The greatest approach to eliminate student debt is to pay more each month than the minimum. The greater amount of money you put toward your loan, the less interest you'll owe and the faster the balance will go away.

To figure out how quickly you could pay off 60k student loans and how much money you'd save in interest, use a student loan payoff calculator. Already done that? Here are seven ideas for getting rid of educational debt even faster.

How to Pay Off $60K in Student Loans Fast

Do you want to be a student loan success story like me? Learn the secrets of paying off your student loan debt fast so you can become debt-free.

1. Make extra payments the right way

There is no penalty for paying off student loans early or more than the required amount. However, there's a catch with prepayment: Student loan servicers may apply the excess payment to the next month's payment.

Advances your due date, but it won't help you pay off student loans faster. Instead, tell them to apply any overpayments to your current balance and keep the following month's commitment.

You can make another payment at any time throughout the month, or you may pay off your student loan in full on the due date. Either option might save you a lot of money.

Let's assume you owe $10,000 with a 4.5 percent interest rate. If you were on a 10-year repayment schedule and paid an additional $100 every month, you'd be debt-free more than five years ahead of schedule if you had paid the normal monthly payment.

Saving an extra $100 each month for loan repayment is easier than you think.

2. Refinance if you have good credit and a steady job

Refinancing your student loans may help you pay off those loans faster while without having to pay extra.

To lower your costs, refinancing replaces several student loans with a single private loan at a cheaper interest rate. Choose a new loan term that is less than the remaining amount on your existing debts to speed up repayment.

If you opt for a shorter period, your monthly payment may go up. However, it will help you pay off your debt faster while also saving money on interest.

For example, refinancing $50,000 from a rate of 8.5 percent to a rate of 4.5 percent may allow you to pay off your student debt in under two years rather than the normal three years. It will also save you roughly $13,000 in interest over the life of the loan even if payments remain unchanged.

If you have a credit score of at least 700, a good income, and a debt-to-income ratio of less than 50 percent, you're a prime candidate for refinancing. If you want or need features like income-driven repayment or Public Service Loan Forgiveness, you shouldn't refinance federal student loans.

