Digit helps you reach financial freedom by doing smart things with your money every day. Is Digit a good app for you?

Formerly known as Digit, Oportun is an all-in-one money app that budgets, saves, and invests for you. Digit rebranded as Oportun in late 2022.

Read our in-depth Digit review to find out more about it.

- Digit is an app that helps you put money in a savings, investment, and/or retirement account.

- Digit looks at your linked bank account balance to determine how much you can save each day.

- The app chooses your investments based on how much risk you want to take.

Is Digit a Good Match for You?

If you have trouble saving money or if you often find yourself spending more than you can afford, Digit could be a good match for you.

The app makes it easy to save money without thinking about it. And because the app is always working in the background, you don’t have to worry about making manual transfers or remembering to save.

If you’re looking for an automated way to save money, Digit is a good option.

It’s time we see how well that works and you can learn if it's right for you by using our Digit review.

What is Digit?

Digit is essentially an app with the goal of making savings a mindless task for its users.

The app is a micro-savings platform that analyzes your spending to determine the perfect amount that you can save over time.

Then it makes automatic withdrawals and transfers it to your savings without you even thinking about it.

As Digit’s CEO Ethan Bloch had it, the goal of the app is to make saving as easy, stress-free and automatic as possible.

Simply put, Digit does all the hard work of getting started with your savings. You can go with your regular financial habits and the app figures out how much can be the extra amount and move it into your savings. And, all that is done automatically so you won’t even notice it.

Digit Features

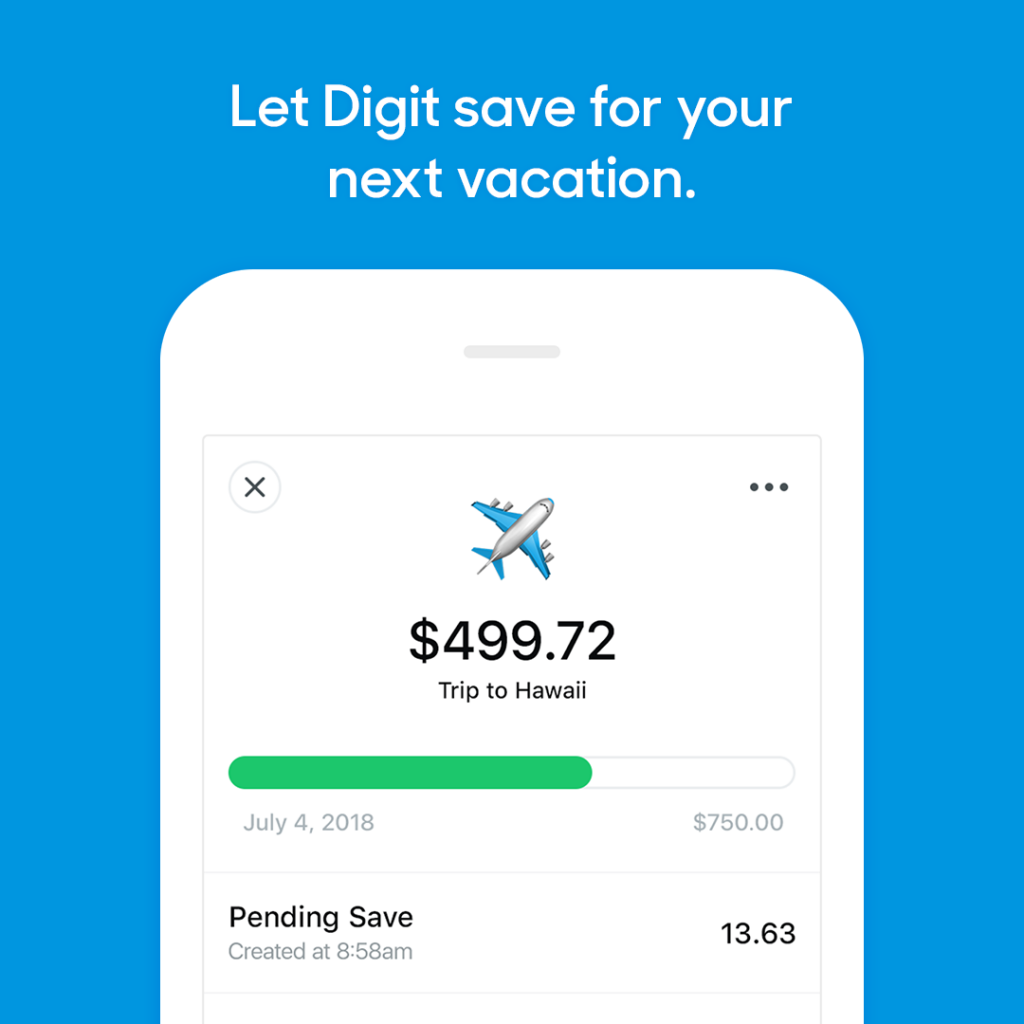

Saving

Digit is a personal finance app that connects to your bank account and analyzes your spending habits. It automatically saves money for you, so you don’t have to think about it.

