Want to manage your budget and forecast your finances better? PocketSmith wants to help you make things easier by projecting the future of your finances with cash flow forecasts.

You probably already heard about financial independence apps and other money saving apps, but this is the first time we've done a PocketSmith review. We wanted to learn if the calendar and event-based approach that PocketSmith uses is viable.

Does the company have a real selling point here? Or is it not worth your time to even bother downloading? Let's find out in our PocketSmith review.

What is PocketSmith?

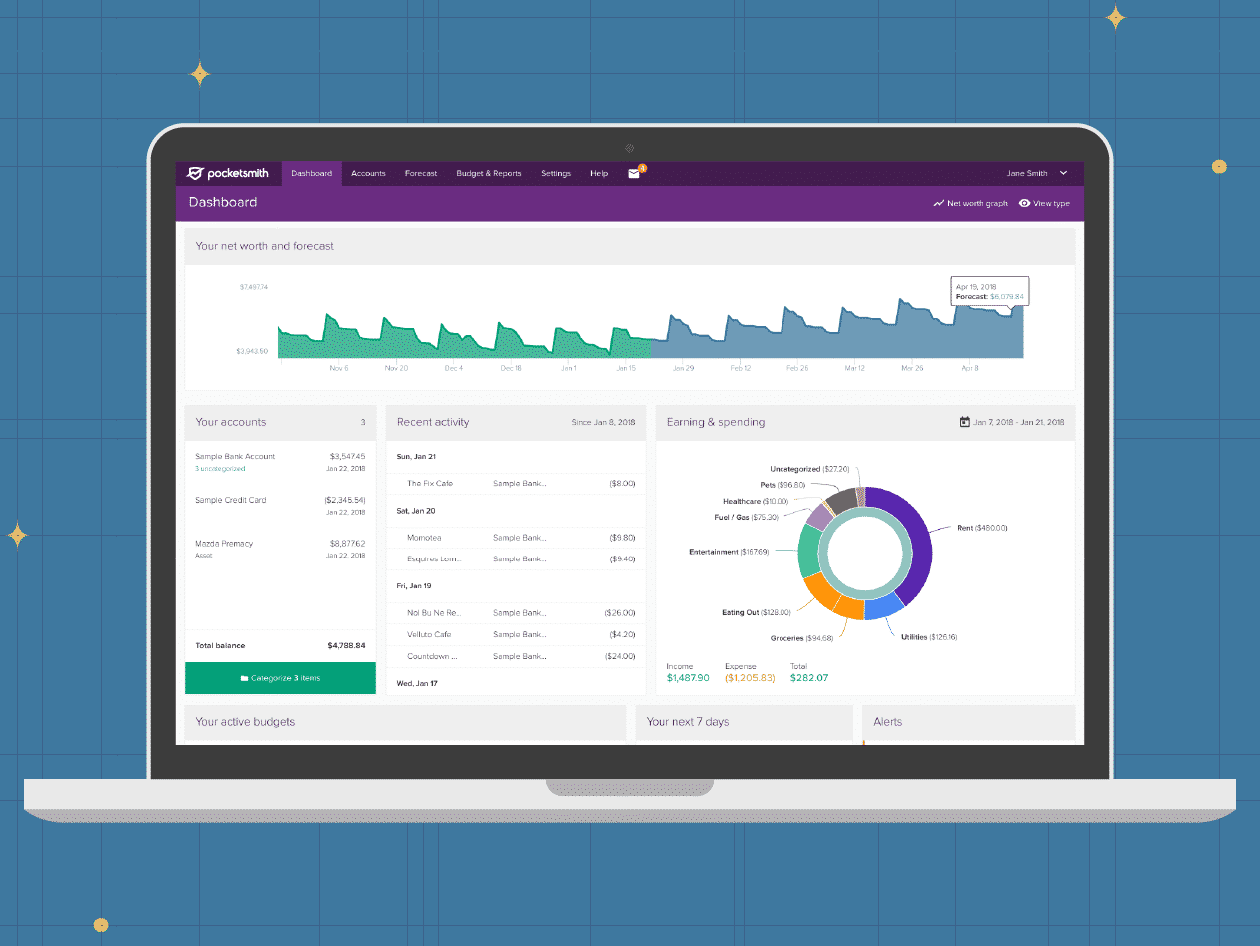

PocketSmith connects to over 14,000 banks worldwide to automatically download and categorize transactions from your bank, credit card and loan accounts.

