One incredibly valuable lesson you can teach your kids is how to think about money and make smart financial choices.

But your kid doesn’t have to store their cash in a piggy bank to learn how to save and spend money anymore. In fact, opening a bank account and debit card for your kid is one of the simplest ways to encourage saving and teach the importance of personal finance.

Continue reading to learn more.

Best Debit Card for Kids

So, if you’re looking for the best debit card for kids, you’re in luck. There are plenty of companies that have kid-friendly debit cards or cards designed specifically for minors:

|

Rating:

5.0

|

Rating:

4.5

|

|

$4.99 per month

|

$5.00 per month

|

- Greenlight (Our Pick): With the Greenlight™ debit card and app, kids earn money through chores, set savings goals, spend wisely and invest. Parents set flexible controls and get real-time notifications every time their kids spend money.

- Acorns Early: With the Acorns Early kids' debit card and app, kids learn how to budget—and grow to understand the difference between wants and needs by spending wisely. Parents can help guide their progress with real-time updates, customizable controls and more.

- Step: Step is a free debit card designed specifically for teenagers and younger children. It's available to people of all ages. Teens can have their own accounts sponsored by their parents, while parents can directly manage accounts for younger kids. This card is secured, which means it helps prevent overspending. Plus, there are no monthly fees, overdraft fees, or interest charges to worry about.

- Chase: Consider choosing Chase as your child's first banking option, as it can be a beneficial choice. With Chase First Banking℠, your child can learn how to manage money effectively, without encountering any fees, as it is a free service.

- Current: If you want a comprehensive debit card for kids and teens that offers a range of parental control and saving goals for kids, the Current debit card for teens is worth considering.

- FamZoo: FamZoo provides prepaid cards and a financial education for kids and teens. All in one award-winning app. Try it free.

When picking your kid's first banking account and choosing the best debit card for kids, important factors to consider include:

- Age requirements

- Fees

- Minimum balance requirements

- Perks like free ATM withdrawals or earning interest

- Spending limits

- Real-time notifications

- Security features like EMV chips or multi-factor authentication

Think about the factors that are most relevant to your child’s financial situation when making your pick.

You don’t have to spend a fortune, or anything at all, for your kid to have access to their own debit card. But make sure you’re picking a debit card that has the features you and your kid need.

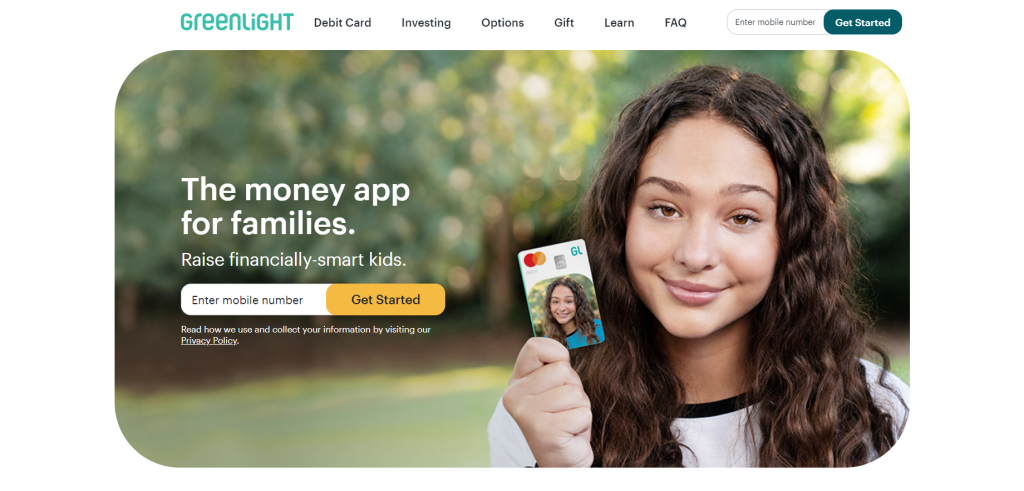

1. Greenlight

Greenlight is one of the most popular debit cards for kids and teens and has over four million parents and kids on the platform.

With a Greenlight debit card, kids and parents share one account. On the parental side, parents set flexible spending controls and receive real-time spending notifications. For kids, Greenlight lets users set savings goals, check their balance, and track spending.

There isn’t an age requirement or minimum account balance. Kids also earn 1% cash back if they move money to general savings or part of a savings goal.

