|

MMG Rating:

5.0

|

MMG Rating:

4.8

|

|

30 day free-trial

|

Fees: $1/mo

|

|

|

When it comes to taking out a payday loan, there is no question that it can be beneficial if you need money in a hurry. You've probably seen payday loan stores or online ads for cash advances at some point in your life.

Whether you need money to cover an expense to avoid overdraft fees or just need access to money in a rush, these loan apps can help you get paid today. In this article, we will cover the most popular payday loan apps for iOS and Android.

Top 10 Payday Apps for Instant Money

These cash advance apps that loan you money are all highly reviewed and legitimate. In a hurry? Here are the top loan apps for instant money.

- Best option to get paid today: Dave Payday Loan App

- Best for cash advances: Empower App

- Best payday membership: MoneyLion App

- Best for gig workers: Cleo App

- Best for saving on overdraft fees: Brigit Payday Loan App

- Best for instant advances on paycheck: B9 App

- Best for workers with hourly wages: Earnin Payday Loan App

- Best for paycheck advances: PayActiv Loan App

- Best banking app: Chime

- Best all in one app: Albert

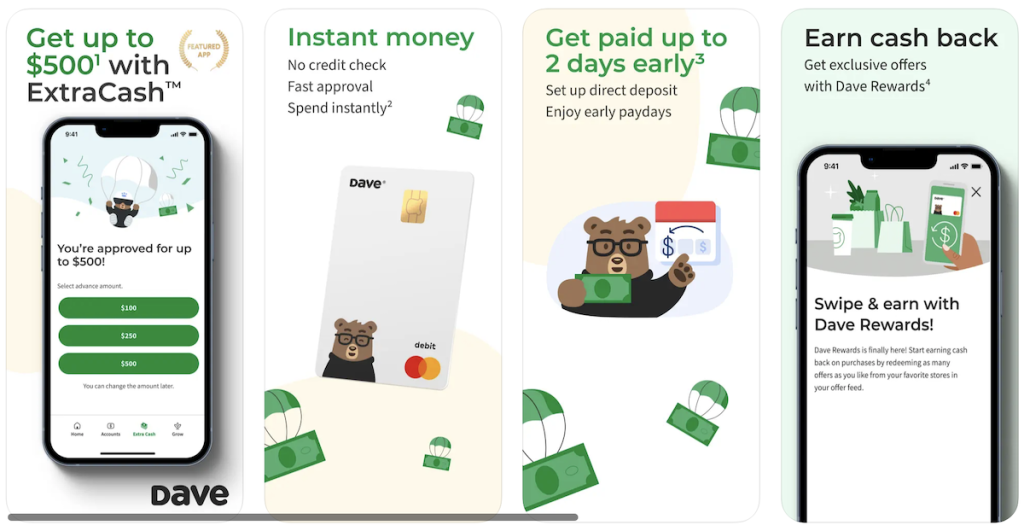

1. Dave Loan App: Best Option to Get Paid Today

Dave is a banking app that offers ExtraCash™ advances of up to $500 with no interest or late fees for as low as $1 per month.

It’s a reasonable choice for people who want to avoid overdraft fees. Dave offers automated budgeting tools to help you manage your finances better.

And for freelancers, this app also offers advice on finding side hustles so you can earn some extra money.

Over 7 million people use Dave on a daily basis to help them achieve their financial goals and you can do the same.

- Meet the banking app on a mission to build products that level the financial playing field

- Get paid up to 2 days early, earn cash back with Dave Rewards, and get up to $500 with ExtraCash™ without paying interest or late fees

- Join millions of members building a better financial future

Where to get it?

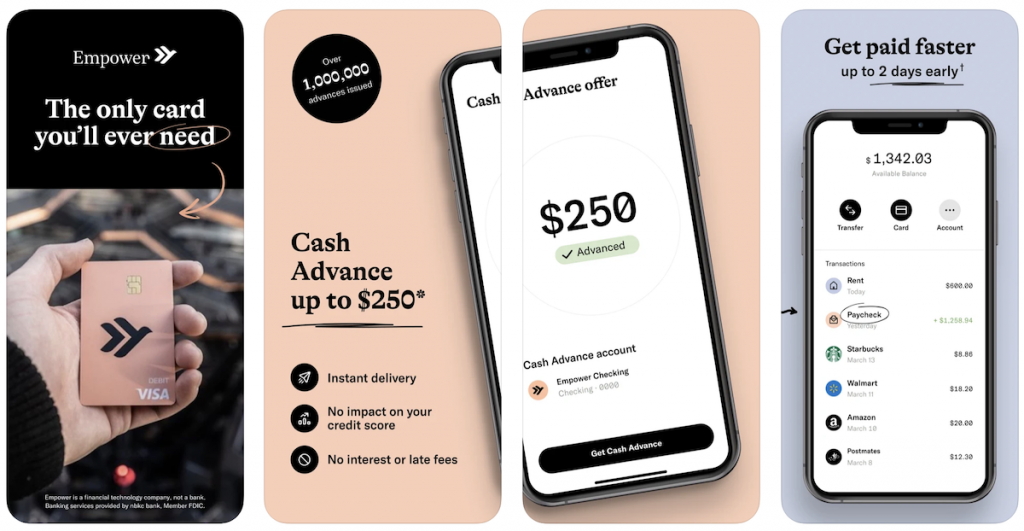

2. Empower: Best for Cash Advances

Empower is an application built for today's generation. They'll be there for you every step of the way, whatever comes your way. You may get a cash advance of up to $250 when you need it most by downloading the app, and save for your future.

