When people have huge expenses, which arise unexpectedly, they often take personal loans or put those expenses on their credit card to be able to cover for the cost.

This can lead to a high-interest rate which only increases debt for most people. It can also make it difficult for someone to improve their financial situation. This is where MoneyLion can help, and they provide a much better financial option for their consumers.

Since it was founded in 2013, MoneyLion has helped lots of people improve their financial health and to find ways to save more money. In addition, since 2013, MoneyLion has provided over 200,000+ loans to people to help improve their financial life. You can learn more about their loan products here.

For people still struggling with debt repayment and those who are trying to improve their financial security, MoneyLion provides then with options that can help them save money with reduced effort and can help them find better rates. This MoneyLion review will show what you can expect when using the MoneyLion app.

Key Takeaways:

- Improve your financial health with the free MoneyLion App.

- Provides you with access to low-interest personal loans, helps track spending and savings.

- The app provides financial advice to help you improve and control your financial life.

- The MoneyLion community has over 2,000,000 members.

- Instantly access up to $500 with no interest

- Includes a RoarMoney checking account

- Build credit with low-risk credit builder loans

- Earn cashback on everyday purchases

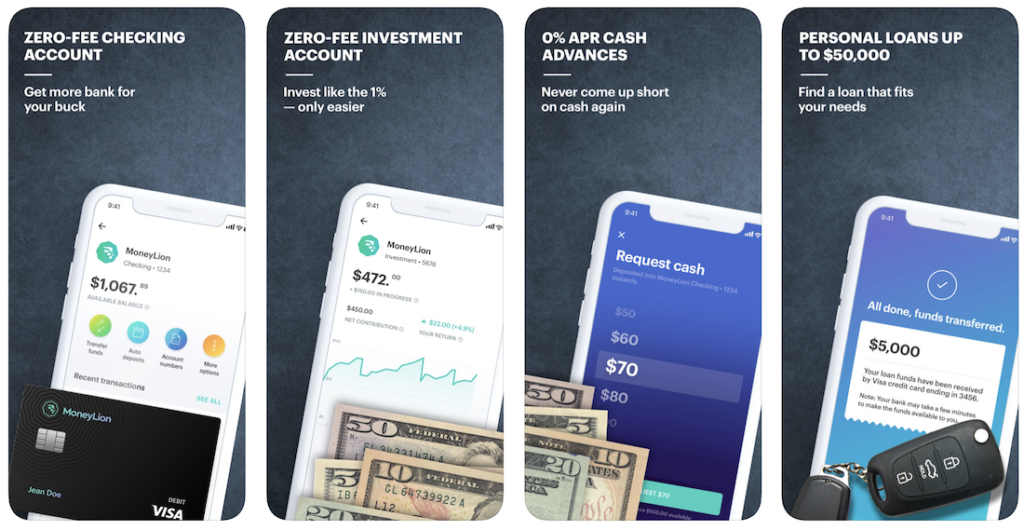

What Does MoneyLion Offer?

MoneyLion is a financial service mobile app and website that provides customers with access to low-interest personal loans, helps track spending and saving, and also provides financial advice to customers to help them improve and control their financial lives.

MoneyLion was designed to help people regain full control over their financial lives and it does this by arranging peoples financial information in one location on their smart devices. It is an app that provides many functions such as tracking credit score and spending or helping customers find a lower interest rate.

MoneyLion Plus Loans

MoneyLion provides loans between $1000 to $35,000 to their customers without the need to provide collateral.

This loan can be used without any restriction.

However, if you are simply looking for a personal loan, you do have other options that can get you funded more quickly:

MoneyLion's Automated Savings Program

In addition to providing easier ways to save, MoneyLion also helps customers access an automated savings program where their money is being invested in a wealth account.

This means that’s customers can take zero interest loans to repay debts and cover other expenses, thus saving money that would have been spent on high-interest loans.

MoneyLion's Credit Tracking

Instead of signing up for credit monitoring programs like Credit Sesame that can impose arbitrary clauses just to provide access to credit tracking, the MoneyLion credit monitoring software is a better option.

In this program, not only will you be able to keep track of your credit records, but you will also be able to improve your credit score by means of other programs which MoneyLion offers to its customers.

MoneyLion Cash Advance

This payday loan app packs a big punch with a plethora of features that can help you. MoneyLion provides you with access to 0% APR cash advances.

How MoneyLion Cash Advances Work:

- Download the MoneyLion app and enroll in free MoneyLion Core. Receive your new black debit card in approximately 7 days.

- Fund your MoneyLion Checking account with an instant transfer, and then use it everywhere you go with no fear of hidden fees, overdraft fees, or minimum balance fees!

- Add direct deposit of just $250 or more to your MoneyLion checking account to unlock instant 0% APR cash advances.

- Upgrade your membership to MoneyLion Plus to get any time access to a 5.99% APR credit-builder loan, $1 daily cashback, exclusive perks, and more.

MoneyLion is a wonderful choice for people who want to improve their financial situation, but cannot due to high-interest loan rates and many others.

It helps them take control of their financial lives and improve their savings and can be downloaded for iOS or Android.

- Instantly access up to $500 with no interest

- Includes a RoarMoney checking account

- Build credit with low-risk credit builder loans

- Earn cashback on everyday purchases

MoneyLion's Rewards Program

When customers ‘display financial responsibility’, they receive endorsements on their MoneyLion accounts.

These endorsements will help them earn rewards such as gift cards to stores such as Starbucks, Amazon, or Walmart.

They can also receive discounts on their loan APR which can be up to 15%.

Customers can display financial responsibility in the following ways:

- Verifying their identity by confirming their email address or phone numbers and confirming their social profiles to prevent fraud.

- Making sure they make loan payments on time.

- Avoiding late fees, increasing saving by 5%, viewing net worth, connecting bank accounts and credit cards, amongst many others.

- Increasing credit scores or making sure credit utilization is below 10%.

- Writing reviews and getting upvotes on such reviews.

What is MoneyLion Plus?

Cash Advance Apps Like MoneyLion

MoneyLion isn't the only financial app that offers cash advances and banking features. Here are some alternatives and apps like MoneyLion for you to consider:

Best Overall: Albert ($14.99 per month with 30-day free trial)

Albert combines instant cash advances of up to $250 with budgeting tools and personalized financial advice. Its “Genius” feature offers users direct access to human financial experts, making it a well-rounded choice for managing money.

Best Banking App: Current (free)

Current stands out with its modern banking features, including fee-free overdrafts of up to $500 and early access to direct deposits. The app also offers robust money management tools, making it ideal for those looking for a full-service banking experience.

Best for Gig Workers: Cleo ($5.99 per month)

Cleo helps gig workers manage their irregular income with budgeting tools and cash advances of up to $250. Its AI-driven chatbot makes managing money easier and more engaging for independent workers.

Best for Saving on Overdraft Fees: Brigit ($8.99 per month)

Brigit provides instant cash advances of up to $250 to help users avoid overdraft fees. Its predictive financial tools help users anticipate low balances and stay on top of their finances.

MoneyLion Review: Is it a Scam or Legit?

MoneyLion is legit and not a scam. This MoneyLion review shows that MoneyLion is a wonderful choice for people who want to improve their financial situation, but cannot due to high-interest loan rates and many others. It helps them take control of their financial lives and improve their savings.

- Instantly access up to $500 with no interest

- Includes a RoarMoney checking account

- Build credit with low-risk credit builder loans

- Earn cashback on everyday purchases