Fundrise is one of the most popular real estate crowdfunding companies, and it lets investors diversify their portfolios with real estate starting at just $10.

However, Fundrise is just one company in the space. Additionally, there are numerous ways to benefit from real estate investing apps, like equity-based investing, earning dividends, or earning interest on real estate loans.

So, if you’re looking to start investing in real estate but want to explore all of your options, this list of Fundrise alternatives is for you.

Best Fundrise Alternatives for Accredited and Non-Accredited Investors

Before picking a company like Fundrise to invest in, define your investing goals, timeframe, and how much capital you have to start with.

From there, you can pick the right Fundrise alternative to suit your investing style.

|

MMG Rating:

5.0

|

MMG Rating:

4.5

|

MMG Rating:

4.0

|

|

Minimum Investment to Start: $10,000

|

Minimum Investment to Start: $5,000

|

Minimum Investment to Start: $25,000

|

These are more details on the best Fundrise alternatives for both accredited investors and non-accredited investors:

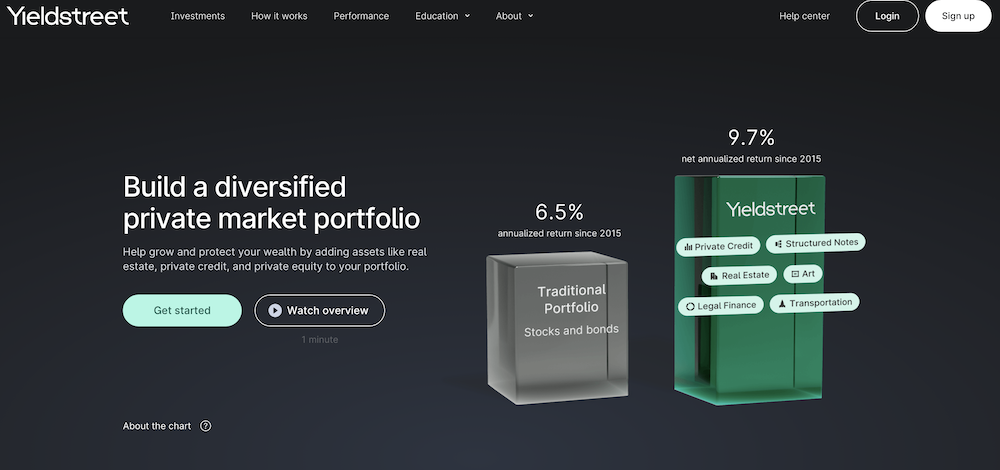

1. Yieldstreet: Best for Alternative Investing

- Minimum Investment: $10,000

- Fees: 1% – 2.5% in management fees

- Fund: Access to real estate, commercial, marine, legal and art investments.

Yieldstreet is an alternative investment marketplace that brings private investment opportunities to retail investors. These alternative investments have typically been dominated by hedge funds and the ultra-wealthy.

As of last year, $1.5 billion had been invested in the platform. Yieldstreet was placed 46th on the 2020 Inc. 5000, a list of the fastest-growing privately held businesses in the United States.

Although most transactions are limited to accredited investors, Yieldstreet launched the Alternative Income Fund in August 2020, which is accessible to nonaccredited investors with a $10,000 minimum investment.

Best for

Yieldstreet provides a marketplace where individuals can invest in privately structured credit deals, which are typically inaccessible to retail investors. There is no other platform that lets you invest in real estate, art, legal finance, and more.

Pros

- Investments starting at $10,000

- A great way to diversify your investments

- Access to real estate, commercial, marine, legal and art investments

Cons

- Most investments are open only to accredited investors

Traditional investments that were reserved for the ultra-wealthy are now available to you. Wealth professionals recommend allocating 15-20% of your portfolio to alternatives. Diversify your portfolio and earn passive income with investments starting at $10,000.

2. RealtyMogul: Best for REITs and 1031 Exchange

- Minimum Investment: $5,000

- Fees: 1%

- Fund: MogulREIT I and MogulREIT II

RealtyMogul lets you can get access to private market offerings that 128,000+ investors have joined and invested over $650 million.

