With Acorns, automatically invest spare change from everyday purchases in expert-built portfolios recommended for you, easily save for retirement, get paid early, and more. Start in under 5 minutes and get a $20 bonus today!

Want to get started investing but don't know where to start? You don't have to risk much in 2022. In fact, this one app that I am going to tell you about today has a minimum of $5 or less to get started.

This way you can set your savings on autopilot and invest 5 dollars to maximize your financial power, and bank a free $10 bonus on us (more on that later).

Do your coworkers or friends all talk about their investment portfolios? You’ve been meaning to get in the stock game, but how do you start if you don’t have a big wad of cash to invest?

We’ve got your answer. It’s called Acorns, and it’s an app that lets you start investing with just 5 dollars; without risking much.

How to Claim a Free $10 to Invest

Here's how to get started investing with just 5 dollars:

|

What is Acorns?

Want to invest 5 dollars or less? Apps like Acorns help you set your investing and savings on autopilot and you can conveniently bank a $10 Acorns bonus on us through here!

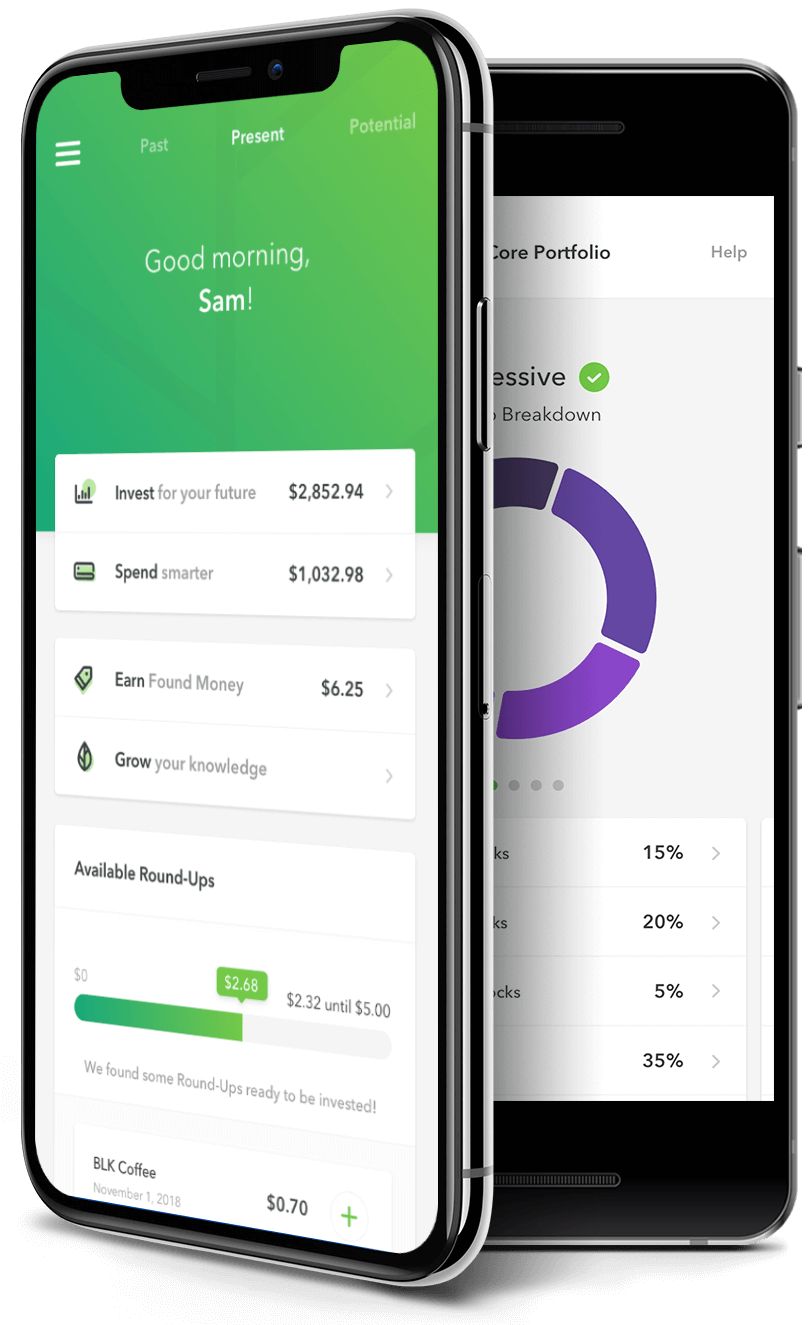

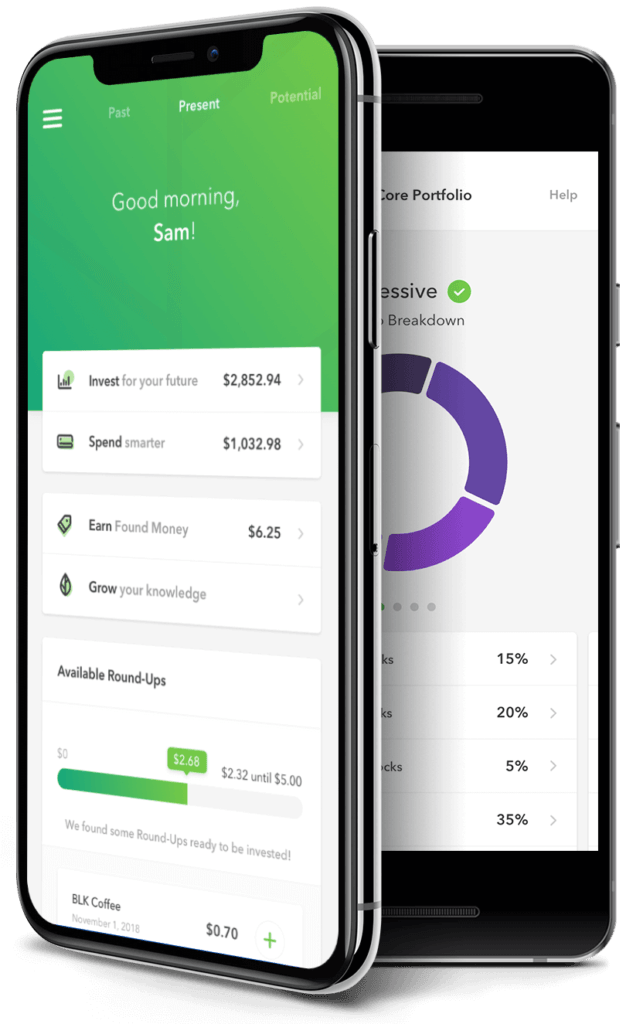

How Does Acorns Work?

You can download Acorns for free.

With the app, you’ll start small and stack up change over time with the Acorns “round-up” feature.

For example, if you spend $15.25 on your connected debit or credit card, 75 cents gets dropped into your Acorns account and investing.

Then the app does the whole investing thing for you. It’s that simple. Now you can brag to your friends, too.

The idea is you won’t miss the digital pocket change — you know, out of sight, out of mind. And those automatic savings stack up faster than you’d think.

The app is free to download on the App store or Google play, and the service costs $3 to 5 a month for balances under $1 million — plus you’ll get that $10 bonus just for starting out. Or you can sign up with your student email and it's free.