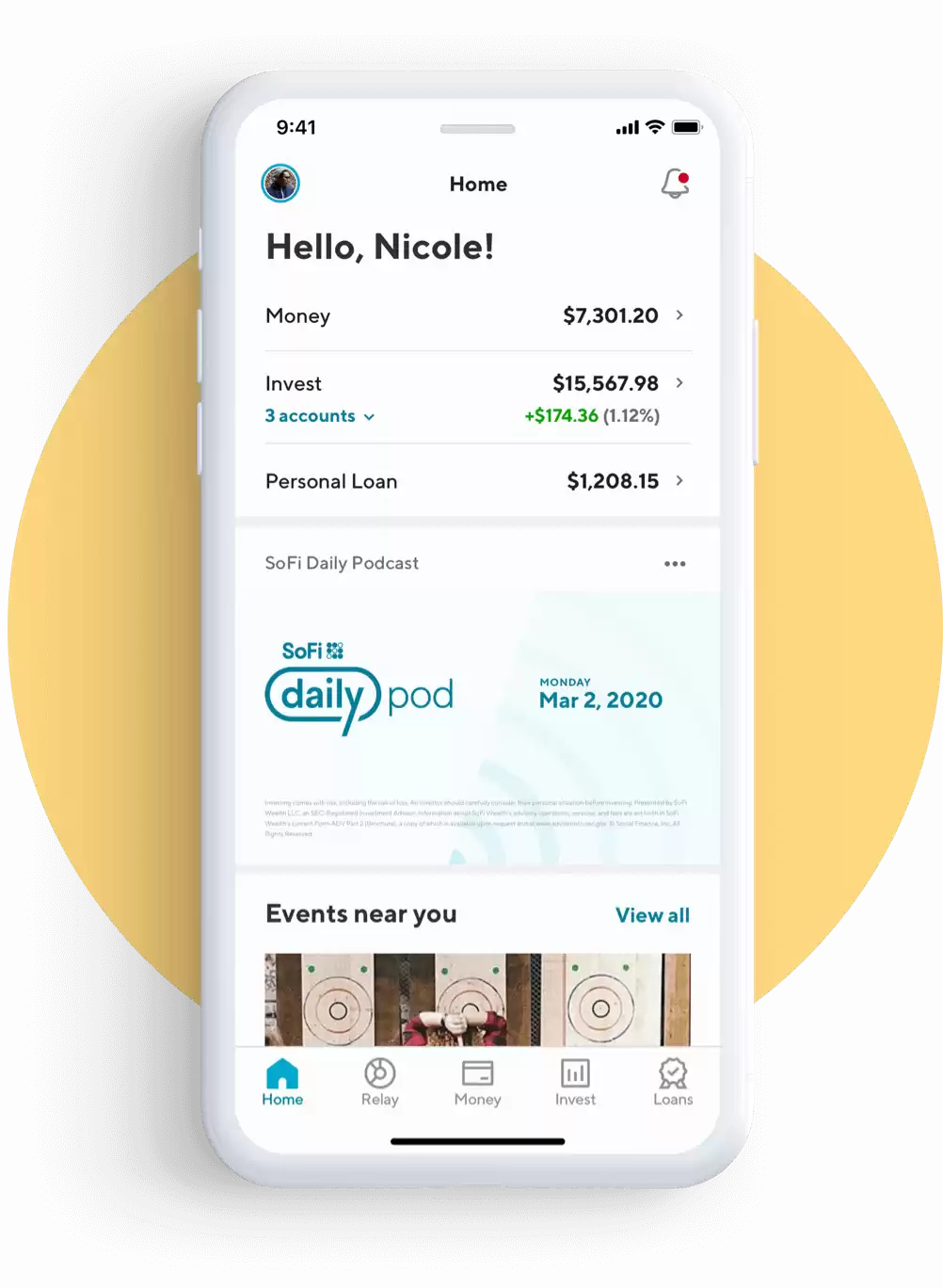

If you are ready to lower your interest rate and decrease your monthly payment our top recommendation for student loan refinancing and consolidation is SoFi.

SoFi is an online lender that helps you with your student loans. If you want to change your current student loan to get better perks, SoFi's refinancing option is a great choice. If you need a new student loan, SoFi is also good because it lets you choose how you pay it back and doesn't charge extra fees.

Related: 5 Key Benefits of Refinancing Student Loans

3. Enroll in autopay

Signing up for autopay is another option to reduce your student loan's interest rate if you don't want to refinance your student loans.

If you let your bank account be automatically debited, you may qualify for a quarter-point interest rate reduction from student loan servicers. Many private student loan lenders also provide for automatic bank payment deductions.

If you can borrow $10,000 at 4.5% interest and pay it back in five years, with no penalties for paying early or late, your interest savings will be minimal — about $144 over a 10-year repayment plan. But that's still more money to put toward student debt repayment.

Contact your servicer to enroll or to see whether an autopay discount is available.

4. Make biweekly payments

The technique of making a payment every two weeks instead of one full payment monthly is a deceptive method to motivate yourself to pay more on debt. Pay half of your money each two weeks rather than one complete payment monthly.

You'll wind up paying an extra payment each year, which will save you time on your repayment schedule and money on interest charges.

To discover how much time and money you may save, use a biweekly student loan payment calculator.

5. Pay off capitalized interest

If your loans are subsidized by the federal government, interest will accumulate while you are in school, and your grace period and periods of deferment and forbearance will begin once more.

The more interest you pay, the greater your loan expands and the more interest you'll pay. When payments begin, your balance increases, and you'll be charged interest on a larger amount.

To avoid capitalization, consider making monthly interest payments while it accrues.

Or make a lump-sum interest payment before your grace period or postponement ends. That won’t immediately speed up the payoff process, but it will mean a smaller balance to get rid of.

6. Stick to the standard repayment plan

Unless you opt out, the government sets a ten-year repayment schedule for federal student loans. The quickest approach to pay off federal student loans is to stick with the standard plan.

Federal loans come with various income-driven repayment options, which may extend the payback period to 20 or 25 years. You can also combine student loans and consolidate them, extending the payback period to a maximum of 30 years if your balance is zero.

If you don't truly require these alternatives and can afford to stay on the standard plan, it will lead to a faster path to becoming debt-free.

7. Use ‘found' money

If you obtain a raise, a student loan refinance bonus, or another financial windfall, set aside at least a portion of it for your debt. Consider using this breakdown: 50% of the extra income could be directed toward debt repayment, 30% to savings, and 20% to fun, discretionary spending.

Some businesses provide student debt repayment as a perk for their staff. Check to see whether your firm has an employee student loan forgiveness program and sign up if you haven't already.

You may also establish side hustles to help you pay off student loans faster. For example, you can trade your unused gift cards; rent out your spare room, parking space, or car; or offer your talents as a freelancer or consultant on the side.