So when does Digit know when to save?

They take a few things into account, namely your spending habits, upcoming bills, and the end dates on your savings goals. Digit sets aside money whenever you can safely afford to, so you don’t have to think about it.

Digit pulls money from your Spending account. You add money to Spending via direct deposit, a manual transfer, or Smart Deposits. Then Digit calculates smart amounts to move to Bills, Savings, or Investing.

You can easily move money from savings, bills, and spending — funds transferred between Spending, Bills, and Savings, are available in a few seconds.

Ultimately, the goal of Digit is to push non-savers to save money. All you need to do is sign up for the app and connect your checking account.

This money-saving app works by evaluating your financial lifestyle and spending patterns and moves the extra money to your Digit account. The amount of extra money the app automatically transfers will depend on different factors including your checking account balance, your upcoming income, upcoming bills, and your recent spending.

Budget

Need a way to stay ahead of your bills? Digit can help. The company states they want you to have enough for expenses coming up later in the month. They do this by helping you whenever you make a deposit, Digit calculates a smart amount to budget for bills.

Essentially, Digit will move money you’ll need for bills into a separate, dedicated account.

Here's how it looks like:

- Link bills and credit cards. Add bills that happen every month (like rent or a car payment) or link credit cards and pay down your balance.

- Budget with every deposit. Digit automatically moves money to your Bills account so expenses are squared away and ready to pay

- Pay with your Bills account. Enter your Bills account details wherever you pay your bills to use the money Digit’s budgeted for you.

You can even keep up with car payments with this app. Make car payments without hitting any speed bumps. Digit chips away at the cost all month, instead of budgeting all money at once.

Or do you need help with rent? Digit budgets a little at a time, so your rent payment won’t feel massive when it’s time to send the check.

Even streaming services like Netflix or Hulu can be budgeted for. Streaming, delivery, storage — they all add up. Digit saves a little at a time, so the things you use daily don’t cost you all at once.

Basically, Digit can budget for all types of common bills like credit cards, rent, subscriptions, gym memberships, internet, and insurance. Just let Digit know how much the bill is and when you need the money.

Spend

When you open a Digit account you'll also get a spending account. This can only spend money that you know you're actually good for and live within your means.

Digit uses machine learning and financial best practices to calculate how much should be available in Spending at any given time. This is based on your deposits, what you owe, and planning for way down the road.

Here is how it works:

- You make a deposit. Money from a direct deposit or a transfer from a linked bank starts in Spending.

- Digit runs the numbers. Digit decides what you’ll need for expenses and goals and moves that amount to Bills, Savings, or Investing.

- And shows what’s left. What’s available in Spending is good to use on everyday items or a spontaneous splurge.

You can use your spend account for direct deposits as well. Which be done right in the app with its partner, Atomic. Digit can also send you a form that you can share with your employer, HR department, or payroll service.

You can add money to your spending account via direct deposit, a manual transfer from a linked bank, or Smart Deposits. Smart Deposits are automatic transfers from your linked bank that happen each week based on upcoming Bills and Savings deadlines.

If your transferring money between accounts in the Digit app, it usually takes a few seconds. From a linked bank, transfers typically settle within 3-5 business days. It depends on your bank’s processing schedule and time of day the transfer was made.

Invest

Investing is can be for you even if you only have a little money to invest. Some places make it really easy to buy individual stocks — Digit takes a different approach. Digit guides your money to a balanced portfolio of exchange-traded funds (ETFs) based on your risk level.

If you are new to investing or wish it was easier, then this feature is right for you. Don’t worry about how much to put in the stock market. Digit knows your spending habits, bills, and goals. They use that info to calculate the right amount to invest in a portfolio that fits your situation.

Similar to Acorns, Digit has three ways to go about investing:

- Conservative: This portfolio of ETFs minimizes risk for folks who may need their money sooner.