They're always there for you, and they'll get a cash advance up to $250 straight into your bank account. Free instant delivery is available for eligible Empower Checking Account customers with an activated debit card.

To determine if you're qualified to receive a Cash Advance, Empower calculates your bank account history and activity, recurring direct deposits, and average monthly direct deposits.

There are no applications, interest or late fees, or credit checks or risks involved. You simply reimburse them as soon as you receive your next payday. There's nothing hidden about it. It's that easy.

Where to get it?

- Empower app for iOS

- Empower for Android

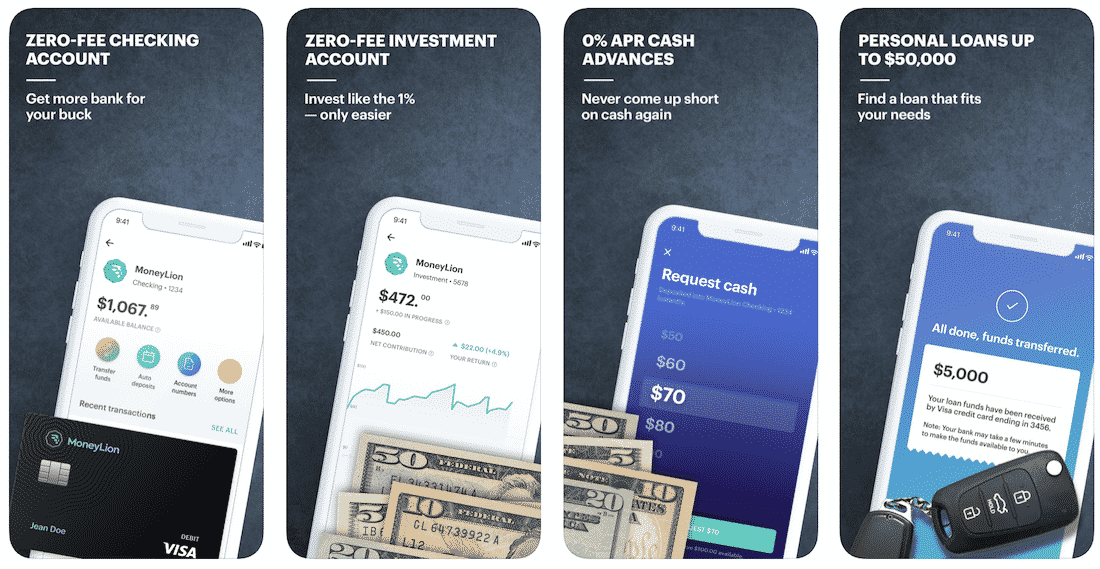

3. MoneyLion Loan App: Best Payday Membership

This payday loan app packs a big punch with a plethora of features that can help you. MoneyLion provides you with access to 0% APR cash advances, low-interest personal loans, helps track spending and savings.

The app also provides financial advice to help you improve and control your financial life. It is no surprise that the MoneyLion community has over 2,000,000 members.

How MoneyLion works:

- Download the MoneyLion app and enroll in free MoneyLion Core. Receive your new black debit card in approximately 7 days.

- Fund your MoneyLion Checking account with an instant transfer, and then use it everywhere you go with no fear of hidden fees, overdraft fees, or minimum balance fees!

- Add direct deposit of just $250 or more to your MoneyLion checking account to unlock instant 0% APR cash advances.

- Upgrade your membership to MoneyLion Plus to get any time access to a 5.99% APR credit-builder loan, $1 daily cashback, exclusive perks, and more.

Since this app has so many bells and whistles you can learn more in a comprehensive MoneyLion review that goes through each feature. MoneyLion is a wonderful choice for people who want to improve their financial situation, but cannot due to high-interest loan rates and many others. It helps them take control of their financial lives and improve their savings and can be downloaded for iOS or Android.

- The maximum advance is $250

- No interest. No monthly fee. No credit check

- Link your checking account to qualify for 0% APR cash advances

Where to get it?