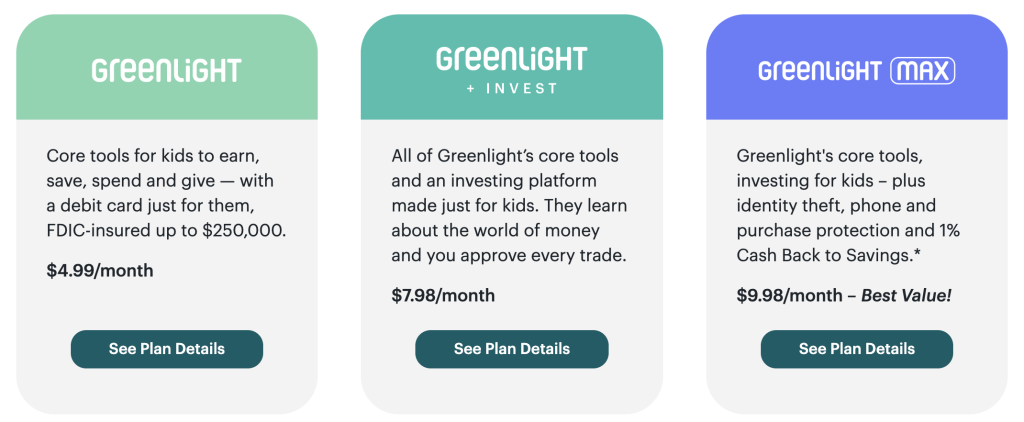

Greenlight has three plans (Greenlight, Greenlight + Invest, Greenlight Max) and your first month is also free. The basic Greenlight debit card account costs $4.99 per month for up to five kids. You can also pay $7.98 per month for a Greenlight + Invest account or $9.98 per month for Greenlight Max.

These plans unlock perks like higher interest rates and investing, but you can stick with a basic plan for your kid to learn the basics of money management. You can see the pricing page here.

With the Greenlight™ debit card and app, kids earn money through chores, set savings goals, spend wisely and invest. Parents set flexible controls and get real-time notifications every time their kids spend money.

2. Acorns Early

With over 2 million members, Acorns Early is another popular debit card for kids ages 6 to 18 years old. With the Acorns Early kid's debit card, parents transfer money into their kids’ accounts, so everything functions like a prepaid debit card.

Parents can set up recurring allowance transfers, send one-time payments, and create chore lists and automatically send money once chores are done. Parents can also set single and weekly spending limits, receive real-time spending alerts, and choose where the Acorns Early card can and can’t be used.

If you want more insight and control over your kid's spending, Acorns Early has you covered and can help instill good financial habits. As such, it is a good debit card for kids since kids can create savings goals and track their progress towards them.

Your first month is free, and Acorns Early costs $5.00 per month per child afterward. You can also get the family plan which is $10.00 per month, for up to 4 children.

The parental control side of the platform supports up to four kids. Kids can’t go into overdraft and there aren’t any fees or minimum balance requirements. The only fee is a $1.50 ATM withdrawal fee.

Overall, our Acorns Early review found it to be a slightly cheaper alternative to Greenlight which also has in-depth parental controls.

With the Acorns Early kids' debit card and app, kids learn how to budget—and understand the difference between wants and needs by spending wisely. Parents can help guide their progress with real-time updates and customizable controls.

3. Step

Step, a mobile banking app for teens, builds credit by reporting payments to credit bureaus. Step offers a secured Visa card that allows users to build credit without debt.

Unlike traditional credit cards, Step doesn't charge interest on monthly payments, and users can only spend money that's in their deposit account.

The card also has a Smart Pay feature that automatically pays off purchases each month. When users turn 18, they can opt in to have Step report their positive payment history to the three major credit bureaus: Equifax, TransUnion, and Experian.

Step also offers other benefits, including up to 8% cash back on purchases, 5% APY on savings balances, and commission-free stock investment platform, and a bunch more.

Step is an excellent, free debit card designed specifically for teenagers and younger children. It's available to people of all ages. Teens can have their own accounts sponsored by their parents, while parents can directly manage accounts for younger kids. This card is secured, which means it helps prevent overspending. Plus, there are no monthly fees, overdraft fees, or interest charges to worry about.

4. Chase First Banking℠

Chase First Banking℠ is unique for its one-of-a-kind checking account for kids that includes chores and allowance functions, as well as the opportunity to open an account as young as 6 years old.

Exclusively for Chase checking customers, this bank account and debit card gives you control over how much your kids can spend, and gives them the opportunity to learn the fundamentals of saving, spending and even earning. And there are no monthly service fees or no fees at 16,000 Chase ATMs.

Not a Chase checking customer? You'll first need to have a qualifying Chase checking account before you can add a Chase First Banking℠ account. You can explore the latest Chase promotions here to see available sign-up offers.

Consider choosing Chase as your child's first banking option, as it can be a beneficial choice. With Chase First Banking℠, your child can learn how to manage money effectively, without encountering any fees, as it is a free service.

5. Current

If you want a comprehensive debit card for kids and teens that offers a range of parental control and saving goals for kids, the Current debit card for teens is worth considering.

Like other leading cards, Current lets parents send one-time transfers, set up allowance payments, and create a chore list so kids work for their money. Parents also get instant spending notifications and can create spending limits or block certain merchants.

For teens, Current helps teach financial management by letting cardholders create a budget. Teens also create savings goals and can save automatically by rounding up spare change after making a purchase.

Current doesn’t have a minimum balance requirement. There aren’t transfer or overdraft fees either. The account costs $36 per teen per year, which is $3 per month.

