Wondering how to invest 10k in real estate?

There’s a common misconception that you need to be rich to invest in real estate. However, nothing is further from the truth.

In reality, you can start earning passive income and building wealth through real estate investing without much starting capital. And, with around $10,000, a surprising number of real estate investing opportunities become available which make it possible to turn $10K into $100k at times.

If you’re wondering how to invest 10k in real estate and want to diversify your portfolio, this is the post for you.

- 1. Real Estate Crowdfunding

- 2. Real Estate Investment Trusts (REITs)

- 3. Millionacres: Real Estate Winners

- 4. Real Estate Syndication

- 5. Real Estate Wholesaling

- 6. Find A Real Estate Partner

- 6. Try Airbnb

- 7. Renovation Projects

- Can I invest in property with 10k?

- What are the best assets to buy with 10k?

- How to invest in real estate crowdfunding?

- Can I buy land with 10k?

- Where to invest 10k in 2024?

How To Invest In Real Estate With 10k Online

In recent years, numerous online real estate investing platforms have grown in popularity. With $10,000, you can now get in on the action, even if you’re a beginner real estate investor.

1. Real Estate Crowdfunding

With real estate crowdfunding, a group of investors pool money together to buy income-generating real estate. Typically, this means buying multi-family homes, office buildings, or other properties that generate rental income.

There are several advantages to real estate crowdfunding. Firstly, it lets you invest in real estate with less capital. Secondly, because of lower capital requirements, you can often invest in several properties to diversify your real estate portfolio.

And, the great news is you don’t have to round-up a group of investors and research properties to buy yourself. There are actually several popular online real estate crowdfunding companies, many of which let you invest in real estate with 10k or even less.

Fundrise is one of the most popular crowdfunding platforms you can consider. You only need $10 to start with Fundrise. But if you invest $10,000, you unlock the Advanced plan which provides a customized portfolio strategy, IRA investing, and more investment properties to choose from.

Historically, Fundrise has seen 8% or higher annual returns. The platform charges a 0.15% annual advisory fee and 0.85% annual asset management fee, so it’s also a low-cost way to invest 10k in real estate.

Fundrise is a very easy-to-use app that allows individuals to access crowd-funded real estate investing without spending a fortune. This option is best for users who want to make money consistently and let their money make them money. Open an account with a minimum investment of $10 and get quick access to real estate funds tailored to different investment goals.

2. Real Estate Investment Trusts (REITs)

A real estate investment trust, or REIT, is a company that owns and usually operates income-generating real estate properties.

REITs are similar to crowdfunding because they usually invest in multi-family homes and commercial real estate to generate rental income.

However, REITs are legally required to pay at least 90% of profits back to investors in dividends. Additionally, many REITs are publicly traded on a stock exchange, so you can buy REIT shares through your bank or an online broker. Because of this, REITs are often more liquid than investing in real estate through a crowdfunding company.

So, if you want to invest $10,000 in real estate and like the idea of predictable dividend income, REITs could be the right choice.

If you want to pick specific REITs to invest in, a commission-free online broker like M1 Finance lets you buy shares of different REITs. And, M1 Finance usually has sign-up bonuses for new investors who deposit $1,000.

