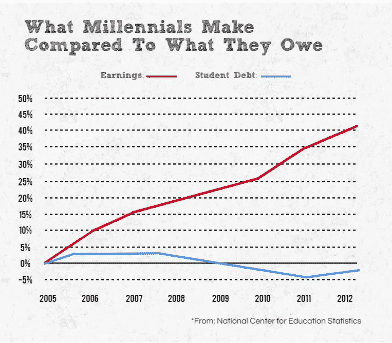

Even with heaps of student debt, there are ways to fund your entrepreneurial dreams of running your own company. We’ll explain how to start a business when you have student loan debt. Many millennials have experienced a phenomenon that was the first of its kind; they earned higher degrees at an unbelievable rate compared to earlier generations, only to face some of the worst career prospects and student debt our country’s ever seen.

Job prospects are slowly getting better, and this creates a heavy pressure that spills over into personal milestones. Who wants to start a family with that weight hanging over them? Then, the dreams of entrepreneurship, which run deep amongst millennials, are dimmed or entirely diminished due to their inability to pay back debt.

And herein lies the problem…

Americans owe over $1.56 trillion in student loan debt. The average college graduate of 2018 has $29,800 in student loan debt, up from last year.

Even if the debt doesn’t overwhelm to the point of giving up the dream, it can render it impossible. No matter how deep your passion is for entrepreneurship, if you’re drowning in $100,000 worth of debt (plus interest), your business can suffer dramatically and lose the ability to gain financial tools that could offer quicker and greater success. Here’s why:

- It is difficult, nearly impossible, to find loans, line, and credit with high debt

- On top of that, you’re juggling monthly demands of loans with regular living expenses and possibly credit card debt; this high debt can cause delinquencies or hurt your personal credit, thus reducing your already immature, higher risk credit scores.

- When you combine a high debt load with lowered credit scores, it is almost impossible to get approval on reasonable personal loans/mortgages, business lines, loans, and credit cards

And thus, low personal credit scores brought on by massive student debt

makes starting a business very difficult.

Now, that’s not to say there isn’t someone who is willing to extend varied types of financing your way. You will find many websites that offer “guaranteed financing” or “bad credit loans”, but at what price?

If you do seek out a business loan, but you’re without established credit and a limited cash flow, you’ll likely be faced with exorbitant interest rates. These rates can run anywhere from 13%-30%. On the other hand, loans with good credit could have rates as low as 3%.

You may even find investors or those willing to be a partner, but now you’re accountable to someone else. As a business owner, you got into this to make your own way, as opposed to having a lender own you and your company.

But don’t worry, millennials. Even with heaps of student debt, there are ways to fund your entrepreneurial dreams. We’ll explain.

1. Never just stop paying your loan

This will damage your credit and make your future aspirations harder and more expensive to achieve. The simplest way to maintain your credit while paying back loans is to always pay on time. Students usually have very limited credit history, so paying off debts on time is one of the most important ways to build healthy credit history. This may mean putting off opening your own business or limiting other expenditures, but the long-term payoff is worth it.

2. Join your parents or older friends trusted credit card account

Average age of credit is a factor used when calculating personal credit scores. Many millennials do not have old credit, so being added as an authorized user to a parent or older trusted friend’s credit card can make your average age of credit increase and thus improve your personal FICO scores.

An important note: Be sure to use MasterCard and Visa for the authorized user addition, and avoid using American Express. Reason being, Amex updates authorized user accounts with the open date they were added to the card–rather than the date the account was actually opened–which reduces the average age of credit.

Also, make sure the card has good payment history and the balances are not maxed out. With these changes, improvements should show on your credit within a few months.

Once your credit is at a manageable level, there are ways to prepare yourself when you’re looking to actually start your business. Here’s how:

3. Research and create a business plan

This may involve seeking advice, mentoring, or coaching from other professionals or organizations like SCORE.

4. Figure out what your startup costs will be

You can do this by estimating long and short-term assets and expenses, then calculating how much you will need in savings to keep the business running during the first few months (especially when revenue is expected to be low). Then you can start budgeting for the expenses well ahead of time, while factoring in your student loan expenses.

5. Make sure that you’re not counting on really high interest or fee lines and loans to keep your business moving

If your business was to run into financial hardships, you will want to make sure that your personal credit and assets are protected.

6. Look into how you want to structure your business

You have many options here, carefully consider each to protect you and your new business.

- Sole proprietors & partnerships – Owners are personally responsible for debts.

- Setting up an LLC or corporation, etc. – You are legally separating yourself from the business. This is the best way to limit personal liability as well as impacts on your personal credit, should your business runs into financial hardships.

7. Research startup and operational financing

SBA loans, start up loans, angel investors, crowd funding, traditional bank loans are a few (of many) options. Your ability to obtain financing will depend on your credit standing.

Related: Best Business Loans

8. Licensing

You may need to get state/federal licenses and permits to operate legally. This will depend on the industry you’re specialty is in and its accompanying requirements.

9. Obtain an EIN (Employer Identification Number)

This is like a SSN for your business, and every business owner needs one. You will need it for filing taxes, creating your DUNs number, and when applying for lines of credit/loans.

10. Start Building Business Credit

Now that you’ve gone through the steps to establish your company as a legal entity, you will want to start building business credit.

Start by looking for a small loan, line of credit, or credit card that does not require a personal guarantee and does not report to the personal credit bureaus (if they are asking for your SSN, it requires a personal guarantee). You will want to avoid providing a personal guarantee in order to protect your personal finances and credit, if you can.

You will also want to establish accounts through vendors who report to the bureaus. When doing so, always ask what bureaus they report to. This will vary depending on the company and you would be surprised to find out how many do not report at all. If your vendor accounts are not reporting, you are not building business credit through them. You might consider either asking them to report or finding an alternative vendor. In order to find out if your vendors are reporting, you can simply ask them, or you could request a copy of all three business credit reports to see if they are showing up. Remember that all the bureaus report separately so it’s important to order all three reports. If your preferred vendor is not reporting, you might consider either asking them to report or finding an alternative vendor.

Succeeding in business, be it big or small, revolves around having strong personal and business credit. It creates the foundation to be flexible with your financing down the road, and is a great advantage for generating more approvals for partnerships, new accounts and more options in financing and pricing.

Student loans holding you back?

Save money on your student loans by refinancing:

|

Rating:

5.0

|

Rating:

5.0

|

Rating:

4.0

|

|

APY from: 4.35%

|

APY from: 4.49%

|

APY from: 4.55%

|

|

|

|

- Gain access to the best lenders

- Instant interest rate estimate

- Seamless online experience

- $300 bonus

- Get your rate in 60 seconds

- Instant credit decision

- No fees to apply

- Easy online application

- 0.25% APR discount with autopay

- No hard credit pull required

- 1. Never just stop paying your loan

- 2. Join your parents or older friends trusted credit card account

- 3. Research and create a business plan

- 4. Figure out what your startup costs will be

- 5. Make sure that you’re not counting on really high interest or fee lines and loans to keep your business moving

- 6. Look into how you want to structure your business

- 7. Research startup and operational financing

- 8. Licensing

- 9. Obtain an EIN (Employer Identification Number)

- 10. Start Building Business Credit