower is more than just a budgeting app. You can use the platform to manage all of your accounts, including bank accounts, savings accounts, loan accounts, credit cards, and investment portfolios.

Once you have opened a free Empower account, link your accounts to the app and all transactions and account information is updated in real time.

You will know what’s happening at any given time, which will help you make the right financial decisions.

Start for Free

With the free Empower app, you can easily and quickly link your accounts. They integrate with over 14,000 financial institutions, including Fidelity, Schwab, Wells Fargo and thousands of local and regional credit unions. You can be up and running in about a minute for a 360° view of your financial life.

Interactive Cash Flow Tools

Create and follow a budget. See if you’re spending more than you’re making. Monitor credit card balances. See detailed income and spending by category or payee. Review transactions in the last 24 hours with the Recent Transactions Today extension.

Track Your Investments

What’s the market doing and how is it affecting your assets? Track the numbers by account, asset class or individual security. Compare your portfolio against major market benchmarks and stay on track to meet your investing goals. Install the Holdings Today extension to track the daily market and individual holdings movement.

Built-In Investment Tools

With Investment Checkup, you can compare your portfolio’s allocation to the ideal target allocation and see how well your investments are doing. Uncover opportunities for diversification, minimize risk, and pinpoint hidden fees to fine-tune and improve performance.

Uncover Hidden Fees

Is your portfolio working as hard as it could be? The Allocation Checkup feature could save you thousands on expensive mutual fund fees.

Empower for Apple Watch

Set a spending target and track it on the go. Quickly check your status by day, week, month or year. Access your spending simply by checking the date.

Voice Activation

You can ask Siri to give a summary of your accounts, check current balance and more.

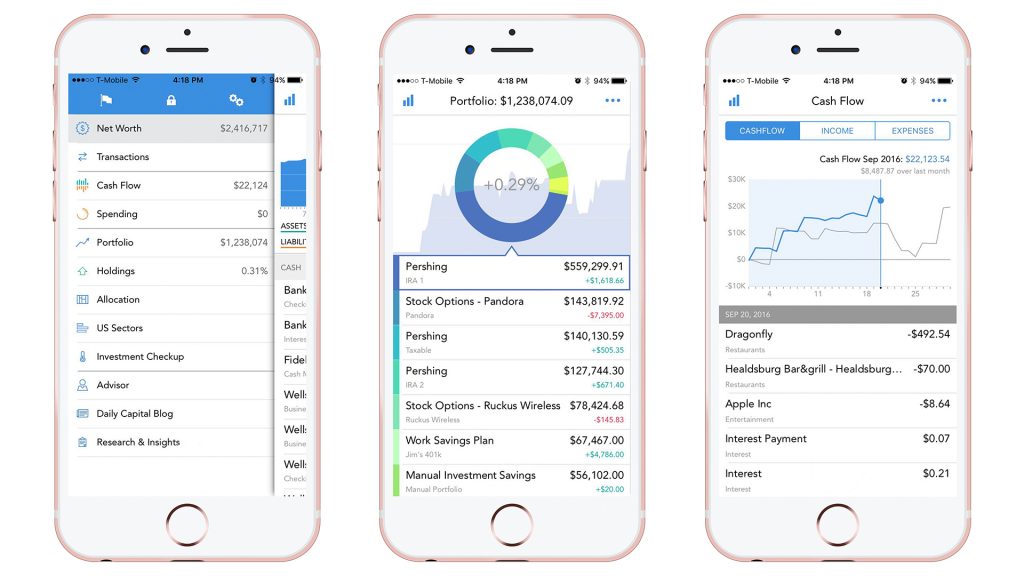

Manage Your Net Worth

If your main objective is to manage your net worth – no problem – the Empower app is designed to make life easy. Thanks to the app, you have your entire portfolio on your wrist. The app monitors your investment portfolio’s performance in real-time. Have you made the right investment decisions? Are your stock holdings on a downward spiral? Find out by checking the app.