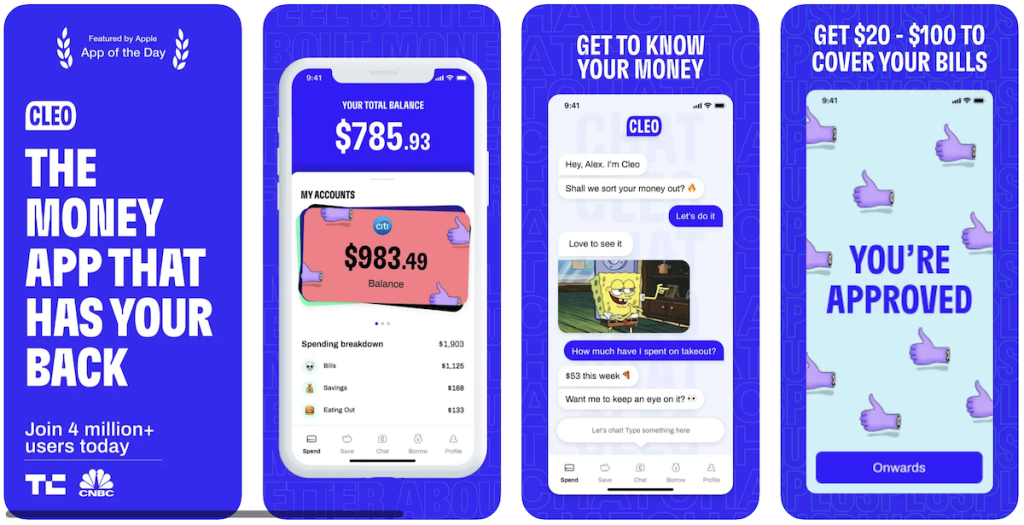

4. Cleo App: Best for Gig Workers

Cleo is your AI pal that looks after your money. Budget, save and track your spending. It’s available in the Apple App Store and Google Play Store.

After downloading the app and signing up for a free account — ask Cleo anything from ‘what’s my balance’ to ‘can I afford a coffee’, and she’ll do the calculations instantly. Drill down with personalized updates, graphs, and data-driven insights.

Let Cleo do the work, as she puts your spare change aside automatically, sets you a budget, and helps you stick to it.

If you upgrade to Cleo Plus, you can qualify for getting spotted up to $100* to stop you from going into overdraft. This money is given to you interest-free and without a credit check, so they are literally spotting you $100.

You can still get a cash advance as a gig worker as they don't check W2s or require proof of employment.

Keep in mind that cash advance is available to Cleo Plus and Cleo Builder users — which comes with a monthly subscription of $5.99/month.

- Borrow up to $250 instantly with no credit check or interest

- Personalized tips on how you can save more

- Get help creating and sticking to a budget

- Costs $5.99 per month for Cleo Plus

Where to get it?

*First timers can usually qualify for $20 to $70 to start with. Once you pay it back you'll unlock higher amounts up to $100.

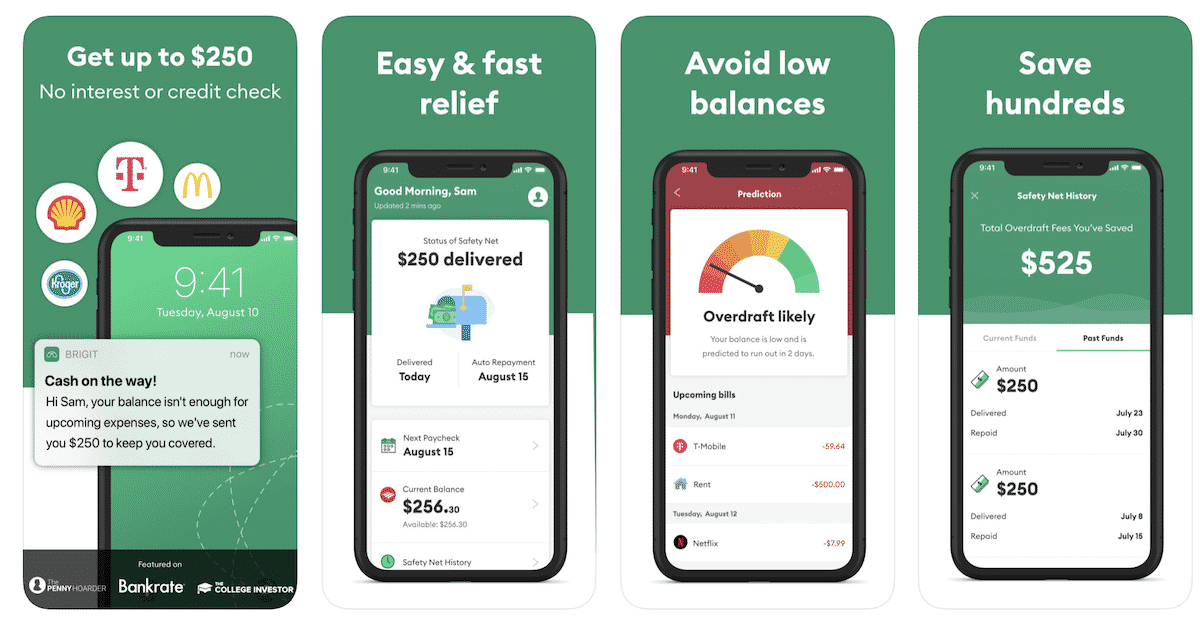

5. Brigit Loan App: Best for Saving on Overdraft Fees

With the Brigit app, you can get up to $250 with no interest or credit check quickly. It's easy and fast relief when you need it and helps you avoid low balances.

If you have a low balance in your checking account, Brigit will see that your balance isn't enough for upcoming expenses and send you up to $250 to cover your expenses. You can save hundreds by avoiding overdraft fees with this app.

How Brigit works:

- No red tape. No hoops. Connect your bank account and that’s it!

- Brigit works with thousands of banks like Bank of America, Wells Fargo, TD Bank, Chase, Navy Federal Credit Union and 15,000+ more.

- Get paid up to $250 instantly.

This is best for those users who keep low balances in banking accounts and are prone to overdraft. You can learn more here.

- Tap to get an advance within seconds

- Get up to $250

- No credit check is required and no interest

- Pay it back without hidden fees or “tips"

Where to get it?