It sorts and analyses your financial activity without the need for manual tracking.

Think of it as accounting software tuned for your personal finances.

PocketSmith Download

Featured: at PocketSmith at PocketSmith |

Short Description about PocketSmith

|

PocketSmith Features

Secure automatic bank feeds

- Connect to banks all over the world and track accounts in multiple currencies.

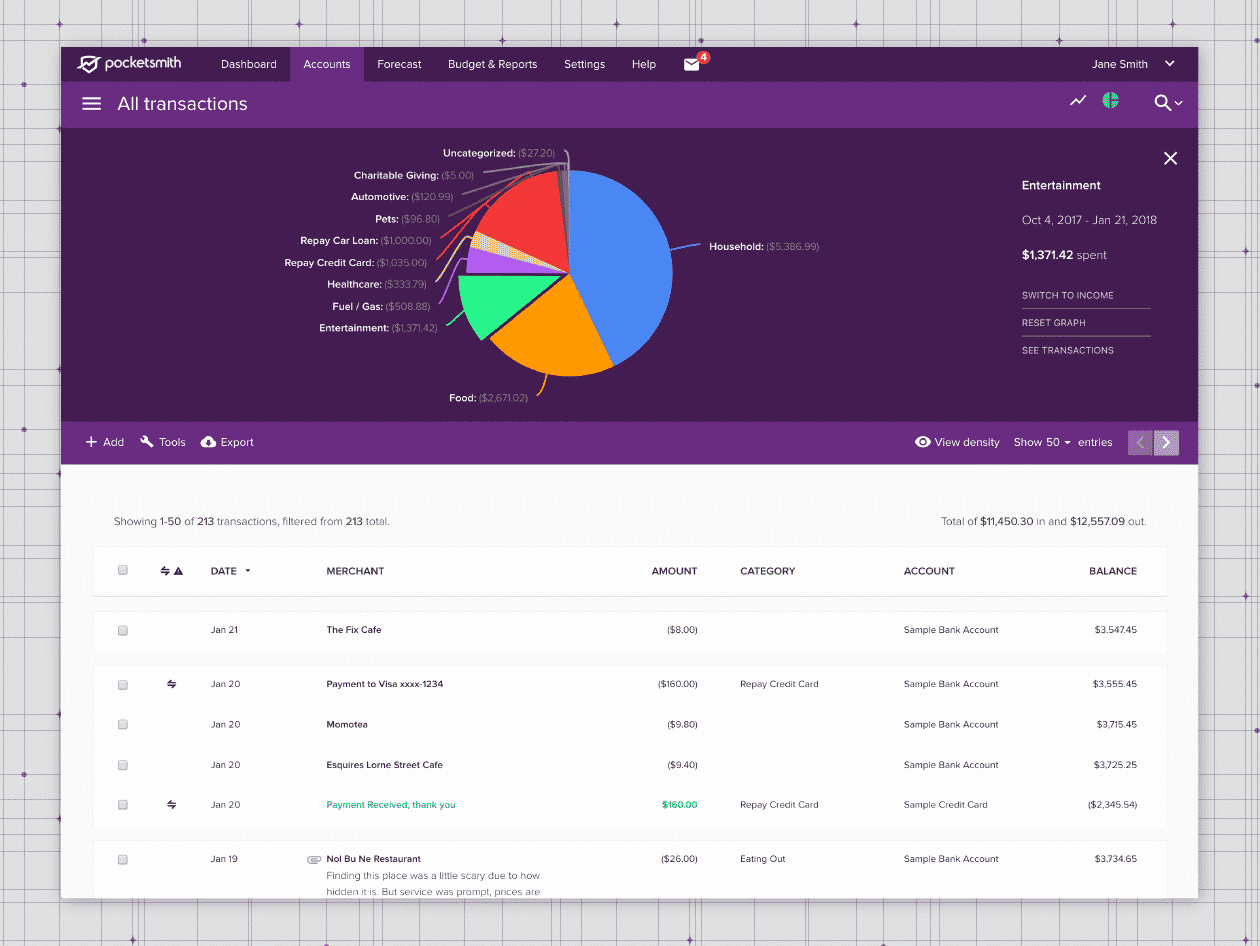

- Add notes, labels, files, and pictures to your transactions, and further customize the automated categorization using rules and filters.

- Find transactions quickly with a powerful multi-criteria search engine and saved searches.

