Some of the links in this post are from our sponsors. We provide you with accurate, reliable information. Learn more about how we make money and select our advertising partners.

For those looking to get refunded for silly fees and price drops, apps provide plenty of avenues to consider. Have you ever made a purchase just to find out the price dropped just days later? This probably even happens more than you realize.

Wish you could instantly get refunded for things you already purchased without doing a thing? Well, you can get automatic price-drop refunds with these apps.

Interested? Read on.

Best Price Tracking Apps

Do you want a great deal without having to keep an eye on it yourself? These price drop apps will help!

If you aren't using price drop apps, then it may be like you're losing out on free money. The following mobile applications and websites can help you save a little extra money each time you purchase something.

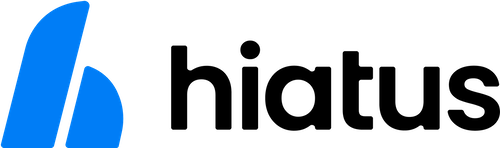

1. Hiatus – Best to Trim Down Subscriptions

Hiatus works a little differently than Capital One Shopping but saves users on average $300 over the app's lifespan. The first thing Hiatus does for you is scan through your linked accounts to find any forgotten, live subscriptions.

It has some great features including:

- Monitors existing bills and upcoming rate changes

- Ongoing financial analysis and recommendations

- Negotiate monthly bills like being able to lower your AT&T bill

- Cancel unwanted subscriptions

- Holds banks balances, current subscriptions, bills

Using your linked accounts, Hiatus creates a comprehensive view of your current subscriptions, bills, and utilities. They monitor trends, watch for increases in your billing, and alert you if any rate changes are coming.

Hiatus charges $10/mo but offers one of the best experiences for users, which may make it worth the price for you to try out. You can try it out here.

- Manage subscriptions and cancel unwanted ones directly through the app

- Negotiate and lower monthly bills with no percentage-based fees

- Track spending and account balances in one streamlined dashboard

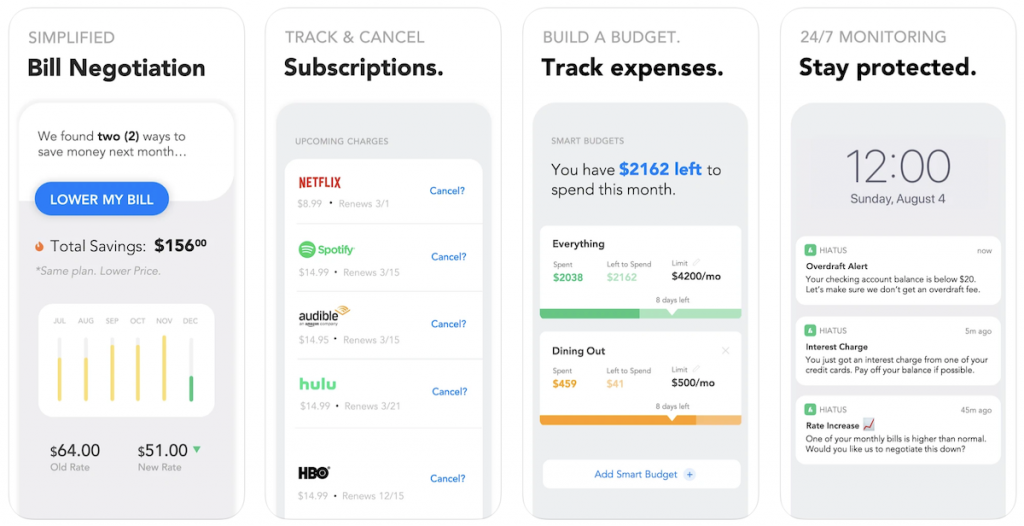

2. Capital One Shopping – Best to Find Better Prices

Capital One Shopping helps you find better prices, automatically searches for coupon codes at checkout, and lets you know when prices drop on products you’ve viewed or purchased.

Just click and it will try to apply available codes at checkout on thousands of retailers.

Codes are updated in real-time based in part on which codes save other users the most.