It's important to make yourself a set of rules, such as finding ways to save $200 or even saving $1000 a month so you can put it towards your student loans. Some money-saving apps, like Digit and Qapital, can also help you create savings objectives and regulations.

- Digit is an app that helps you put money in a savings, investment, and/or retirement account.

- Digit looks at your linked bank account balance to determine how much you can save each day.

- The app chooses your investments based on how much risk you want to take.

How I Paid Off $60,000 in Student Loans

Those are the tried and tested tips straight from the personal finance experts. But do you want to know my story on paying off $60,000 in student loans. If so, keep on reading!

I went to college and not surprisingly I also graduated with student loan debt. A lot of student loan debt. Around 60K in student loan debt.

College, for me, was an interesting educational environment. I was taught all the concepts when what I really needed was practical, actionable lessons. The one place the American public depends on to make adults out of children had failed to prepare me for the “Real World”.

The most valuable learning experiences during those times were working for 3 different companies at the same time, living off campus, and having roommates. By the time I graduated, I realized I was on the hook for about $60,000, and I’ve been working towards getting that number down month after month ever since.

Being a first generation American student, I didn’t have too much guidance during my college acceptance process. The only advice I got was to take out student loans because as the saying goes, “That’s how everyone does it”.

I received grants to offset some of the tuition costs and took out private and federal loans for the remainder. I vaguely remember a small speech from the finance counselors about having to repay back everything with interest, but none of that lecture sunk in.

My mindset at the time was to simply take out whatever amount I needed in order to keep the semesters going.

However, I knew I needed to make some changes.

I Pursued Making Some Extra Money

I quickly learned the school offered opportunities to make some extra money while taking classes, so I became a resident advisor during my second year. Taking that position lowered my tuition, allowing me to receive a smaller loan that year.

I also worked as a cashier in the bookstore to make a little bit more money on the side. In hindsight, this is when I should have made another visit to the finance center to get educated on how to start paying down the interest on the loans I got. Generating that small amount of income wouldn’t have made a dent, but it would set the foundation for paying off the loans early.

The third year, I was able to live off campus with my friends and learned how to pay bills and live with people. Going off campus lowered the total balance for the subsequent years because I only had to pay for the credits. In order to afford the tuition, housing, and the fun college lifestyle, I had 3 different jobs while also taking on a few full credit semesters.

Since I was working so much and not understanding the courses fully, my grades suffered, making me graduate in 6 years instead of 4. Even though I worked through all those years, I didn’t quite understand the way interest works, so I didn’t use the income to significantly pay off debt. All I can think now is that I blew it.

When the student loan payments finally started, I struggled to make the payments mainly because my starting salary was way less than the total owed. Feeling like being in a hole that was getting deeper and deeper every month, made me a little bit depressed.

I Learned To Make Sacrifices

I made it a goal to learn all about paying off student loans, which led me to put a search into Google under the variations of “How to pay off (x amount) in student loans”.

There were many Yahoo Answers as well as personal finance bloggers sharing their battles with student loans and other debts. Consuming as much of this content as I could taught me all the defensive tactics such as budgeting, living frugally and reducing or cutting out monthly costs.

I learned that I would have to sacrifice going on vacations and buying the next and best tech or apparel, in order to pay off the loans early. This is what I’d signed up for and I embraced making that sacrifice because no one else was going to do it for me.

Three years since graduating, my student loan balance is now a little bit over $50,000. I’ve been practicing all the defensive tactics and have kept at least 2 jobs at all times. Working hard at my jobs led to a few promotions, which have helped financially.

During this time, I kept consuming personal finance content and found that the only way to make even more of a dent in the debt, is to create multiple streams of income at scale.

I’ve been educating myself on the multiple ways to start businesses and documenting the process. To me, this is what it means to go on the offense to combat debt.

In order to win like the ones that have influenced me, I would have to start thinking like they do and deploy the same mindset. I know it will take time to pay off my loans, but I will have learned many lessons along the way and I’m patient for that.

I went from being ignorant, to resourceful and finally impacted by personal finance. I know that with time, my defense will be my foundation and my offense will help me pay off any debt.

If you have student loan debt (or in my case, 60k in student loans) have you taken action to get in a better place financially? If you don’t have student loans, what are you doing to get in a better place financially? Did you know My Millennial Guide just launched their student loan payoff guide?

Related:

Contributor's Bio: K.P.

Come with me on my journey on HungryBeing.com where personal finance meets hustle meets life. Follow along as I document my entrepreneurial tendencies towards financial freedom.