- Moderate: This portfolio is designed for solid gains over a longer time period.

- Aggressive: This option carries the highest risk, but has potential for larger returns over time.

Not comfortable with a certain type of investment? You can adjust your settings at any time. You can choose the Individual Retirement Account that fits with your salary so you can save on taxes. Digit keeps annual limits in mind so you won’t contribute too much.

Just like saving up for goals, Digit finds small amounts each day that you won’t feel. You won’t notice it today, but your tomorrow self will thank you very much.

How Much Does Digit Cost?

The Digit app is free for the first 30 days. After that, you’ll be charged $5.00 monthly and you can cancel anytime.

Saving with Digit rewards you with a 0.10% annual Savings Bonus paid every 3 months. Your bonus amount is calculated from the average daily balance in your Digit account over the previous 3 months — including Rainy Day savings and money accrued toward goals or bills.

Is Digit FDIC Insured?

Funds held are FDIC insured, up to $250,000 per depositor. It also enables you to make convenient transactions using your phone SMS services and allows unlimited withdrawals 24/7.

Is Digit Safe?

Yes, Digit is safe. When it comes to security, the app utilizes advanced 128-bit encryption to enhance the protection of sensitive user information and transactions.

Pros and cons

Pros

- A great set-it-up-and-forget-it app that makes saving easier and automatic.

- Simplified savings goals.

- You get an annual savings bonus paid every 3 months.

- It’s easy and convenient to use and you don’t have to set up a savings account to use the app.

Cons

- Monthly charge of $5.00. Think before you start paying any amount to save money.

- Not available internationally, as it’s only currently available for US-based users.

- Customer contact is limited, no phone or chat support. So, if you have concerns the closest thing you can do is contact them via email.

Money-Saving Apps Like Digit

Since one of our favorite automated savings apps, Digit, announced that they would be adding a monthly fee we were looking for other comparable saving apps.

So here are other best round up apps like Digit:

Acorns

Like Digit, Acorns offers a mobile and web app. It too functions by saving small amounts of money automatically, this time by rounding up your purchases on a linked account or card and by investing the difference in your Acorns account. The service recently launched “Acorns Later” — a full-featured retirement account that that’s perfect for anybody without an employer-sponsored retirement plan.

- Acorns rounds up spare change from purchases and invests it for you

- Get a $20 bonus when you invest just $5 and start a recurring deposit

- Start building long-term wealth with just $3/month—free if you're under 24 and in school

Qapital

Qapital is another mobile-focused savings app that makes automatic or manual deposits based on your income. But it goes a step further than some of the others by offering a social and family component, where you can save money as part of a group, as well as robust goal-setting features for when you have specific savings milestones in mind.

Qapital is a personal finance mobile application for the iOS and Android operating systems. The app is designed to motivate users to save money through gamification of their spending behavior. Qapital is a full-service banking app that helps its members save smartly and invest confidently, all so they can spend happily.

Summary

Almost all of us would agree that setting aside savings is quintessential for our overall financial health. However, for most of us, the most difficult thing about saving money is figuring out how to get started. Wouldn't it be easy to learn how to save money and get paid to do it? Believe it or not, there is.

Building your savings is simple with Digit. This innovative app saves your money without you having to lift a finger. Simply link it to your checking account, and its algorithms will determine small (and safe!) amounts of money to withdraw into a separate, FDIC-insured savings account.

The Digit app can be a great platform to launch your savings habit for short-term savings goals. The best thing about the app is that it does everything automatically for you.

If you are a non-saver this app can help push you to become one. If you aren't a fan of paying $5.00 for the service, you can discover other free budgeting tools available to you.

Key features:

- Automated Saving – Digit analyzes your spending and saves the perfect amount every day.

- Unlimited Goals – Save for a vacation, an emergency fund, or anything you can think of. Set as many goals as you like, and Digit will get to work.

- Automated Debt Payments – Digit will save for and automatically pay down your credit card debt.

- Overdraft Prevention – Digit sends money to your checking if your balance dips below a certain amount.

- 1% Savings Bonus – Digit automatically rewards you for saving.

- Unlimited Withdrawals – There's no limit to how many times you can pull from Digit, and you can upgrade to instant when you need it.

- Overdraft Reimbursement – The fee is on them if Digit saves too much.

- No Account Minimums – You can leave as little or as much as you want in Digit.

- Investing (new) – Digit guides your money to a balanced portfolio of exchange-traded funds (ETFs) based on your risk level.