Capital One Shopping also keeps track of products you've viewed or purchased and lets you know when prices drop which is helpful.

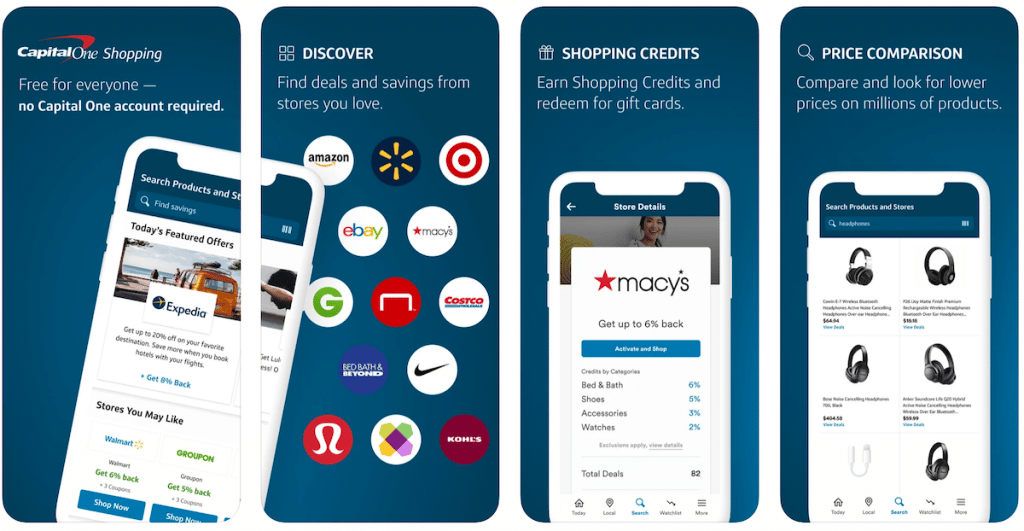

3. Earny – Best for App Features

When you sign up for an Earny account, you’ll link your email account along with your credit cards. Once you have an account, Earny goes to work and monitors your purchases via receipts in your inbox and checks back on those items to see if there is a price drop.

Your pal Earny, a cute figure whose eyes track your movement in the app, helps you effortlessly get refunded for things you've already purchased. Earny does require a subscription for users to get the full price tracking benefits that Earny offers.

The cost for a subscription is $7.99 per month or $47.99 if billed annually. So some would argue that Capital One Shopping is a better and free option.

Here are some top reviews about the refund app:

Business Insider: “The app launched early May and is designed to automatically track your purchases, find better prices, and file refund claims.”

- Forbes: Earny automates the entire claim process for the consumer, from determining price adjustment eligibility, to contacting the store or credit card company that owes the price adjustment, to submitting the actual claim.

- Tech Crunch: Earny’s app syncs with your inbox and identifies receipts. It then monitors prices at Amazon, Wal-Mart, Target, Best Buy, and others. Earny will contact the retailers to ensure that the money goes back on your credit card, or arrives via a check.

- ABC News: Once you download the app, you give it permission to access your credit card account online. It combs through all your purchases for 90 days. If it notes a discrepancy between what you paid and current pricing, Earny does the heavy lifting of submitting a request for a refund from the credit card company.

Earny has identified a ton of money in potential savings for its users to date! It’s as easy as signing up and getting refunds on price drops.

In this Earny review, you'll learn if it's too good to be true.