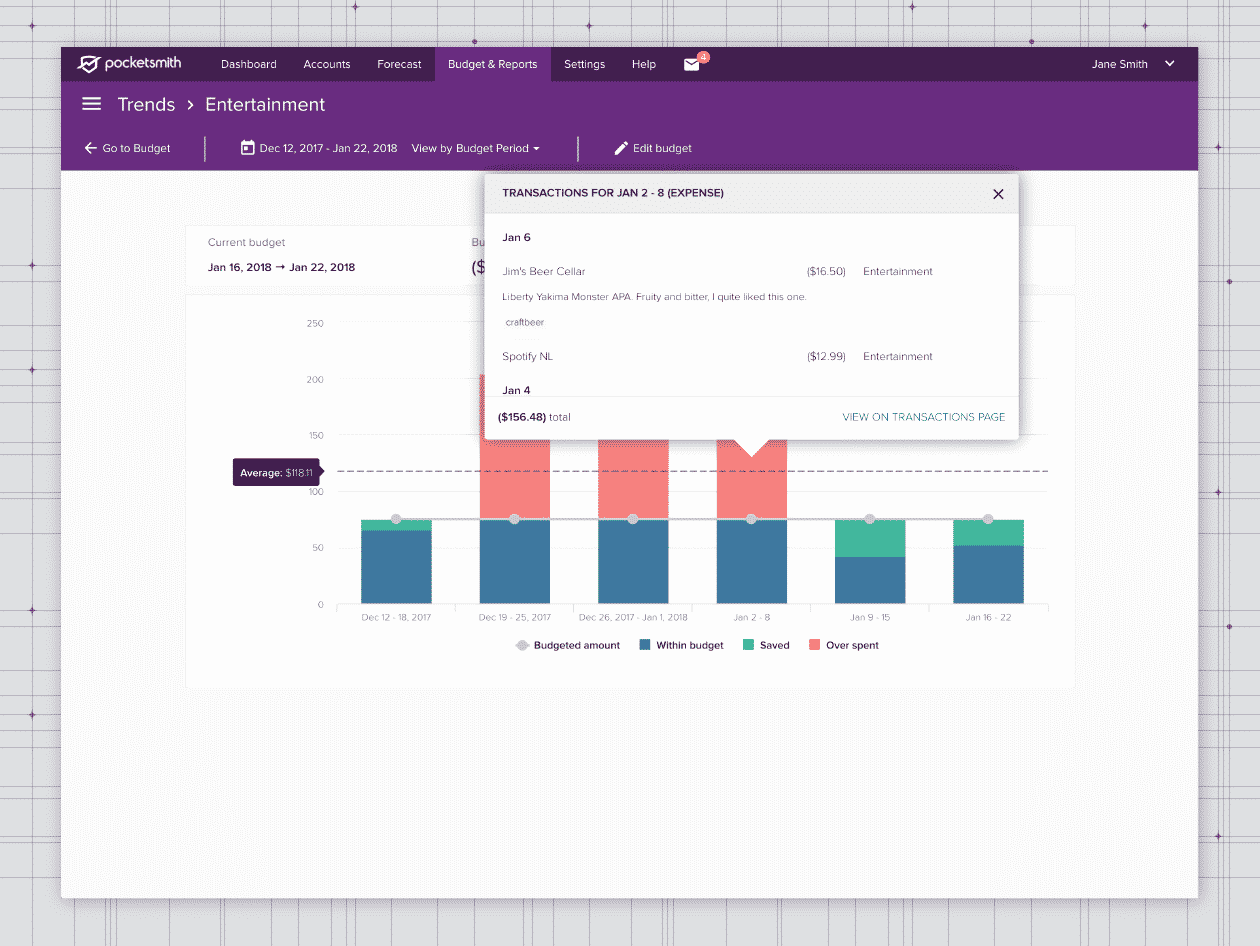

Powerful budgeting, tracking, and reporting

- Build budgets your way with your own categories, flexible budget periods, nesting and roll-ups.

- If you’re short on time, use Auto-Budget to predict your budgets based on historical spending.

- Track your overall and per-category spending on the Trends page.

- Get better clarity across your finances with Income & Expense, Cashflow, and Net Worth statements.

- Check your finances on the run with PocketSmith's mobile apps. View accounts, categorize transactions and keep an eye on budgets from your mobile device!