Track Your Spending

One of the best features is how easy it is to track your spending. It can be difficult to manage several different accounts and credit cards, but once you install the Empower app on your smartphone, you can set a monthly spending target and check whether you are on track.

The app lets you set daily, weekly or monthly spending targets. If you exceed your spending limit, the app tells you it’s time to quit spending. Blue means you are good, but red means you should put the shoes down and leave the store immediately.

Empower Wealth Management

Personalized Investment Advice

Empower’s registered financial advisors provide customized advice tailored specifically to your goals. If you prefer, you can pay for hands-on management service, but this is aimed at high net worth individuals and for the majority of customers, the free app service is sufficient.

Empower offers dedicated financial advisors if you meet the minimum balance in your investment account. If you have $100,000 as a minimum investment, then you can access human advisors that have management fees that start at 0.89%.

Traditional human investment advisors are typically grouped with robo advisors, which isn't completely accurate. While they do utilize powerful automated investment tools, there is also a strong element of active human management. That places the service between traditional human investment advisors and robo advisors in terms of how it compares to each.

Empower, like robo advisors, begins with assessing your risk tolerance, investment goals, and time horizon. They also consider your personal preferences when building your portfolio. Your portfolio is constructed based on Modern Portfolio Theory (MPT) and invests in a variety of asset classes to provide appropriate diversification. They also periodically re-balance your assets to

Your portfolio is invested in six asset classes:

- U.S. stocks

- U.S. bonds

- International stocks

- International bonds

- Alternative investments, including real estate investment trusts, energy and gold

- Cash

The percentage of your portfolio in each asset class is determined by your investor profile, which is based on your risk tolerance, investment goals, time horizon, and personal preferences.

To provide broad market exposure at a low cost, each asset class is invested in a low-cost index-based exchange-traded fund (ETF). The U.S. equities portion, on the other hand, will be kept in a well-diversified sample of at least 70 different stocks to allow for tactical weighing and tax optimization by Empower.

Empower App

Along with a full suite of web features, you can also use the Empower app to manage your finances.

Is the Empower App Secure?

Security is a big issue with any online finance management app or platform. We need to know our data is secure and our accounts protected. Empower takes cybersecurity seriously and there are numerous layers of protection in place. All credentials are encrypted and stored in a third-party system. Each time you register a new device, you must respond to a telephone call or email to verify it’s you.

You can use the free Empower app with confidence. The two-step remote authentication process builds in an extra measure of security to verify your identity and your device, so you can manage your money and finances knowing your data is safe.

Is the Empower App Available on All Platforms?

The best apps work across all platforms and the Empower app is no different. You can download the app from the Apple App Store and Google Play Store.

Use the app on your smartphone, tablet, or smartwatch. The more devices you use, the better able you are to keep track of your financial position.

Empower Reviews

Here are what some of the best editorial sites on the map have to say about Empower

- Forbes: “Empower's app makes it clear who was in mind when the app was developed. The look and feel are like reporting apps for most brokerage firms such as Etrade, Schwab, and Fidelity.”

- CNN: “Though Mint is one of the oldest players in the game, there are many other choices when it comes to budgeting software: Dave Ramsey's EveryDollar, Empower and You Need a Budget are some other budgeting tools out there.”

- Tech Radar: “Empower's primary function is to track your investments, assets and savings, rather than specifically looking after your current accounts.”

Empower Review Summary

Empower is an easy way to manage your personal finances and it’s 100% free to use. There are some valuable tools included in the app, such as spending alerts and investment tracking, which are not available in other budgeting apps. You will find the app easy to use and the interface is very intuitive. The only negative is that some users have reported annoying glitches, but from a personal perspective, I have had no issues using the app.

Considering all that Empower has to offer, this is a great financial tool that is well worth checking out. You can set up your free Empower account here.

Do you have any thoughts on our Empower review? Let us know below!

- Plan smarter, retire sooner—Empower helps you optimize your investments for free.

- Maximize your retirement with tools like Monte Carlo simulations and portfolio tracking.

- Take control of your future—get personalized insights to grow your savings.