The greatest approach to eliminate student debt is to pay more each month than the minimum. The greater amount of money you put toward your loan, the less interest you'll owe and the faster the balance will go away.

To figure out how quickly you could pay off 30k student loans and how much money you'd save in interest, use a student loan payoff calculator. Already done that? Here are seven ideas for getting rid of educational debt even faster.

How to Pay Off $30K in Student Loans Fast

Do you want to be a student loan success story like me? Learn the secrets of paying off your student loan debt fast so you can become debt-free.

1. Make extra payments the right way

There is no penalty for paying off student loans early or more than the required amount. However, there's a catch with prepayment: Student loan servicers may apply the excess payment to the next month's payment.

Advances your due date, but it won't help you pay off student loans faster. Instead, tell them to apply any overpayments to your current balance and keep the following month's commitment.

You can make another payment at any time throughout the month, or you may pay off your student loan in full on the due date. Either option might save you a lot of money.

Let's assume you owe $10,000 with a 4.5 percent interest rate. If you were on a 10-year repayment schedule and paid an additional $100 every month, you'd be debt-free more than five years ahead of schedule if you had paid the normal monthly payment.

Saving an extra $100 each month for loan repayment is easier than you think.

2. Use debt payoff apps

Any large chunk you can put towards your loans will go a long way towards relieving debt-related stress. That is where paying off your debt using debt payoff apps like ChangEd can really pay off.

ChangEd gives borrowers the ability to link all of their loans and builds a repayment journey that aligns with any budget. This app will help you save in small increments and automate those savings toward your debt regularly to help borrowers save in interest and become debt free sooner.

ChangEd, a Shark Tank and Mark Cuban backed app, is an app that allows you to link all of your student loans into one easy to use app. This app will help you build a repayment path that's budget friendly and will automate extra savings it finds toward your debt.

It's helped thousands of borrowers pay off over $20 Million in debt, saving the average borrower thousands in interest costs and helping them pay it off years sooner.

3. Refinance if you have good credit and a steady job

Refinancing your student loans may help you pay off those loans faster while without having to pay extra.

To lower your costs, refinancing replaces several student loans with a single private loan at a cheaper interest rate. Choose a new loan term that is less than the remaining amount on your existing debts to speed up repayment.

If you opt for a shorter period, your monthly payment may go up. However, it will help you pay off your debt faster while also saving money on interest.

For example, refinancing $50,000 from a rate of 8.5 percent to a rate of 4.5 percent may allow you to pay off your student debt in under two years rather than the normal three years. It will also save you roughly $13,000 in interest over the life of the loan even if payments remain unchanged.

If you have a credit score of at least 700, a good income, and a debt-to-income ratio of less than 50 percent, you're a prime candidate for refinancing. If you want or need features like income-driven repayment or Public Service Loan Forgiveness, you shouldn't refinance federal student loans.