Both non-accredited and accredited investors can invest in real estate through RealtyMogul.

Non-accredited investors can choose from two different real estate investment trusts (REITs) that invest in a portfolio of properties.

An accredited investor can acquire a single property or take part in a 1031 Exchange, which is the trade of one investment property for another that allows capital gains to be avoided.

The 1031 Exchange is named for Section 1031 of the Internal Revenue Code, which allows you to defer capital gains taxes when you sell personal property and reinvest the proceeds within prescribed time limits in a similar kind and value property or properties.

Best for

RealtyMogul is ideal for investors who want to invest in REITs and 1031 Exchange. With a 1031 exchange, investors can defer capital gains taxes. RealtyMogul enables qualified investors to sell current properties and acquire “like-kind” properties.

Pros

- Two REIT options

- Private placements

- 1031 exchange

Cons

- REITs require a minimum investment of $5,000

- For the first three years, REITs have an early-redemption penalty

Getting started with RealtyMogul is a smart option for real estate investors that want a ton of diversification and private placements options. You can gain explore to more deals by signing up, over $3.5 billion in deals have been posted on the platform.

Diversify with thoroughly vetted commercial real estate with the potential to generate income and grow in value.

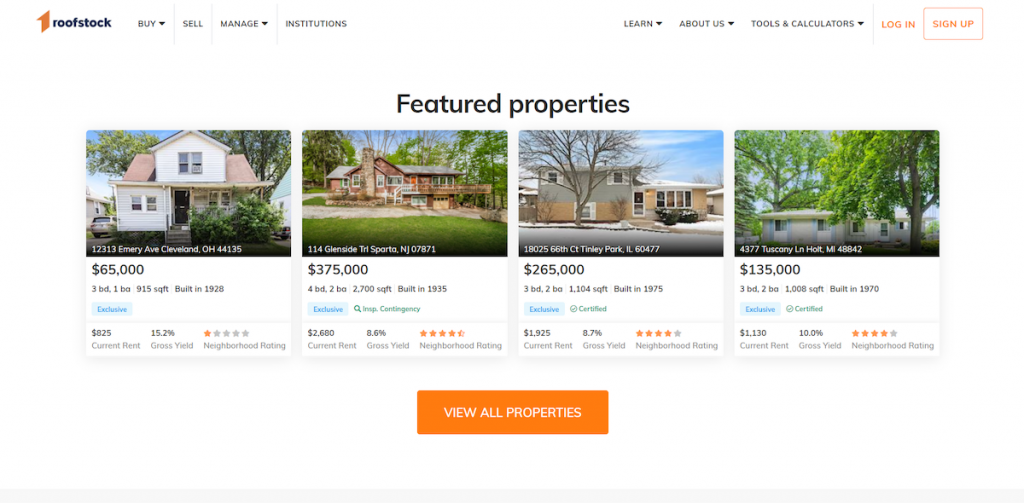

3. Roofstock: Best for Passive Rental Income

- Minimum Investment: You make offers on rental units

- Fees: 0.50% or $500 of contract price

- Fund: Rental properties

If you want to earn passive income from rental units without having to manage tenants yourself, Roofstock is for you.

With Roofstock, you can buy rental properties across the United States. Listings include comprehensive information on expected annualized returns, appreciation, cash flow, and property taxes. Listings also share the current occupancy status, when leases end, and expected rent and expenses.

There’s a healthy variety of rental properties, ranging from sub $100,000 single-family rentals to more expensive multi-family condos. Roofstock also includes information on neighborhood ratings, previous property inspections and valuations, and title report and insurance quotes so you can analyze properties properly.

Making an offer is free, and Roofstock charges a marketplace fee of 0.50% or $500 of the contract price if the offer is accepted. Following closing, Roofstock can connect you with local property managers to handle tenants and property maintenance for you.

Best For

Roofstock is ideal if you want an efficient way to acquire rental properties and outsource property management to keep things passive.

Pros

- Variety of listings and home prices

- In-depth property metrics

- Network of local property managers

- Offers IRA investing and a 1031 Exchange

Cons

- You generally require significant capital to buy rental properties

- Roofstock used to let you invest in rental properties shares, but this feature isn’t currently available

If you want to earn passive income from managed rental units, Roofstock is the company for you.