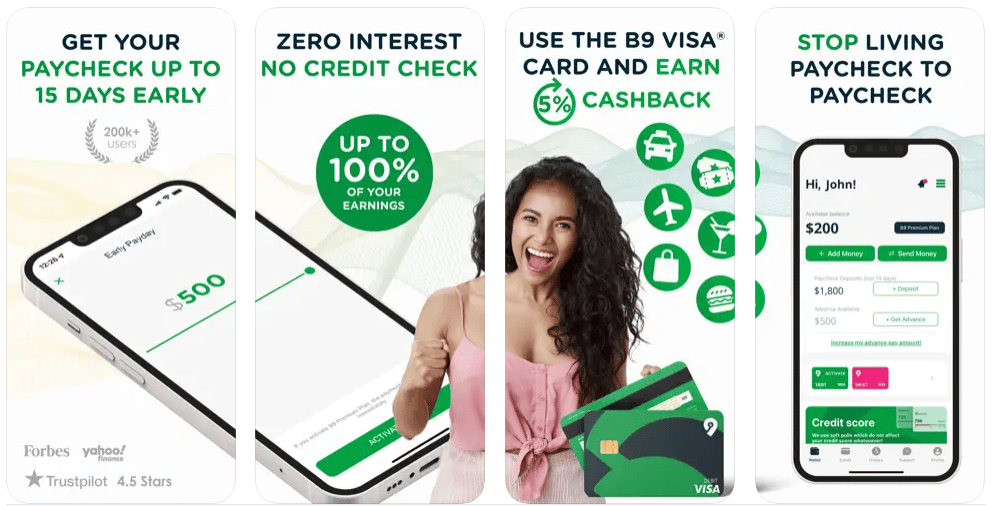

6. B9 App: Best for Instant Advance on Paycheck

B9 is a cash advance app with a monthly membership fee that gives you up to 15 days early access to your paycheck. You can access your paycheck by opening a checking account with B9 and setting up payroll direct deposit with your employer.

Apply for a B9 Advance once your employer has deposited at least one paycheck into your B9 Account. You can get up to 100% of your paycheck and turnaround is instant once your account is set up.

B9 may be a good option for those who just need early access to their paycheck and don't require additional financial services. However, those looking for more comprehensive cash advance options may want to consider alternatives with a wider range of services. B9 costs $9.99 or $19.99 per month depending if you want the basic or premium plan.

Where to get it?

*All B9 Advance℠ members start with up to $100 early pay advance, with a potential for it to increase up to 100% of your earnings you deposit from your paycheck to your B9 Account℠. B9 Members are informed of their current available maxes in the B9 mobile app. Their limit may change at any time, at B9's discretion.

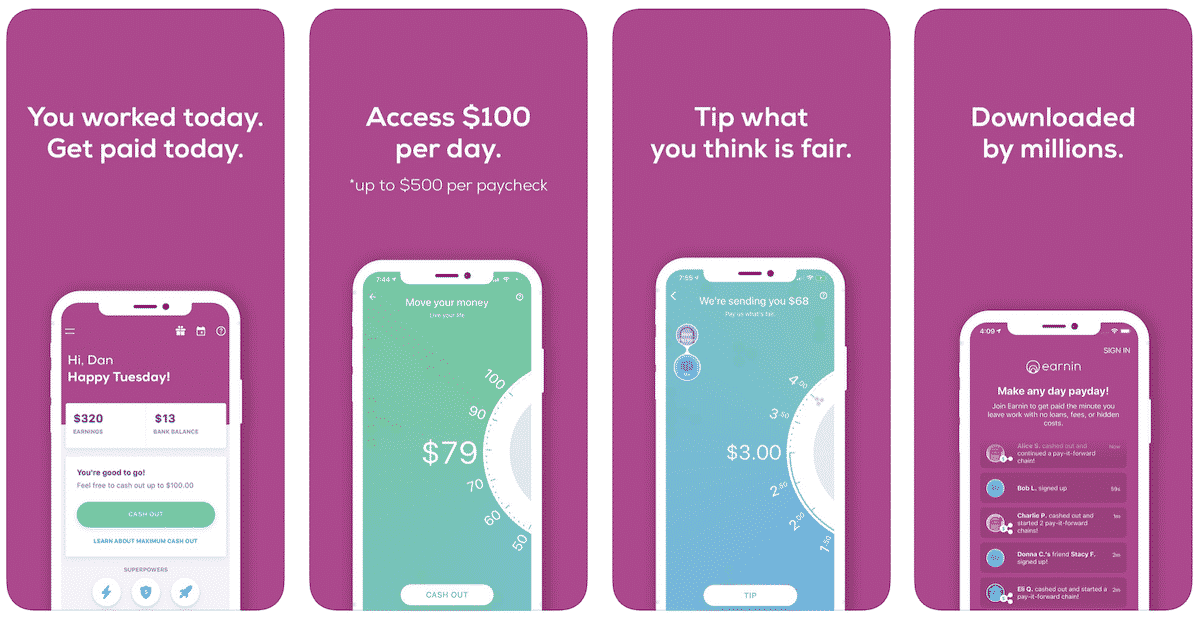

7. Earnin App: Best for Workers with Hourly Wages

The Earnin app allows you to get paid today and access $100 per day, up to $500 per paycheck. The app is free and you only have to pay what you think is fair and millions already use this app to get paid today.