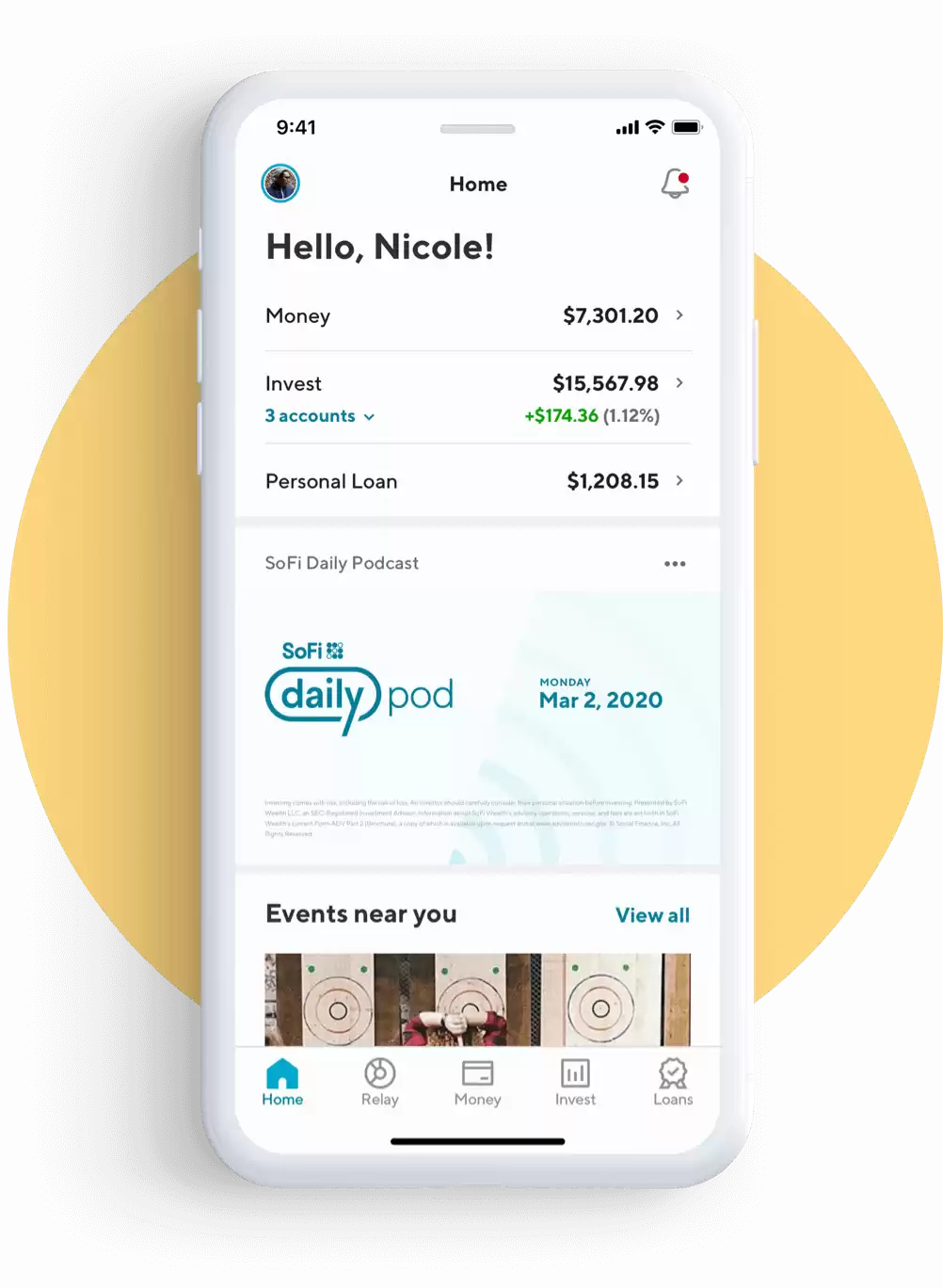

If you are ready to lower your interest rate and decrease your monthly payment our top recommendation for student loan refinancing and consolidation is SoFi.

SoFi is an online lender that helps you with your student loans. If you want to change your current student loan to get better perks, SoFi's refinancing option is a great choice. If you need a new student loan, SoFi is also good because it lets you choose how you pay it back and doesn't charge extra fees.

Related: 5 Key Benefits of Refinancing Student Loans

4. Enroll in autopay

Signing up for autopay is another option to reduce your student loan's interest rate if you don't want to refinance your student loans.

If you let your bank account be automatically debited, you may qualify for a quarter-point interest rate reduction from student loan servicers. Many private student loan lenders also provide for automatic bank payment deductions.

If you can borrow $10,000 at 4.5% interest and pay it back in five years, with no penalties for paying early or late, your interest savings will be minimal — about $144 over a 10-year repayment plan. But that's still more money to put toward student debt repayment.

Contact your servicer to enroll or to see whether an autopay discount is available.

5. Make biweekly payments

The technique of making a payment every two weeks instead of one full payment monthly is a deceptive method to motivate yourself to pay more on debt. Pay half of your money each two weeks rather than one complete payment monthly.

You'll wind up paying an extra payment each year, which will save you time on your repayment schedule and money on interest charges.

To discover how much time and money you may save, use a biweekly student loan payment calculator.

6. Pay off capitalized interest

If your loans are subsidized by the federal government, interest will accumulate while you are in school, and your grace period and periods of deferment and forbearance will begin once more.

The more interest you pay, the greater your loan expands and the more interest you'll pay. When payments begin, your balance increases, and you'll be charged interest on a larger amount.

To avoid capitalization, consider making monthly interest payments while it accrues.

Or make a lump-sum interest payment before your grace period or postponement ends. That won’t immediately speed up the payoff process, but it will mean a smaller balance to get rid of.

7. Stick to the standard repayment plan

Unless you opt out, the government sets a ten-year repayment schedule for federal student loans. The quickest approach to pay off federal student loans is to stick with the standard plan.

Federal loans come with various income-driven repayment options, which may extend the payback period to 20 or 25 years. You can also combine student loans and consolidate them, extending the payback period to a maximum of 30 years if your balance is zero.

If you don't truly require these alternatives and can afford to stay on the standard plan, it will lead to a faster path to becoming debt-free.