4. Groundfloor: Best for Short-Term Debt Investments

- Minimum Investment: $10

- Fees: Investors don’t pay fees

- Fund: Short-term real estate loans

Many Fundrise alternatives let you invest in real estate equity to generate returns. However, this often requires a longer investment period and more starting capital.

With Groundfloor, you invest in short-term, high-yield real estate debt instead of equity investments. There’s a $10 investment minimum, and Groundfloor states it’s seen 10.5% returns to date.

You can build your own debt-based portfolio as well. Groundfloor lets you browse real estate projects with various loan terms, interest rates, and loan to ARV ratios to suit your risk tolerance and investment timeframe.

Groundfloor investors typically receive payments within six to nine months, and with a $10 minimum, this is one of the most beginner-friendly investment options around.

Best For

Groundfloor is best if you want a shorter-term real estate investment option with a low investment minimum.

Pros

- Investors don’t pay any fees

- $10 minimum initial investment amount

- Short-term loans so you get repaid quickly

Cons

- Loan defaults are an investment risk

- Listings have a decent amount of information, but you can’t dig into the nitty gritty details of a loan

Groundfloor has one of the lowest minimum investment requirements on the market and also lets you invest for the short-term.

Groundfloor offers short-term, high-yield real estate debt investments to the general public. You can get started with only $10.

5. Streitwise: Best for Real Estate Dividend Income

- Minimum Investment: $5,000

- Fees: 3% upfront and 2% annually

- Fund: Commercial real estate REIT

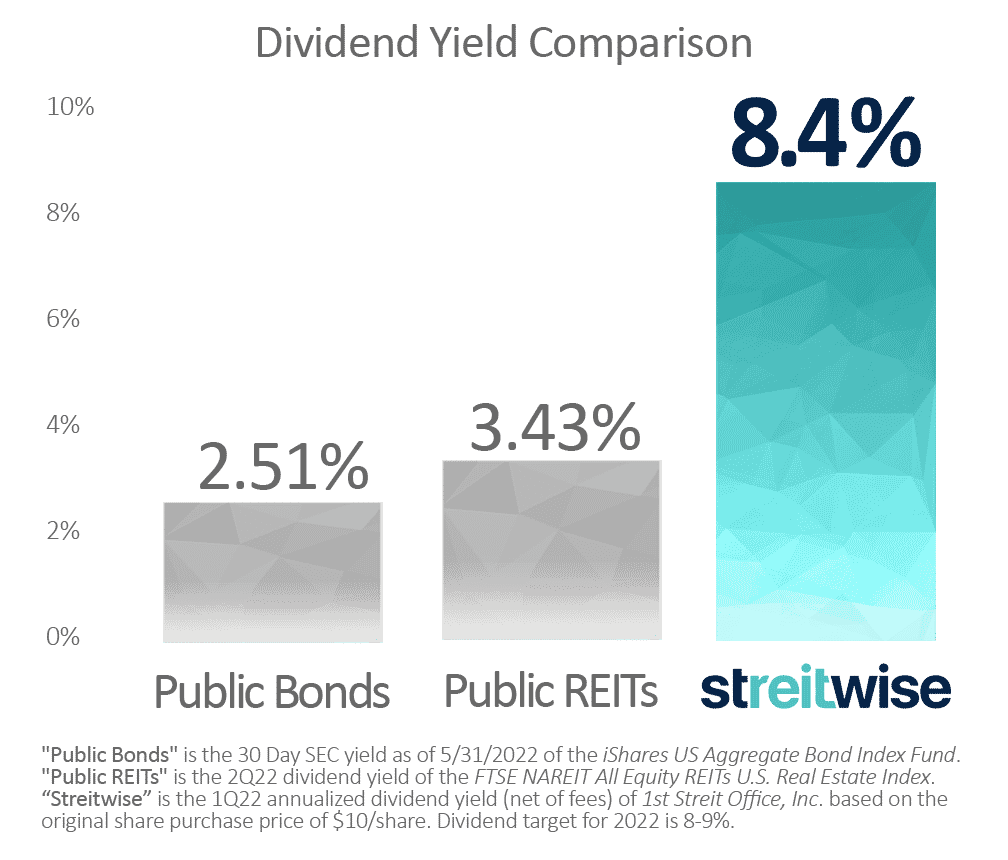

While Streitwise requires $5,000 to begin investing, it’s one of the best Fundrise alternatives if you’re looking for dividend income.