The sooner you start investing with 5 dollars, the sooner your money can start to grow toward your goals.

Get started with this Acorns bonus today and invest your 5 dollars now.

Get a $10 Bonus Right Now!

|

What Stock Should You Buy?

Do you have any of these stocks in your portfolio? Chances are that you probably do. If you aren't sure what stock you should look into buying, here is the list of millennials top favorite stocks according to TD Ameritrade.

1. Apple

Stock Ticker: AAPL

Percentage of Millennials' stock portfolio: 12%

2. Facebook

Stock Ticker: FB

Percentage of Millennials' stock portfolio: 2.1%

3. General Electric

Stock Ticker: GE

Percentage of Millennials' stock portfolio: 1.7%

4. Berkshire Hathaway

Stock Ticker: BRK-B

Percentage of Millennials' stock portfolio: 1.7%

5. Bank Of America

Stock Ticker: BAC

Percentage of Millennials' stock portfolio: 1.6%

6. Disney

Stock Ticker: DIS

Percentage of Millennials' stock portfolio: 1.5%

7. Tesla

Stock Ticker: TSLA

Percentage of Millennials' stock portfolio: 1.3%

8. Microsoft

Stock Ticker: MSFT

Percentage of Millennials' stock portfolio: 1.3%

9. Alibaba

Stock Ticker: BABA

Percentage of Millennials' stock portfolio: 1.2%

10. Exxon Mobile

Stock Ticker: XOM

Percentage of Millennials' stock portfolio: 1.2%

The Bottom Line

With the internet being so easily accessible now it is no wonder that many people are turning to make money online by investing or to prepare for retirement.

If you are interested in learning more about stock marketing investing — I compiled a stock market guide on investing for beginners. Your money matters, so it's important to make smart investments.

- Acorns rounds up spare change from purchases and invests it for you

- Get a $20 bonus when you invest just $5 and start a recurring deposit

- Start building long-term wealth with just $3/month—free if you're under 24 and in school