How Earnin works:

- Connect your bank and tell them where you work.

- Earnin will confirm your hours worked, and you can cash out those hours instantly.

- On payday, they will debit your account for the money you cashed out.

You can also set up Lightning Speed by connecting your debit card to your Earnin account and eliminate the wait time between your cash out and the money arriving in your bank account. The best part is that it is all 100% free and you can learn more here.

Where to get it?

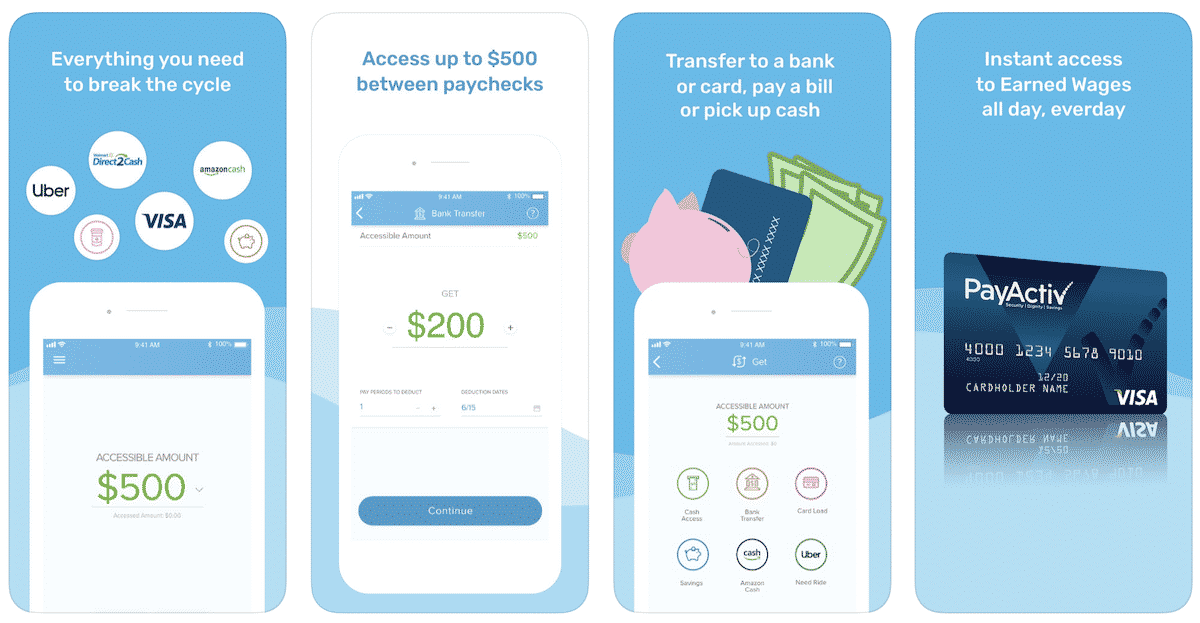

8. PayActiv Loan App: Best for Paycheck Advancements

This payday loan app allows you to get $500 instantly between paychecks. It also offers everything you need to break the payday loan cycles cycle.

How PayActiv works:

- You choose when to use it, or when not to. You’re in the driver’s seat.

- It’s simple, download the app, use the services, and any money you access is paid back out of your next paycheck.

- No interest charged because it isn’t a loan, it’s your money available when you need it.

If you are interested you can download it for Android or iOS.

Where to get it?