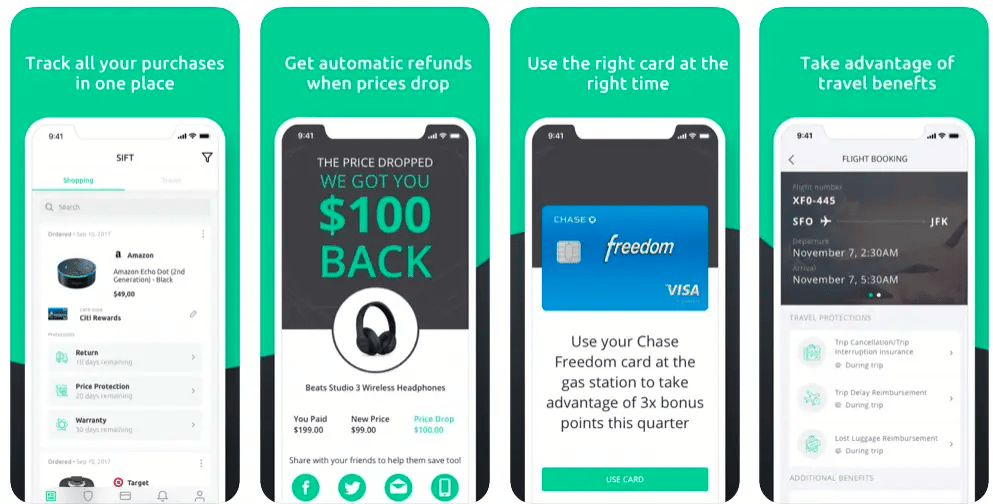

4. Sift – Best for Travel Benefits

Sift is a consumer protection service that looks after your rights as a consumer and makes sure that you get what belongs to you.As an example, Sift automatically gets your money back when prices drop and unlocks many other hidden benefits and policies that you probably were not even aware of.

Your credit cards, all your purchases, and travel bookings and available benefits are automatically tracked. Retailers are changing prices all the time. If you buy something and the price drops within the next 60 or 90 days, you may be qualified to get a refund back.

Sift automatically tracks prices for your purchases and if the price drops, it will automatically get you money back from the retailer or from your credit card provider. You don't have to do anything. You sign up and you start getting money back with this price drop app.

Furthermore, Sift analyzes hidden benefits that are buried in complex retailer and credit card policies and files the appropriate claims on the user’s behalf, getting consumers back tens of billions currently left on the table every year. You can get Sift in the App Store or Google Play Store. Or you can see our full Sift review here if you wanted to learn more.

Other Money-Saving Apps

Saving money by using apps to monitor flunctuating prices can get you great deals but can only save you so much. However, money-saving apps utilize the power of technology to help you effortlessly save money. Most of them are available through iPhone and Android devices and can help you budget without lifting a finger.

But you probably already know that. So which ones are the best? To help you pick the right one, we'll list all the major money-saving apps on the market here but here the top apps that can save you the most.

|

Pros:

|

Pros:

|

Pros:

|

- Automatically invests spare change

- $20 new user bonus

- Cash back at select retailers

- Free budgeting tools

- Retirement planner

- Free portfolio advice

- Robo plus human advisors

- Get control over your subscriptions

- Stay on top of your spending

- Put your savings on autopilot

FAQs

There are a number of great price drop apps available on this list, but some more of the best include ShopSavvy, Honey, and Flipp. These apps can help you save money on your shopping by allowing you to track prices and get alerts when prices drop. They can also provide you with coupons and deals to help you save even more.

While the amount of money you can save with a price drop app depends on a number of factors, such as how often you shop and what kinds of items you purchase, using one of these apps can definitely help you save some money. For example, if you use an app like Karma to track prices on electronics that you’re considering purchasing, you may be able to save a significant amount of money if the price drops before you buy.

In addition to helping you save money, using a price drop app can also help you save time. If you’re constantly checking different stores for the best prices on items, using an app can help you streamline the process by providing you with all of the information you need in one place. This can be especially helpful if you’re doing a lot of holiday shopping and need to keep track of multiple deals.

There are a number of other great apps out there that can help you save money, including rebate apps like Ibotta, Checkout 51, and Receipt Hog. These apps offer cash back or rewards when you make purchases at participating stores or online retailers. They can be a great way to earn some extra money while you’re doing your regular shopping.

Get the Best Refund Apps Today

Many of the price drop refund apps apps allow you to get money back which helps you build up savings over time.

In fact, some of these saving apps can help you change your mindset about money and provide valuable ongoing lessons about financial wellness that can keep you out of debt and on the road to saving more money for today and tomorrow.

Next, get yourself a great savings account and put that money to work!

Consumers who want to open savings accounts can benefit from shopping around to receive the best interest rates, as well as pay the lowest fees for account maintenance.

Good luck and happy savings!