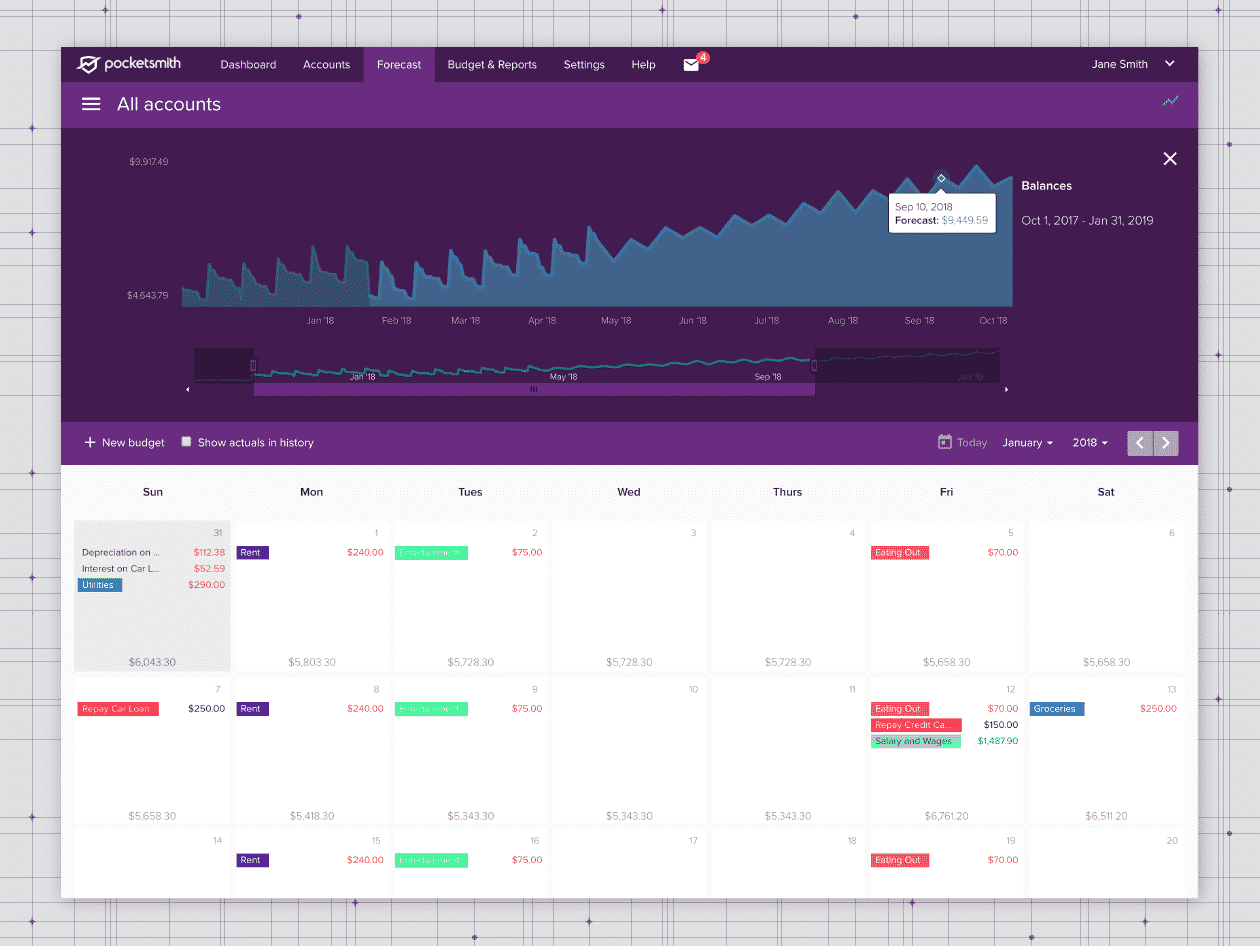

30-year forecast of your daily account balances

30-year forecast of your daily account balances

- See your finances in a calendar.

- See future outcomes based on your current budgeted spend.

- Create and test what-if scenarios.

PocketSmith Pricing Structure

PocketSmith currently offers 4 subscription levels (Free, Foundation, Flourish and Fortune subscriptions):

Free

The free plan that tracks 2 accounts and manual transaction importing. It's great for the casual budgeter.

Foundation

Premium tracks up to 6 accounts with automatic bank feeds, with a 10-year forecast at $9.99 per month.

Flourish

Super tracks 18 accounts with automatic bank feeds and offers a 30-year forecast.

Flourish

Super tracks an unlimited number of accounts with automatic bank feeds and offers a 60-year forecast.

All users have access to PocketSmith’s comprehensive Learn Centre as well as stellar customer service team.