8. Use ‘found' money

If you obtain a raise, a student loan refinance bonus, or another financial windfall, set aside at least a portion of it for your debt. Consider using this breakdown: 50% of the extra income could be directed toward debt repayment, 30% to savings, and 20% to fun, discretionary spending.

Some businesses provide student debt repayment as a perk for their staff. Check to see whether your firm has an employee student loan forgiveness program and sign up if you haven't already.

You may also establish side hustles to help you pay off student loans faster. For example, you can trade your unused gift cards; rent out your spare room, parking space, or car; or offer your talents as a freelancer or consultant on the side.

It's important to make yourself a set of rules, such as finding ways to save $200 or even saving $1000 a month so you can put it towards your student loans. Some money-saving apps, like Digit and Qapital, can also help you create savings objectives and regulations.

- Digit is an app that helps you put money in a savings, investment, and/or retirement account.

- Digit looks at your linked bank account balance to determine how much you can save each day.

- The app chooses your investments based on how much risk you want to take.

How I Paid Off $30,000 in Student Loans

Those are the tried and tested tips straight from the personal finance experts.

But do you want to know my story on paying off $30,000 in student loans in 3 years? If so, keep on reading!

My story is probably going to sound so familiar to many of you.

I graduated in 2013 with a $40,000 salary and $30,000 in student loan debt, with a degree in Political Science.

I still was able to pay off and beat my student loans in 4 years.

Related: How to Pay Off $50,000 in Student Loans

After College

I was working in finance operations, and I absolutely hated my job. After a few months, I immediately began looking for jobs in consulting, after meeting a girl who was a consultant and found out she was making 6 figures in her mid 20's.

Make More Money

I read several books on consulting, and added 500 random people on LinkedIn that worked at the top 20 consulting firms. I set up times to talk with about 30 of them over the span of a few months and got referred by some of them to about 5 jobs. I hadn't made any payments on my student loan debt, as I was deferring them.

I got a job offer for $65k and had to move from Raleigh to Atlanta, but with that salary increase, would finally be able to make some progress. I kept living off my $40k salary, but that extra $25k now went all towards student loan debt repayment, about $1,000 per month.

After a year, I was laid off and spent 4 months unemployed before I found my next job. During that time I applied for over 350 jobs, interviewed at 20 companies, before I got the one I wanted, making $73k at a fortune 100 company.

Pure Luck?

I can already hear the crowd that says, “How lucky to get that big of a raise!” Well, it wasn't luck. I majored in Political Science, remember?

I purposely went into a business-related field where the ceiling for pay would be higher, and I would develop Excel and Powerpoint skills that would be transferable to almost any corporate strategy type job.

Also, keep in mind I applied at about 500 jobs total as I transitioned between jobs those 2 times that I did.

Save, Save, Save

I basically stuck to a 40% savings rate on my take home pay, and after establishing a $10,000 emergency fund, everything else went toward loans.

I drove a 10-year-old car, even if it did break down frequently, lived with roommates for all 4 years that I've been post grad so far, so paying $750-$900 for rent instead of $1500 like some of my friends, and not having a car payment definitely helped. My goal was to build wealth and tackle those student loans.

And if you NEED a new car, you can buy a $10,000 car that's decent, 4% interest, and owe $200 a month, that's not THAT bad.

But where people really mess up is buying a new car and owing $30,000 on it, paying $450-$500 a month; don't do that.

Related: How Much Should I Spend on a Car?

Fast Forward

Fast forward through years 2-3 and paying $1,000 a month for 30 months is essentially how I paid off all those loans. Now I'm a little behind on retirement savings so I'm doing the following:

1) contributing 5% of my pre-tax salary to get a 70% employer match on those contributions.

2) maxing out my Roth IRA ($5500 per year, putting it in vanguard index funds) and

3) contributing 20% of my gross salary to ESPP (buying company stock at a 15% discount and immediately selling it; free money)

I plan on buying investment properties to generate passive cash flow to try and be retired before 40 so I can travel and have some fun. I could write a whole different article about real estate investing, but that's for another time.

Final Takeaways

- Live with roommates

- Create a budget so that you can save 40-50% of your take home pay, if you can

- Contribute 300% of your minimum payment to your student loans (so if the minimum is $300, try and do $900)

- Buy a used, cheap car for about $10,000 if you have to

- Try and take certain skills in your current job and leverage it to get you your next job

- Pursue higher-paying jobs even if you feel unqualified and stretch your experience to try and fit some of that new role. If you get the new job, you'll learn it as you go so don't be too worried about feeling unqualified.

- Also… Don't carry credit card debt.

Author: Vince Crane