Managing your finances can feel overwhelming, but the right budgeting tools can make all the difference. Whether you're saving for a big goal, tackling debt, or simply looking to spend smarter, a solid budgeting tool can turn your financial dreams into reality.

In this article, I’ve rounded up the best budgeting tools available today—each designed to help you take control of your money, stay organized, and achieve your goals. Let’s find the perfect tool to help you budget better and build a brighter financial future!

Best Budgeting Tools and Money Management Apps

Quicken

Quicken lets you take control of your finances. By using it you can plan for today and tomorrow with one solution to manage all of your finances.

The Quicken app lets you see your financial life all in one place:

- #1 personal finance software in the US

- Trusted for 30+ years

- Most trusted brand in PF management software

- Connects to and aggregates information from over 14,000 financial institutions

That's right, the app lets you get your complete financial picture at a glance. With Quicken, you can view your banking, investment, retirement, and credit card accounts – all in one place. Stay on top of your spending by tracking what’s left after the bills are paid. Make more informed money decisions by creating custom budgets you’ll stick to with this budgeting app. Quicken Mobile Companion App is a free personal finance app to use with your Quicken desktop software.

The app has it all and you can start with a free trial otherwise you'll pay an annual fee, but Quicken Deluxe includes excellent reports, transaction tracking, short and long-term planning, and good support.

If you're not a fan of paying — you can see a long list of Quicken alternatives to better manage your money.

You have two great options to take control of your finances: opt for Quicken Simplifi, a sleek, web-based budgeting app that helps you manage spending on the go, or dive into the comprehensive tools of Quicken Classic, perfect for detailed budgeting, tax tracking, and managing rental or business finances. Whichever suits your needs, start your journey to better financial management today by opening your account.

Empower

The financial advisor company, Empower offers several free tools to help users manage their budgets and investments. What’s best is that the tool has an easy-to-navigate dashboard, perfect for beginners trying to save up.

For greater ease, you can maximize benefits by linking up both your investment and banking accounts and using it as a free net worth tracker. Empower is a free net worth tracking app that allows you to sync your assets and liabilities and create budgets to meet your personal finance goals.

I’ve been using it for years now and it has everything you would need. Once you create an account, this app will be an effortless way for you to link your accounts and track your entire net worth.

Empower combines smart tools with the personalized touch of a financial advisor to give you an investment strategy that fits your needs through its investment advisory services.

Overall, when you create your account, it will walk you step by step through entering each and every asset and liability, allowing you to easily keep track of your net worth and build a budget that works—for free!

Some key features of this app include:

- Track expenses down to every credit card swipe

- Analyze all your expenses in real time on your account dashboard

- Use the tool to manage your future goals whether you’re planning to buy a house or get yourself a new car

- Use the Retirement Planner tool

- Ability to track your net worth

- Plan smarter, retire sooner—Empower helps you optimize your investments for free.

- Maximize your retirement with tools like Monte Carlo simulations and portfolio tracking.

- Take control of your future—get personalized insights to grow your savings.

YNAB

You Need a Budget also known as YNAB is another popular finance app that has its own super cult following. Unlike other complex tools, it features an easy to navigate spreadsheet design. This makes it easier for newbies to create a monthly budget in minutes.

Another great thing about YNAB is that it focuses on your last month’s income instead of your future income. Plus, all your data is represented in easy-to-understand graphs and reports.

YNAB (You Need A Budget) makes budgeting simple and effective, helping you take control of your money and reach your financial goals. With YNAB's easy-to-use app, you'll gain clear insights into your spending, save more money, and finally break the paycheck-to-paycheck cycle. Their proven method ensures every dollar has a job, so you can reduce debt and grow your savings. Ready to transform your finances? Sign up for YNAB today and start budgeting better.

Rocket Money

Rocket Money is your automated financial assistant and budget tracker designed to put you back in control of your money. Rocket Money lets you easily track bills, cancel unwanted subscriptions, and proactively requests refunds on your behalf, putting real money back in your pocket.

With Rocket Money, you can save money, find the best credit card, lower your bills, and stay in control of your finances. It’s like your own personal finance watchdog. This free app delivers on its promise to save you money effortlessly. You can use it to lower your bills, cancel unwanted subscriptions and bill negotiations.

- Lower your internet, phone, and cable bills automatically

- Trusted by over 5 million users to cut monthly expenses

- Contacts providers to find discounts and hidden savings

- Saves users an average of $300 per year

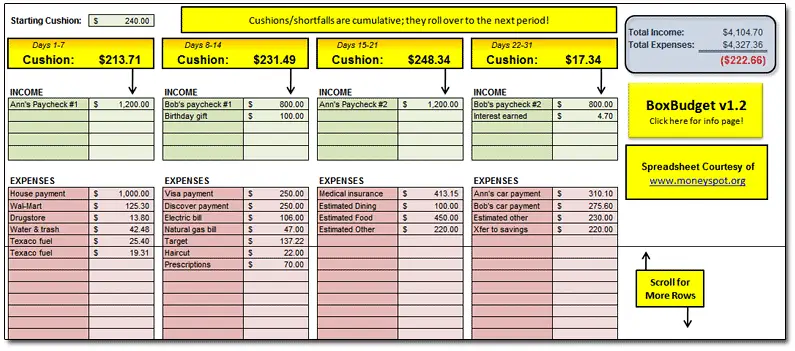

Spreadsheets

Whether it’s Google Sheets or Excel, nothing can beat the classic spreadsheet. True, it may not come with all the bells and whistles that you would expect in a finance tool, but it works well.

One of the obvious plus-points of using a spreadsheet is users have complete control over how they can track data. Plus, it is a safer option since you don’t have to integrate your financial accounts online.

Need help setting up your spreadsheet? Tiller Money automatically imports daily spending, account balances, and transactions into Google Sheets and Microsoft Excel. You can customize the spreadsheet to your liking or they also have free budget templates you can use. Tiller Money keeps you up-to-date on your spending with daily account activity emails.

Tiller Money costs $79 a year. Try it out at no cost with a free 30-day trial.

Take Charge of Your Finances Today

Budgeting doesn’t have to be complicated or overwhelming. With the right tools at your fingertips, you can gain control over your spending, save for what truly matters, and confidently work toward your financial goals.

Whether you’re just starting out or looking to refine your budgeting process, the tools we’ve covered are designed to make managing money easier and more effective. Choose the one that fits your needs and take the first step toward a brighter financial future today!