- No fees on any of your investments

- Choose from over 80 pre-built portfolios

- Low $100 minimum investment amount

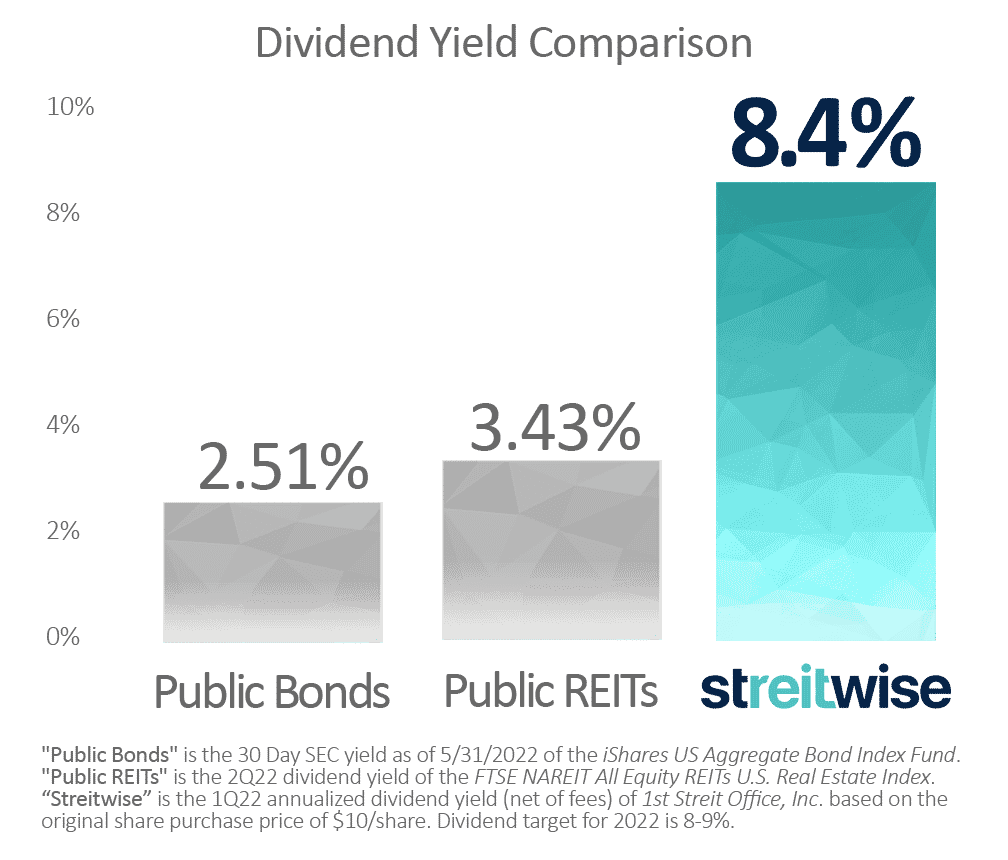

Alternatively, you can invest through companies that offer their own REITs if you want more simplicity. For example, Streitwise is an excellent way to invest in real estate with $10,000, especially if you want dividend income.

Streitwise primarily deals with commercial real estate, and there’s a $5,000 minimum investment for properties. The company has paid over 8% in dividends to investors since 2017, and you don’t have to be an accredited investor to get started.

For fees, Streitwise charges 3% upfront and then a 2% annual management fee. Your upfront fees don’t reduce your share count, however.

Streitwise is a real estate investing company that enables investors of all wealth levels the ability to own a portion of commercial real estate through an equity REIT. Investors can now access a professionally-managed, tax-advantaged portfolio of real estate assets with over four years of 8%+ returns and earn passive income.

Ultimately, if you want dividend income and more liquidity, investing $10,000 in REITs is an excellent choice.

3. Millionacres: Real Estate Winners

Ready to build real wealth? If you’re ready to rack up returns like 13.4%, 14.1%, and 16.7% per year – Real Estate Winners can help. You can benefit from real estate’s supposedly unfair advantages like almost unbelievable tax breaks, government-mandated payouts, and limited supply without ever becoming a landlord and swinging a hammer!

Armed with investment alerts, you can create a real estate portfolio with just a few clicks and start building real wealth today. Priced at $149 per year, Real Estate Winners teaches subscribers how to build a real estate portfolio and develop real wealth.

Unlike the other Millionacres subscription service, Mogul ($3,000 per year), Real Estate Winners is an affordable way for investors to dip their toes into the space, learn more, and get started – even if they have limited or zero real estate investing experience.

Real Estate Winners can benefit from:

- New stock recommendations each month.

- Regular updates on recommended stocks following earnings and other events.

- Top 10 Investment Alerts delivered each quarter.

- Tons of great educational content and resources to make you a smarter real estate investor.

Real Estate Winners wants to supercharge your wealth, diversify your portfolio, AND provide consistent and predictable income!

4. Real Estate Syndication

Another option to invest $10k in real estate is to form a real estate syndicate.

With real estate syndication, a group of people pool resources together to purchase properties that then generates wealth through rental income and potential appreciation.

Real estate syndication is similar to crowdfunding, except you’re investing with a group of people you know and have more ownership because there’s fewer investors.

Usually, real estate syndication needs two roles: A syndicator, also known as a sponsor, and investors.

The syndicator is responsible for researching real estate properties for potential investment and managing the property after acquisition. Usually, the syndicator puts up less capital and relies on the pool of investors to raise enough money. Sometimes, the syndicator doesn’t even put in capital, and instead earns a small acquisition fee for completing the deal.

Whatever the arrangement, real estate syndication is another option to invest in real estate with $10,000. You can also become a syndicator if you know how to manage properties.

Other Methods To Invest 10k In Real Estate

Crowdfunding, REITs, and real estate syndication are three popular ways to generate real estate income.

But, if you’re still wondering how to invest in real estate with $10k, you have plenty of other options to consider.

5. Real Estate Wholesaling

If you want to make money in real estate without ever owning properties yourself, real estate wholesaling could be for you.