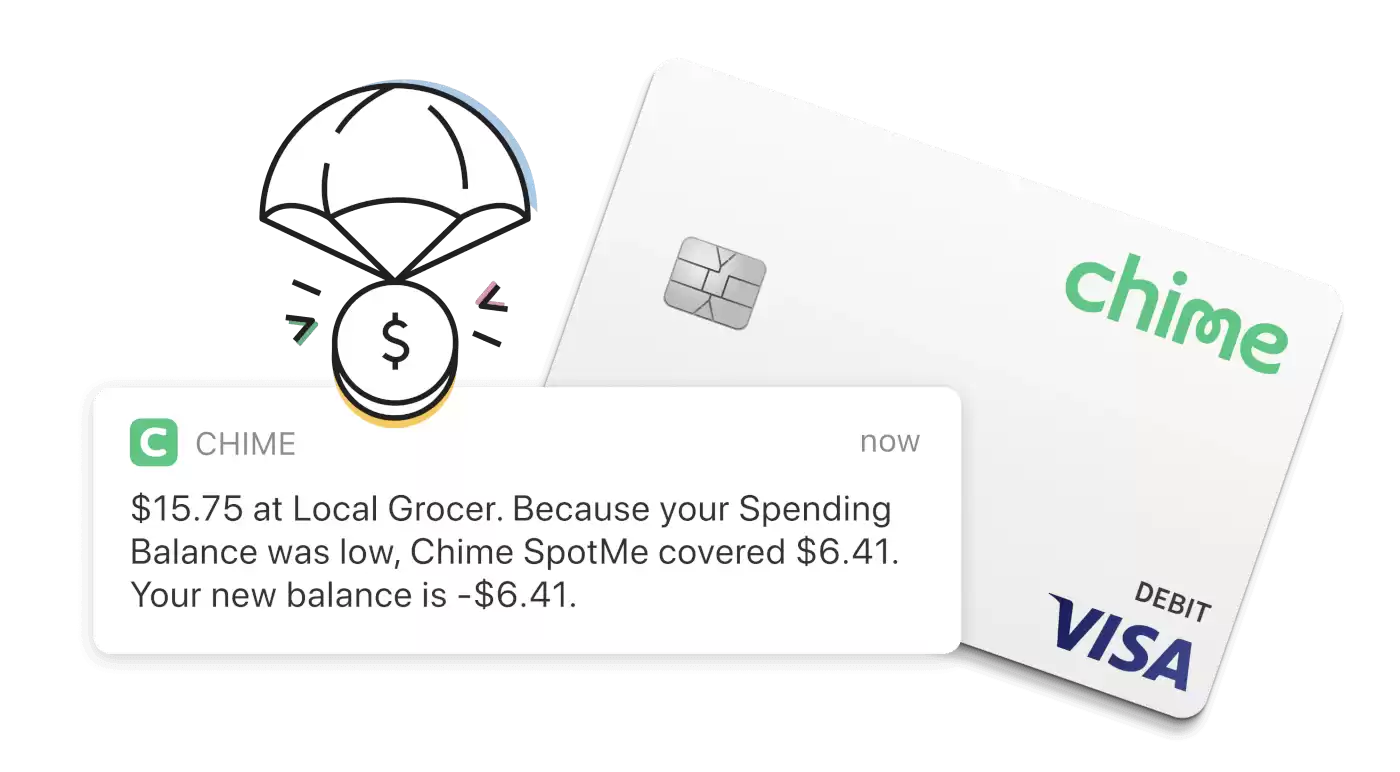

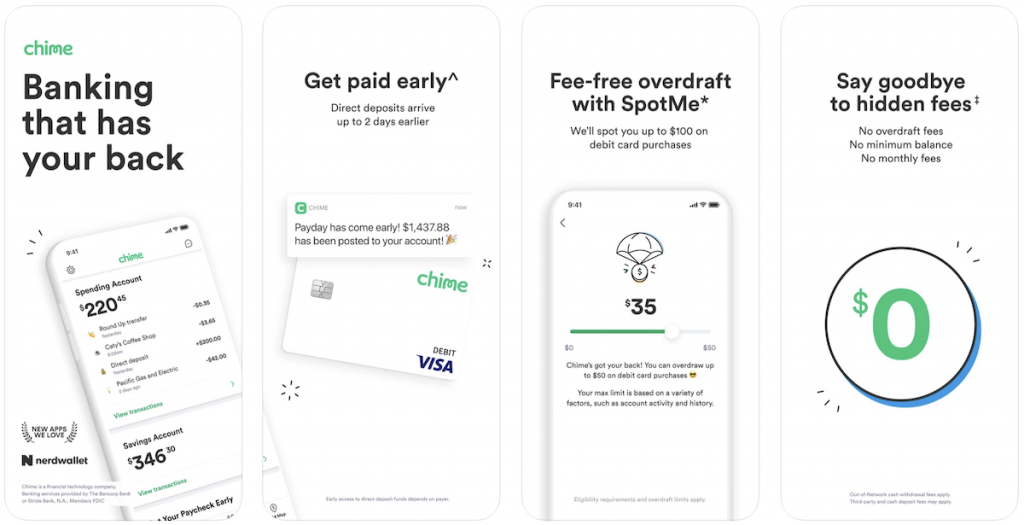

9. Chime: Best Banking App

Chime is one of the best checking accounts we've reviewed and allows you to overdraw up to $200 on debit card purchases without charging a fee with SpotMe®.

If you set up a Chime account with direct deposit through them — you can get early access to your paycheck, up to 2 days earlier than some of your co-workers*.

Plus, they don't charge any overdraft fees, no foreign transaction fees, no minimum balance fees, or no monthly fees at all.

Top that off with 60,000+ fee-free ATMs at stores you love, like Walgreens, CVS, and 7-Eleven1.

This is the best app to get up to $200 spotted to you at any time. It's that simple.

- Experience fee-free overdraft up to $200* when you set up direct deposit with SpotMe.

- Let Chime spot you when you need that little extra cushion to cover an expense.

- Join the millions and make the switch today!

Where to get it?