Streitwise still lets you invest in commercial real estate with its REIT. The fund has paid over 8% in dividends since 2017, with the latest dividend being 8.4% in Q2 of 2022.

Streitwise typically has one or several investment offerings at a given time. Properties are commercial real estate, meaning the tenants are companies and the properties themselves are usually multi-million dollar office spaces or retail buildings.

For fees, it's simple enough where you simply pay a 2% annual management fee.

Best For

Streitwise has a higher investment minimum than Fundrise, but it boasts a high quarterly dividend to let you earn passive income from real estate.

Pros

- Historical dividend payments of 8% or higher

- Commercial real estate properties can carry less tenant risk

- You can reinvest dividends

Cons

- Higher fees compared to Fundrise

- Few active listings to invest in

According to Streitwise, the goal is to develop a diversified portfolio of value oriented investments with creditworthy tenants. Ultimately, this allows for a handsome quarterly dividend payment and minimal risk of rental income loss.

Streitwise is a real estate investing company that enables investors of all wealth levels the ability to own a portion of commercial real estate through an equity REIT. Investors can now access a professionally-managed, tax-advantaged portfolio of real estate assets with over four years of 8%+ returns and earn passive income.

6. DiversyFund: Best for Long Term Investors

- Minimum Investment: $500

- Fees: No management fees

- Fund: Growth REIT

At DiversyFund, they make it easy to buy shares in a portfolio of fully vetted, multifamily real estate.

With the click of a button, you could own a piece of a real estate investment trust (REIT), across multiple properties, just like Fundrise.

DiversyFund provides only one type of investment: The Growth REIT. This real estate investment trust focuses on offering investors income by investing in residential apartment buildings.

Unlike other crowdfunding platforms, DiversyFund invests in commercial properties and owns them outright. This saves the investor from hefty commission fees that come with other crowdfunding sites.

Investing with DiversyFund is a great alternative to Fundrise. You can get started with just $500 and your small investments can reap big returns. All dividends are reinvested in properties so you don’t have to worry about withdrawing gains until your property sells.

Investors don’t have the option of selling their investments and must wait until the company liquidates to make a profit. The investment term may be at least five years in duration.

Best for

DiversyFund is an excellent choice for investors who want a more passive way of investing and aren’t too worried about liquidity. The low investment minimum of $500 is appealing.

Pros

- The minimum investment for Diversity Fund is $500.

- Investors see no management fees on their investments.

- They own and manage the properties.

Cons

- Only one fund to invest in.

- Dividends are reinvested.

DiversyFund is an opportunity for new investors to diversify in alternative investments.

DiversyFund opens opportunities for the everyday investor to access high value private real estate investing through its non-traded REIT (real estate investment trust).

Fundrise Alternatives for Accredited Investors Only

Some Fundrise competitors are only open to accredited investors. According to Investors.gov, to qualify as an accredited investor, you must either:

- Have a high net worth of over $1 million, either alone or with a spouse, excluding the value of your primary residence.

- Earned income over $200,000 (or $300,000 with a spouse) in each of the prior two years and anticipate earning this amount for the current year.

If you meet this criteria, the following companies like Fundrise are viable investments.

7. CrowdStreet: Best for Commercial Real Estate Investing

- Minimum Investment: $25,000 for most marketplace listings

- Fees: 0.50% to 2.5% for most investments

- Fund: Offers single properties or two types of funds

Out of all the commercial real estate investing options for accredited investors, CrowdStreet is one of the largest and most flexible options we've reviewed.

On CrowdStreet, you can invest in individual deals on commercial real estate properties, and there’s usually several properties on this online marketplace. Typically, single-property investments require at least $25,000 to invest.