In a nutshell, real estate wholesalers make money in three steps:

- The wholesaler creates a contract with a seller to find a buyer for their property

- The wholesaler finds a buyer for the property and offers a higher price than the seller agreed to

- The wholesales keeps the difference in profit if the deal closes

This is arbitrage, and it’s an attractive business model for some because you don’t need your own capital as a real estate wholesaler.

Additionally, you don’t always have to put in work flipping properties or increasing the value somehow; you can just charge the buyer more than the seller was asking for.

Usually, real estate wholesalers deal in properties that are distressed, meaning they’re undergoing foreclosure or pre-foreclosure. This is because sellers are under more pressure to sell their property at a bargain, widening your potential margin.

You still need money to fund a real estate wholesale business. For example, you probably need legal advice to ensure your contracts are in order and you’re following state laws. Advertising costs to get your first clients are also worth factoring in.

But, if you want to start a side business that involves real estate, consider real estate wholesaling.

6. Find A Real Estate Partner

A real estate partnership is similar to real estate syndication, except you usually work with one other person and it’s often less formal.

For example, family members, two friends, or even work colleagues might decide to go in on a property together. This could be a rental property or a property that is flippable with the right renovations.

If you’re wondering where to find potential properties you and a partner can invest in, you can check out Roofstock.

Roofstock is a marketplace of rental properties across the United States, including single-family rentals to multi-unit condos. Making an offer on properties is free, and Roofstock only charges 0.50% or $500 of the contract price for accepted offers.

6. Try Airbnb

While this real estate investment idea doesn’t always require $10,000, it’s another way to create a new income stream.

Thanks to the gig economy, you can now make money renting out assets you own. And, one of the poster boys for this movement is renting out your home or a spare bedroom as an Airbnb host.

So, if you want to earn passive income and don’t mind renting, you can invest money in making your home more Airbnb-friendly.

Usually, this includes finishing an unfinished basement or bedroom so you can rent it out. But if you spend $10,000 finishing a bedroom and then rent it out for $150 per night, you only need 66 rentals before you recoup your money. After that, every rental is pure profit.

7. Renovation Projects

A home renovation might seem like a money sink, but did you know some renovations usually increase the value of your home?

According to HGTV, renovation projects that can turn a profit when you sell your home include:

- Kitchen remodels

- Landscaping

- Minor bathroom remodels

- Exterior improvements

Usually, your returns are only a few percent at most, and you have to avoid going over budget if you want your renovation to yield a return.

But you can also consider things like making your home more energy efficient with better windows, or looking into projects that get you an energy efficient tax credit.

The bottom line is that investing $10k in real estate doesn’t have to be for other properties; you can improve your home and make money in the process!

Frequently Asked Questions

Can I invest in property with 10k?

Popular ways to invest in property with $10,000 include methods like crowdfunding, REITs, and real estate partnerships.

What are the best assets to buy with 10k?

Buying shares in income-generating real estate with companies like Fundrise is one of the best assets you can buy with 10k. But you can also invest in real estate stocks for free with platforms like M1 Finance to begin building wealth.

How to invest in real estate crowdfunding?

To invest in real estate crowdfunding, create an account with online crowdfunding websites like Groundfloor or Fundrise. You can then deposit funds from your bank account and begin investing in real estate, even if you don’t have experience with this asset class.

Fundrise is a very easy-to-use app that allows individuals to access crowd-funded real estate investing without spending a fortune. This option is best for users who want to make money consistently and let their money make them money. Open an account with a minimum investment of $10 and get quick access to real estate funds tailored to different investment goals.

Can I buy land with 10k?

Platforms like FarmTogether let you invest in income-generating farmland, and some of the investment opportunities on the platform are $15,000 or less.

FarmTogether's crowdfunding platform is one of the few ways accredited investors can get exposure to farmland as an asset class. With decent returns and low fees, it is a compelling choice for those looking to diversify their portfolios. The minimum investment amount is $15,000.

Where to invest 10k in 2024?

Investing $10,000 in 2024 is a wise move to begin growing your wealth. But you need to determine your investing timeframe, risk tolerance, and goals for returns. Stocks, cryptocurrency, bonds, and real estate are just a few examples of places you can invest $10k.

Summary

Investing $10,000 in real estate is an excellent way to diversify your portfolio and create multiple income streams. And, the great news is there are more avenues to invest than ever before.

Just ensure you have your ducks in a row before investing. This includes tasks like building an emergency fund or working to become debt free. Real estate can create serious wealth, and it’s also a more beginner-friendly investment than you might think!