While Current markets the card for teens, you can open an account as long as the primary account holder is 18 or older, so younger kids can try out the Current debit card to learn how to save and spend wisely.

With free instant money transfers, instant spending notifications, spending limits, and merchant blocking, using Current gives teens financial freedom and visibility, and security for parents.

6. FamZoo

FamZoo aims to “prepare kids for the financial jungle,” and its prepaid card certainly helps accomplish this goal and it's easy to sign up through here and get a free trial.

From there, parents can open a prepaid FamZoo card for kids of any age as there is no minimum age limit. It's simple for parents to set up allowance transfers or quickly approve money requests from their kid. Parents can also send split payments to multiple accounts which is useful if you want to pay several of your kids at once.

FamZoo also has numerous parental controls, including payment notifications, card locking, and spending limits. Furthermore, you can create save, spend, or give accounts and create savings goals for each account type. This helps teach your kid how to budget and allocate money for different purposes.

FamZoo doesn’t pay interest, but parents can create automatic interest payments to teach the power of compounding. Additionally, you can create family billing to charge kids a portion of family bills, like a Netflix subscription or their phone plan.

Overall, FamZoo has more in-depth controls than most debit cards for kids. There aren’t minimum account requirements or hidden fees. However, FamZoo costs $5.99 per month after a free first month. This monthly fee covers any number of family members. You also save up to 58% for prepaying for 24 months, so FamZoo can become more affordable — check out the pricing here.

FamZoo provides prepaid cards and financial education for kids and teens. It is designed to save busy families time when managing money and teach kids critical financial skills through hands-on experience.

FAQs for Parents

Many of the best debit cards for kids don’t have age requirements, so you can open an account for your child as long as you’re 18 or older.

This depends on how mature your kid is and when they start earning money. For example, if you pay your kid for completing chores when they’re around eight to ten years old, you could consider opening a checking account for them.

Similarly, if your teen gets their first job, it’s wise to open a checking account so they can securely deposit their paychecks and learn how to save.

Giving your kid a debit card is one of the best ways to teach them financial management. When kids spend cash, there’s no record of previous transactions, and it’s harder to create savings goals and budgets.

In contrast, a kid-friendly debit card helps kids visualize their spending, track their savings progress, and learn the value of compound interest and investing.

Cards like Greenlight and Acorns Early have some of the best parental controls, so they’re great cards for parents who want more oversight.

In contrast, Axos’ First Checking account is one of the best no-fee debit cards for kids.

Finally, if you want to teach your kid how to invest, Acorns Early is an excellent choice.

Debit Card for Kids Comparisons

Below, we'll compare some of the most popular debit cards for kids for those families having a tough time deciding.

Famzoo vs. Greenlight

Greenlight vs. FamZoo prepaid debit card, which one is better?

FamZoo is a more affordable option than Greenlight, even more so if you pay semi-annually, yearly, or buy a two-year subscription.

Both Greenlight and FamZoo have a lot to offer when it comes to educating your children about money.

Both services allow you to terminate your account at any time, and both provide free trials of at least 30 days.

In the end, it's up to you and your family to decide which debit card is ideal for your kids.

Our take? If you want the benefits of an app that won an award as a family finance app but without paying a ton of fees for a prepaid debit card, FamZoo IOU Accounts are your best option.

Do you want your children to begin investing? If that's the case, a Greenlight + Invest account may be useful. It's up to you whether or not you keep it – it's always good to know your alternatives!

With the Greenlight™ debit card and app, kids earn money through chores, set savings goals, spend wisely and invest. Parents set flexible controls and get real-time notifications every time their kids spend money.

Acorns Early (Formerly GoHenry) vs Greenlight

Which is better, Acorns Early or Greenlight?

The best alternative between Acorns Early and Greenlight is determined by your family's circumstances and needs, as with any of these debit cards for kids.

Acorns Early is best if you only have one child that works to learn basic money management and wants a debit card for spending.

With the Acorns Early kids' debit card and app, kids learn how to budget—and understand the difference between wants and needs by spending wisely. Parents can help guide their progress with real-time updates and customizable controls.

While Greenlight is a better option if you have multiple kids or want more features such as investing or cell phone protection.

With the Greenlight™ debit card and app, kids earn money through chores, set savings goals, spend wisely and invest. Parents set flexible controls and get real-time notifications every time their kids spend money.

The main difference between Acorns Early and Greenlight is this: both Acorns Early and Greenlight can teach your youngster the fundamentals of money management. If you're searching for an app with more features and services, such as investment accounts, Greenlight is likely to be a better option since it provides additional services overall.

Debit Cards for Kids Summary

There’s an unfortunate lack of financial education in schools. But, this doesn’t mean you can't build a family financial plan by teaching kids the value of money, saving, and investing from an early age.

With a kid-friendly debit card, you help empower your kid to make their own financial decisions while still having a safety net thanks to parental controls. Plus, by teaching your kid about topics like investing, saving, and budgeting, you can build a foundation of financial literacy that will serve them for the rest of their lives.