Alternatively, you can invest in two funds: a single-sponsor fund that’s run by one real estate firm or a CrowdStreet fund that invests in a variety of properties. If you want more diversification and someone handling real estate investing for you, this is better than investing in properties on your own.

Project fees typically range from 0.50% to 2.5%. Fund fees can also reach around 3% depending on your investments.

CrowdStreet also has a Private Managed Account service that builds a real estate investment portfolio to match your goals. The advisory service requires a $250,000 minimum balance, and fees vary depending on your investments.

Best For

CrowdStreet is an ideal choice for accredited investors who want less hands-on investing in commercial real estate. If you want a personally managed account, CrowdStreet is also for you.

Pros

- Variety of investment options

- Fees can be low for certain projects

- Plenty of marketplace listings at a given time

Cons

- High minimum investment amount

CrowdStreet has a high minimum investment requirement, but this is one of the best ways for accredited investors to diversify their portfolios with commercial real estate.

Join the nation's largest online private equity real estate investing platform, ranked Best Overall Crowdfunding Site of 2023 by Investopedia. Get unparalleled access to institutional-quality real estate deals online. Register for a free account and start building your real estate portfolio today.

8. EquityMultiple: Best for Investment Variety

- Minimum Investment: $5,000 for short-term loans and $10,000 or more for equity-based investments

- Fees: Typically 0.50% to 1.5%

- Fund: Variety of investment options, including debt, preferred equity, and opportunity funds,

EquityMultiple states it makes real estate investing “simple, accessible, and transparent” for accredited investors. And, with a $5,000 investment minimum and variety of ways to build your portfolio, this claim is quite fair.

You have three options to invest with EquityMultiple:

- Direct Investing: Invest in single properties with as low as $10,000 with target durations of six months to five years.

- Fund Investing: Invest in multiple assets for increased diversification. The EquityMultiple fund requires a minimum investment of $20,000 and has a target duration of 1.5 to 10+ years.

- Savings Alternative: Invest in diversified notes with as low as $5,000 with target durations of three to nine months.

Fees vary depending on your investment type. Equity investments usually charge 0.5% to 1.5% while debt investments charge 1% or less.

Funds have varying origination fees and annual administrative expenses, but this is still normally under 2% in annual fees.

Best For

Accredited investors who want a variety of real estate investment options and lower minimum investments than platforms like CrowdStreet.

Pros

- Variety of investment options.

- Low fees.

- Variety of investment properties.

Cons

- Equity-based projects have higher minimum investment requirements

- Fees vary and are somewhat confusing to understand

Overall, EquityMultiple has more variety than most Fundrise alternatives. Equity, debt, funds, and 1031 Exchanges are all available, and properties range from townhouses to commercial office spaces.

They make real estate investing simple, accessible, & transparent for accredited investors. Vetted high-yield projects. $5K minimum investment.

Real estate crowdfunding uses funds from a group of investors to help fund real estate investments.

This could mean using funds to purchase properties in opportunity zones, develop existing properties into higher-value assets, or to provide loans for real estate development.

Real estate crowdfunding is different than traditional real estate investing. There are four main ways to make money with real estate crowdfunding:

Capital Appreciation: This occurs when you own shares in real estate and the property appreciates.

Rental Income: Many real estate crowdfunding platforms invest in single-family rental properties or commercial real estate to generate rental income.

Dividend Payments: Some crowdfunding sites pay annual or quarterly dividends to shareholders.

Interest Payments: If you fund real estate loans, you earn interest as the borrower pays off their loan.

Picking the best real estate crowdfunding platform depends on your goals, starting capital, and risk tolerance.

Companies like Fundrise and DiversyFund are best for long-term, equity-based investing. In contrast, you can try companies like Groundfloor for short-term, debt-based financing.

Summary

Fundrise is one of the most popular real estate crowdfunding platforms. But, you don’t have to limit yourself with how many Fundrise alternatives are on the market.

As long as you pick a platform that matches your investment goals and risk tolerance, you can build your wealth with real estate investing. You can even try multiple investment platforms to diversify your portfolio with equity, debt, and other types of real estate.

We earn a commission for this endorsement of Fundrise.