Track Your Finances with PocketSmith

PocketSmith Reviews

Pros & Cons of PocketSmith

|

|

PocketSmith Alternatives

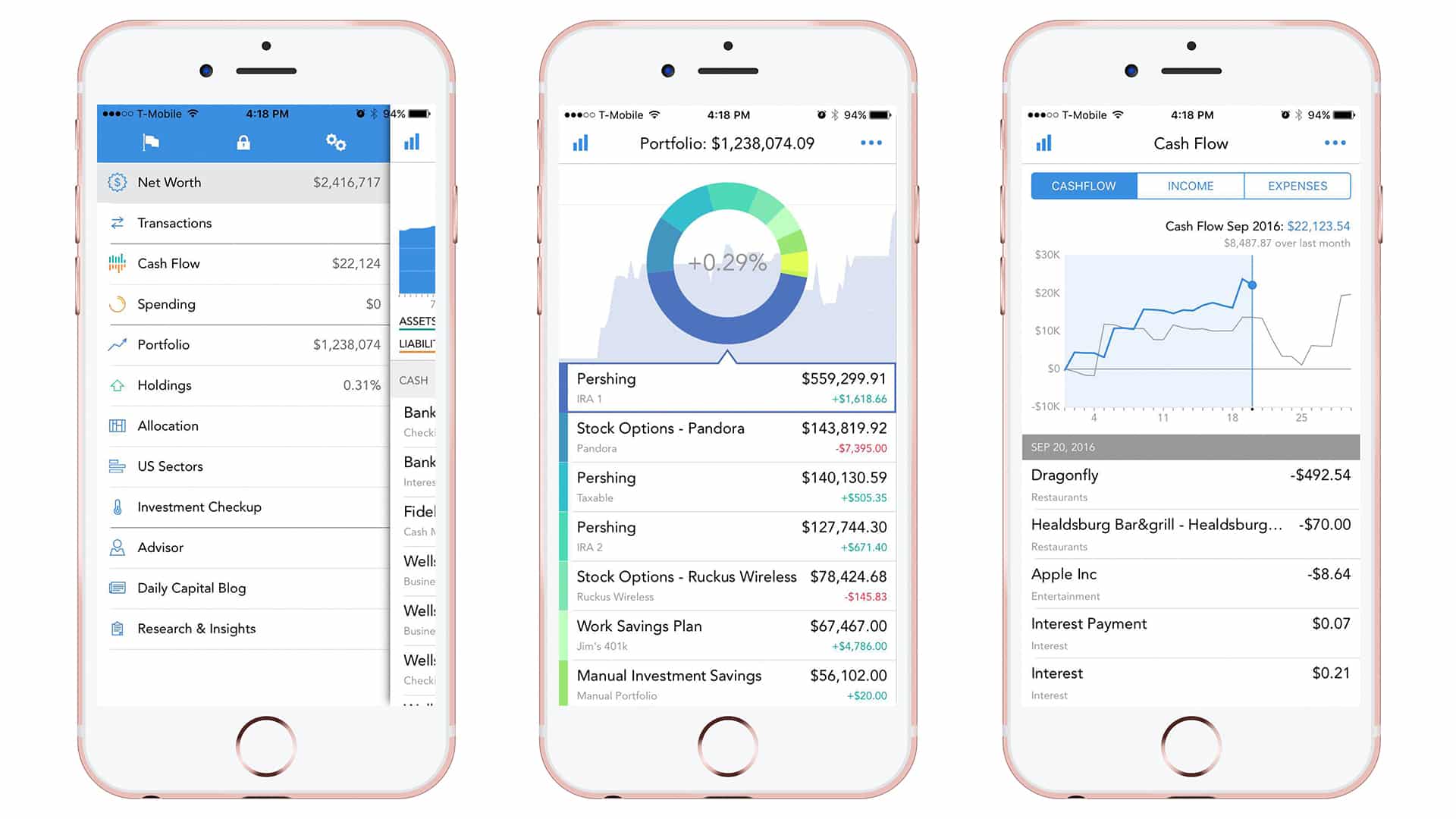

PocketSmith vs Empower

The financial advisor company, Empower offers several free tools to help users manage their budget and investments. What’s best is that the tool has an easy to navigate dashboard, perfect for beginners trying to save up.

For greater ease, you avail maximum benefits by linking up both your investment and banking accounts. You can link your account manually or connect the account automatically. Since there are many categories, you can use the tool according to your convenience. What’s best is that the tool will select the best category for you so you don’t have to go through the trouble yourself.

You can use this brilliant online tool to keep a track of investments or even retirement funds. It’ll do all the calculations so you can keep an eye on your investment costs and asset allocation without a worry. You can learn more in our Empower review.

Some key features of this app include:

- Track expenses down to every credit card swipe

- Analyze all your expenses in real time on your account dashboard

- Use the tool to manage your future goals whether you’re planning to buy a house or get yourself a new car

- Use the Retirement Planner tool

- Ability to track your net worth

Take control of your finances with Empower's free personal finance tools. Get access to wealth management services and free financial management tools.

PocketSmith Summary

PocketSmith shows you how your savings will reward you by revealing your projected daily balances up to 30 years into the future. While PocketSmith does offer a lot, there are definitely better free budgeting tools out there. If you want to see the best budgeting tools in one place, then you’ll enjoy this best budgeting tools list. In that article, I personally tested and reviewed 12 free and paid budgeting tools. And you can filter through the list to find the best money saving apps for you that will help you save money.

Managing personal finances is a painstaking task, but that doesn’t mean you shouldn’t pay attention to budgeting. Managing your money is the best thing you can do for yourself in today’s unpredictable economy. And, there are several online budget tools that can help you achieve your goal. That's second best after you're done reading the best personal finance books that money can buy!

Whether you want to keep track of finances for a residential/commercial move or are saving up for a car, it’s crucial you stick to a saving or spending plan. Here are a couple of budgeting tools you should try:

30-year forecast of your daily account balances

30-year forecast of your daily account balances