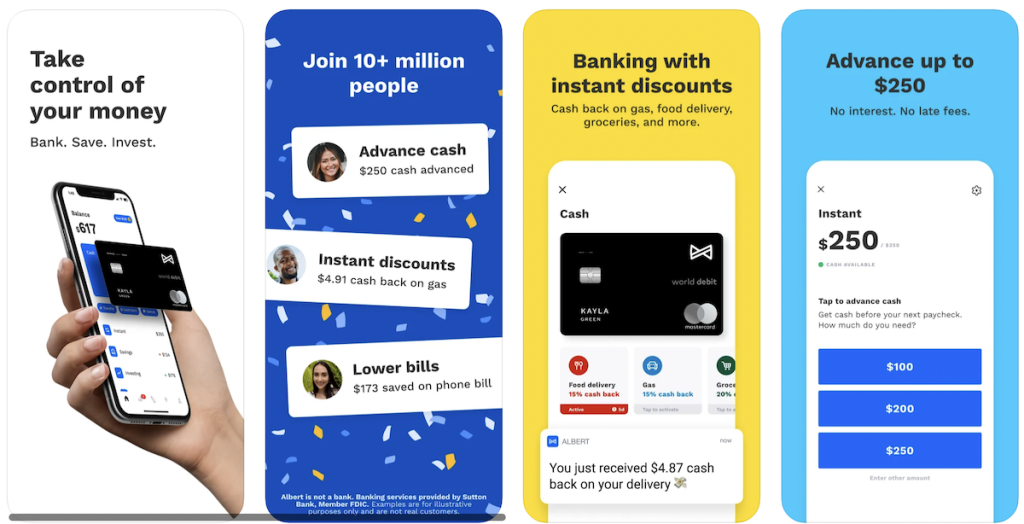

10. Albert: Best All in One App

Albert can spot you up to $250 so you can make ends meet. No late fees, interest, credit check, or hidden hands in your pocket. As long as you have a paycheck and have repaid your past advances, you can request up to 3 cash advances per pay period.

Albert is a super app that offers:

- Checking account with debit card: Offers banking with instant discounts and cash back offers.

- Savings account: Set your schedule or let Albert analyze your spending and automatically move money into your savings account. (On average, they save people $400 in the first six months.)

- Cash advances: Up to $250

- Investing: Invest yourself or enable Robo investing

- Budgeting: AI-driven auto save feature is a big differentiator and very effective

- Genius: Text with a certified financial advisor anytime for a $6/month fee

There’s no catch. Albert is legit.

- Get spotted up to $250 instantly

- Pay a small fee to get your money instantly or get cash within 2–3 days for free

- Costs $14.99 per month after a 30 day free-trial

Where to get it?

How to Pay Off Payday Loans Faster

Whether you use a payday advance app or get a traditional payday loan to access quick cash, here's what you need to know.

Payday loans are an expensive foray and the interest rates can really add up. So, how do you pay off payday loans quickly and start saving money? Here are some ideas.

- Find a way to boost your income. It goes without saying that it is easier to apply extra money to your payday loan when you have more money coming in. Whether you find a way to make more money at your current job or look for an additional job to supplement your income, increasing your earnings can help you pay off your loan much more quickly. You don't even have to look for a traditional job. For instance, you could raise extra money by selling some of your old items on a site like eBay. Applying this extra cash to your loan can help you pay it off much more quickly. Other activities such as blogging or affiliate marketing can help you add to your income over time. If you want, you can even look for a job that you can do in the evenings or on weekends.

- Make an extra payment whenever you have money. Anytime you get extra money, consider paying it to your loan. The longer you hold onto it, the more likely you are to spend it on something frivolous. Making small payments between your monthly payments can help you tackle your debt much more quickly. Of course, before you do this, you will need to check with the lender to make sure that there aren't any penalties for making extra payments. As long as you get the go-ahead, however, this can be a fast way to pay off your debt.

- Decide whether or not you should pay off your loan early. Some loans have a penalty if you pay them off early. Check the terms of your loan to see whether or not you will be charged extra money for paying it off ahead of time. If so, spend some time crunching the numbers to see whether it will cost you more to pay it off early or to pay interest over the life of the loan. That way, you can decide which option will save you the most money.

- Find a Guarantor. A traditional loan or even a guarantor loan is going to have a far lower interest rate than a payday loan. So, if you can find someone to be a guarantor you can take out this sort of loan at a lower rate, payback the payday loan and save on the high interest rates.

- Negotiate a lower rate with the lender. In some cases, lenders may be willing to offer you a lower interest rate. All that you have to do is ask. If you can convince a company that you are working hard to pay off your debt, they may be willing to work with you to make the process easier. You will be able to pay off your loan much faster if the interest rate is reduced.

- Consolidate. Consolidating your payday loans can be a smart way to cut down on your payday loan costs and help you cut down repayments. This sort of thing is especially useful if you have more than one loan or a loan that has run away in terms of interest.

- Tap into your life insurance. The primary advantage of payday loans is that you can get access to the money very quickly. This is extremely beneficial in emergency situations. Once the emergency has been dealt with, however, you can focus on finding ways to pay that money back. One option is to tap into your life insurance. Although this will decrease your payout in the future, it is usually a much better option than paying a ton of money in interest on a payday loan today. The interest rates on life insurance are exceptionally low, which is what makes this option a good choice.

- Consider borrowing from your retirement. If you have a 401(k), you may want to think about borrowing money to pay off your loan. Although you don't want to deplete your retirement account, borrowing a small amount to pay off payday loans might be a good idea since it can save you a lot of money.

- Work with the lender. If you are struggling to pay off payday loans, contact the lender to see if there is any way that they can help make the process easier. Let them know that you are dedicated to paying it off and that you have a plan in place. They may be willing to work with you to lower your interest or to charge fewer fees. It can't hurt to ask. The worst that they can do is say no. Most lenders will work with you if you let them know ahead of time that there might be a problem. Just be sure to contact the lender well in advance of your payment date so that there is time to come up with an alternate arrangement. The majority of lenders would much rather work with a customer to resolve the debt than have it go unpaid.

Need Financial Help?

Feeling financially overwhelmed? You're not alone. Financial stress may be unavoidable, but there are steps that you can take to help you prosper financially.

Do I have to mention that 50% of American households cannot afford an unexpected bill of $500 or more, or only 35% of credit cardholders pay off their balance each month?

Or do I need to let you know that missing a credit card payment, or maxing out your card, can lead to a reduction in your credit score, which means a more expensive lease agreement or personal loan agreement when going to borrow money?

Or do I mention that when most people earn more money, they simply upgrade what they have or attain another bill through another subscription, etc., meaning that the extra money that they have earned is negated?

So, regardless of earnings, the same result will always occur at the end of the month.

So given all these statistics how can you fair in the looming prospect of being financially successful?

Save first, then spend.

If you are feeling financially screwed you need to focus on money-saving ideas first. Pay yourself first. When I first heard this phrase, I actually thought, how do I pay myself? What with?

Then I realized that it does not really mean to pay yourself first, but save first and then spend.

At some point in time in our lives, the odds are is that we have been short of money. Whether it be at the grocery store, traveling, or being on vacation.

In that case, what did we do? We simply made smarter choices. You made do with some things and not others. Think about how your decisions changed when you were short of money.

When you know you have less money to spend, you make smarter choices, because you have to think about the best way to spend that money.

Each dollar has a value and you can only spend it once. I would recommend using that same mentality even when you aren't short on cash.

Savings is key.

When you get paid, I suggest putting 10% away immediately. You will soon get used to having less disposable income each month, but guess what, you will be making smarter decisions, which is a win-win.

(If for example you get paid $1,000 per month)

| Month | Month Amount | Cumulative |

| 1 | 100 | 100 |

| 2 | 100 | 200 |

| 3 | 100 | 300 |

| 4 | 100 | 400 |

| 5 | 100 | 500 |

| 6 | 100 | 600 |

| 7 | 100 | 700 |

| 8 | 100 | 800 |

| 9 | 100 | 900 |

| 10 | 100 | 1000 |

| 11 | 100 | 1100 |

| 12 | 100 | 1200 |

By the end of the year, you have a month’s salary in the bank, you no longer are one of the 50% “have not” statistics and you are making smarter choices each month. As you get paid more, you are able to save more and keep grinding and staying at it.

How to Save Your First $1,000

It's possible to save $1,000 this month — if you're having trouble saving, don't worry because I can show you how to save your first $1,000. If I can do it, you can too. Don't let anyone tell you differently.

Here's what I did to save my first $1,000 in 2 months.

Discipline

The first thing I learned when it came to saving $1,000 was that I had zero discipline. I would put money to the side and a day later find an excuse to spend it. It was like an addiction.

I had to spend something and did a ton of impulse buys. After some reflection, I realized that my issue with saving stemmed from not wanting to be without money (ironic; considering I always spent it).

I looked myself in the mirror and asked myself “how much can you live without?” I decided I would dedicate 10% of my weekly paycheck to my savings and keep the rest.

Get motivated

The first paycheck came and I saved $100. I was proud of myself. I occupied my mind with other ways to make money to keep from going into my savings. I read personal finance books that motivated me to reach my goal of saving $1,000 fast such as:

These books helped get me excited about saving money helped me stay on track with my savings plan. Needless to say, I was excited about the pay week to come. The second pay week came and I saved another $100. I now had $200 sitting in my savings account and my desire to spend it was getting less and less. I started to save like it was a game!

Live within your means.

A few more weeks passed and I now was realizing I didn't need much to get by. The kids had a strict budget. My girlfriend cut our date nights to once a month. Once you stop spending money, you realize how much you have!

I was now looking at $700 in my Aspiration bank account. The next pay week came and I decided to go for the gusto. I had an extra $300 and I put it into my savings and just like that, I had $1,000. I had reached my goal of saving $1,000 fast!

You can do it.

I learned in that short 2-month span, I was capable of more than I give myself credit for. I had developed discipline financially, increased my knowledge by reading the best money books, and became a better provider because of it.

Being Financially Screwed is Not an Option

If you're having trouble saving, read this story and know I was just like you once, and if I can do it you can too. Don't let anyone tell you differently. Start today with these financial tips and be sure to use payday loan apps only when you really need it.

Once you learn how to save money, your savings are now there for a deposit on a house, a car, an unexpected vacation, further tuition, preparing for retirement or whatever priority comes your way.

Like any habit, the good habits are always the hardest to start – no sugar in your coffee etc., but with a little perseverance, you will reap the rewards. Once you get your savings in order, you can learn easy ways to make some extra cash online.

Payday Loan Apps Can Help

When it comes to using payday loan apps, there is no question that it can be beneficial if you need money in a hurry. Most of these apps have no fees or interest. This is a radical change from the way the American financial system typically functions. If you only needed a couple hundred bucks to cover all of my bills then payday loan apps can help.

These apps sound way too good to be true but you will soon find they are all true to their mission statement since day 1 of using them.

- Best overall: Chime

- Best for welcome bonus: Albert

- Best for cash advances: Empower App

- Best payday membership: MoneyLion App

- Best for gig workers: Cleo App

- Best for saving on overdraft fees: Brigit Payday Loan App

- Best for instant advances on paycheck: B9 App

- Best for workers with hourly wages: Earnin Payday Loan App

- Best for paycheck advances: PayActiv Loan App

- Best option for small amounts: Dave Payday Loan App

Disclosures

*Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member's Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime's discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See Terms and Condition

^Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

1 Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.